Facebook earnings

Facebook Inc (NASDAQ:FB) reported a solid quarter, and I have to admit I was a little wary of the company. But, finally Mark Zuckerberg has been able to revive hopes in his company. In an earlier article, I mentioned that advertising in user news feeds should give a boost to mobile revenue that could lead to a beat on expectations.

Lo’ and behold, the company’s mobility segment was the primary contributor to the company’s success in the past quarter. The company reported revenue that was up by 53% year-over-year in the second quarter. It also reported gross margins of 31%, which were up sharply from the -63% gross margin in the previous year.

The company was then able to report non-GAAP (generally accepted accounting principles) earnings per share of $488 million in the most recent quarter. Not only that! The company managed to lower its expenses by $676 million year-over-year. In a previous article, I mentioned that the company could generate higher returns just by managing costs better. Facebook was able to grow net income by 375% year-over-year.

It reported non-GAAP earnings per share of $0.19 for the quarter. Analysts on a consensus basis were anticipating the company to report earnings of $0.14 for the previous quarter. The company beat earnings expectations by 28.5%. At the time of writing, the stock is up by 16.9% in after-hours trading.

Summary and outward-looking analysis

It seems that just a modest shift in product and strategy could have a very significant impact on earnings in the Internet space. Going forward, analysts are going to maintain a buy rating on other web companies under the basis that web properties may generate higher rates of growth by adjusting their strategies to smartphone devices.

Source: Facebook

Source: FacebookWhat’s nice about Facebook Inc (NASDAQ:FB) is that it really doesn’t have to choose sides when it comes to smartphones. The fact is any smartphone can run Facebook, which is another contributing factor to its success. Outward-looking forecasts from IDC indicate that smartphone shipments will grow at a compound annual growth rate of 18.6% until 2016.

Source: Facebook

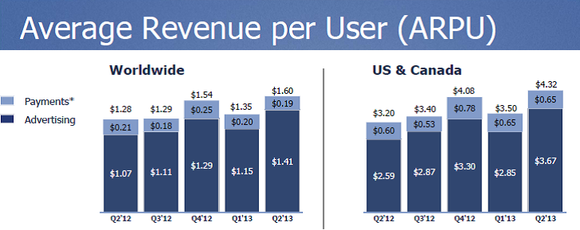

Source: FacebookNot so surprisingly, the largest market for mobile advertising is North America, so by focusing on the 41% year-over-year, revenue-per-user growth in the US and Canada segment, we can get a basic idea of how mobile revenue impacted consolidated revenue results for the past quarter. Another contributor to mobile growth was the 60% year-over-year gain in daily users. The total increase in users paired with the growth in monetization from each user contributed to the company’s earnings beat this past quarter.

Google’s not-so-hot quarter

Software and services seem to be the hot spot in technology. I have to admit that I am not exactly happy with Google Inc (NASDAQ:GOOG)’s results. The company did mention that it was focusing on incremental revenue gains in the first quarter. So going into the second quarter, it has been largely understood that profitability may actually fall below expectations.

Another difficulty Google Inc (NASDAQ:GOOG) faced that Facebook Inc (NASDAQ:FB) did not was that pricing for display- based ads were down by around 6% year-over-year. The decline in pricing (most likely) came from the falling conversion rates from people who click through ads on mobile devices. After all, purchasing a product or service through a mobile advertisement can be difficult, and the quality of the buying experience isn’t exactly hot. The placement of ads on a mobile screen is also difficult. This is why Google’s AdSense business seems to be fine, but banner advertising –not so much.

Analysts have had to lower expectations for Google Inc (NASDAQ:GOOG) in the past quarter as falling gross margins took a toll on projected annual results. Analysts on a consensus basis anticipate that the company will generate 9.5% in earnings growth for the full year.

Apple adds a face lift to technology

There still seems to be demand for smartphones, but it depends heavily on whether or not Apple Inc. (NASDAQ:AAPL) can secure subsidized contracts with different mobile carriers. For now, T MOBILE US INC (NYSE:TMUS) helped to boost demand for the iPhone as the device was put on sale through contract on the T MOBILE US INC (NYSE:TMUS) network in the second quarter. The iPhone was one of the top-selling devices for T MOBILE US INC (NYSE:TMUS). iPhone unit volumes jumped in the past quarter by 20%.

Apple Inc. (NASDAQ:AAPL) may have pent-up growth opportunities through wearable computing devices. It’s also nice to note that the next quarter could be full of surprises, as the next-generation iPad and iPhone devices are likely to be launched. There are also rumors of a bigger-screened iPhone device. An iPhone with a larger screen may boost mobile advertising revenue for Facebook Inc (NASDAQ:FB) and Google, especially when considering a larger screen offers better visuals for display advertisements.

The downside to large screens is the draw on battery, and the size of the device becomes prohibitive for normal use. You might as well rely on Skype conversations because the position of holding the phone in front of your face will be more comfortable than pushing it to your ear. Oh, and, by the way, Microsoft Corporation (NASDAQ:MSFT) reported that Skype calls were up by 41% year-over-year in the second quarter.

Conclusion

Better monetization of mobile should continue. The company that seems to be the best positioned in mobile advertising is Facebook Inc (NASDAQ:FB). We should also anticipate improvements in Google Inc (NASDAQ:GOOG)’s advertising strategy on mobile devices going forward.

Smartphone devices are shifting to screen sizes that are above 4.5 inches and with Apple following the herd, click-through rates and conversions may eventually improve. Let’s not forget that smartphone demand is still expected to grow internationally, so there’s a lot of untapped potential going forward.

The article Facebook Gets Mobile Right originally appeared on Fool.com and is written by Alexander Cho.

Alexander Cho has no position in any stocks mentioned. The Motley Fool recommends Apple Inc. (NASDAQ:AAPL), Facebook, and Google. The Motley Fool owns shares of Apple, Facebook Inc (NASDAQ:FB), and Google Inc (NASDAQ:GOOG). Alexander is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.