Low interest rates help to decrease the cost of capital. In layman’s terms this means that companies are able to finance operations with fewer funds and increase profits.

Pension funds have a hurdle rate, a minimum rate of return. When the U.S. government sticks short term interest rates near zero, investors are forced into stocks and other risky investments to achieve their minimum rate of return. This increased demand helps to boost stock prices.

Is it Dangerous to Bet on Rising Asset Prices?

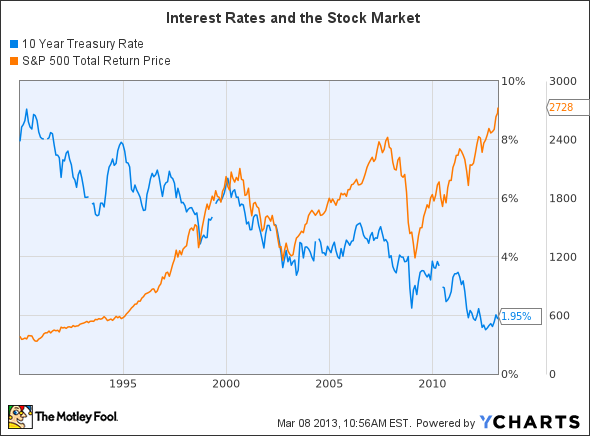

As long as interest rates continue to fall, betting on rising asset prices is any easy way to make money. The downside is that as soon as prices stop rising speculators stop buying, and then prices collapse. A look at the billions of dollars lost in the wake of the tech bubble should be a clear warning sign. The chart below shows how even in the midst of bubbles, lowering interest rates have helped to boost the stock market.

10 Year Treasury Rate data by YCharts

What is an Investor to Do?

Buying a slice of the broad market has its downsides. It is like going to the grocery store and buying a bag of apples. Later you come home to find out that half of those apples were rotten. Selecting companies with defendable moats is a safer way to invest.

Exxon Mobil Corporation (NYSE:XOM) has maintained their dominant position in the energy sector for decades. Energy is known for being highly temperamental. Price swings and overly optimistic projects can bankrupt companies and leave CEOs blindsided.

Exxon Mobil Corporation (NYSE:XOM) takes stability seriously. Through the integration of production and refining assets it has built in safeguard against volatile price swings. If a sudden fall in the price of oil causes losses in their upstream operations then their downstream facilities can help to maintain profitability.

The company has only $7.9 billion in long term debt. The lack of debt shows that the management is able to drive earnings and profits without relying on cheap loans. In 2012 the firm posted a return on average capital employed of 25.4%, a rate significantly higher than that of their competitors. This company offers a stable business and trades at a very attractive price to earnings ratio of 9.1.

Google Inc. (NASDAQ:GOOG) paints itself as an innovative firm serving the needs of humanity. The reality is that the firm is a powerful duopolist with a 66.7% market share with its powerful search engine. Its biggest competitor, Microsoft’s Bing losses money and it is hard to tell when Microsoft will break even with Bing.

Google Inc. (NASDAQ:GOOG) continues to invest in new products like the Google Glass. If it can meld software with proprietary hardware then it will be closer to becoming a vertically integrated monopolist, a most profitable proposition.

Similar to Exxon Mobil Corporation (NYSE:XOM), Google has a total debt to equity ratio under 0.1. Without using debt it has been able to achieve a return on investment of 14.4% and a strong profit margin of 21.4%. High margins and strong growth have helped to drive up Google’s price to earnings ratio to 25.8. The firm is a tad expensive, but it continues to grow and it is a strong long term investment.

Wal-Mart Stores, Inc. (NYSE:WMT) has made a name for itself as a stable investment. The broad market has experienced a number of bubbles since 1999 and Wal-Mart Stores, Inc. (NYSE:WMT) has managed to stay out of the froth. The company has a huge amount of power given its status as one of the top retailers in the world.

The future isn’t all roses and daffodils. The firm’s model of sourcing cheap goods from overseas producers will be hampered by the decline of cheap oil. Also, its focus on the lower end of the market is negatively impacted by low U.S. wage growth.

With a total debt to equity ratio of 0.78 this firm has significantly more debt than any of the other companies mentioned. Its return on investment of 14.9% and profit margin of 3.8% show that it is very profitable. Wal-Mart Stores, Inc. (NYSE:WMT) will not disappear anytime soon and it is a strong stable investment given its prominent position as a worldwide retailer. Still, it does not offer the growth opportunities of Google.

Conclusion

Google Inc. (NASDAQ:GOOG) and Exxon Mobil Corporation (NYSE:XOM) are two strong investments that should be able to weather an increase in interest rates. These companies are not dependent upon cheap loans and have a history of profitability in their industries. Wal-Mart Stores, Inc. (NYSE:WMT) is another strong player, but the low growth in U.S. wages and impact of high oil prices decreases its attractiveness.

The article Low Interest Rates Are Dangerous: Stick with Dependable Firms originally appeared on Fool.com and is written by Joshua Bondy.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.