Members of Generation Y and young adults are proving to be content with renting, versus buying. The U.S. Census Bureau believes the population of young adults aged 20 to 34 will grow by over three million people between 2010 and 2015.

Top choice

Equity Residential (NYSE:EQR) is the top choice in the industry, owning and operating various apartment properties across the nation. This apartment REIT has interests in over 400 properties for a total of over 115,000 units across the U.S.

Equity Residential (NYSE:EQR) focuses on assets in its six-core metropolitan markets: Boston, New York, Washington, D.C., Southern California, San Francisco and Seattle. The beauty about these key markets is that the cost of home ownership is much higher than the national average, making renting much more economical.

Its largest geographic market is the New York metro area, making up nearly 14% of net operating income (NOI). Its other key areas include Washington, D.C. (11.5% of NOI), South Florida (9.0%), Los Angeles (9.9%) and San Francisco (7.9%).

Rental rates are expected to be up nearly 5% for the REIT in 2013, as it takes advantage of the robust occupancy levels to drive rates higher. Equity Residential (NYSE:EQR) also snatched up assets (22,000 apartment units) from Archstone Enterprises earlier this year for $9 billion, which will give the company a greater presence in coastal markets.

The REIT had only $56 million in cash at the end of 1Q 2013 versus the $612 million at the end of 2012. This was due to the company’s prepayment of its $543 million in secured debt that carried a 5.7% interest rate.

The next best bet

Apartment Investment and Management Co. (NYSE:AIV) is another one of the major U.S. owners of multi-family apartment properties. Apartment Investment and Management Co. (NYSE:AIV) has a portfolio of 265 properties, including 67,977 apartment units spread across 36 states.

First quarter FFO (funds from operation) per share came in at $0.48 compared to $0.40 for the same period last year. Apartment Investment and Management Co. (NYSE:AIV) is looking to focus on the largest markets in the U.S., expanding to the coastal areas. Via the disposition of its under-performing assets, the company believes it should see material improvements in its average rent per unit.

Earlier this week, Apartment Investment and Management Co. (NYSE:AIV) posted 2Q EPS of $0.07 compared to essentially breaking even for the same quarter last year. Its FFO was also up, coming in at $0.49 compared to last year’s $0.38. The REIT also took the earnings announcement as an opportunity to tighten its fiscal 2013 FFO expectations, but ultimately lowering the top end. The company previously expected to post FFO per share of $1.94 to $2.10, but now sees 2013 FFO coming in at $1.99 to $2.07.

A niche operator

BRE Properties Inc (NYSE:BRE) has a portfolio of 74 multi-family communities, with 21,160 units in California and Washington state. The REIT also has joint venture interests in eight apartment communities with 2,864 units.

BRE Properties Inc (NYSE:BRE) is also looking to get rid of under-performing assets. In 2012, it sold off six properties for $115 million, and expects to sell another $150 million worth of properties in 2013.

The real problem with BRE Properties Inc (NYSE:BRE) is that its key markets are not seeing as strong a performance as the likes of Equity Residential (NYSE:EQR). The company has around 60% of its units located in Southern California. Specifically, its Orange County markets are seeing weak results.

The big news of late for BRE is a the potential buyout by Land & Buildings. The company is offering to buy up BRE Properties Inc (NYSE:BRE) for about $4.6 billion, or $60 per share; this is more than 15% above current trading levels. However, BRE Properties Inc (NYSE:BRE) management is of the opinion that it’s better off independent.

Bottom line

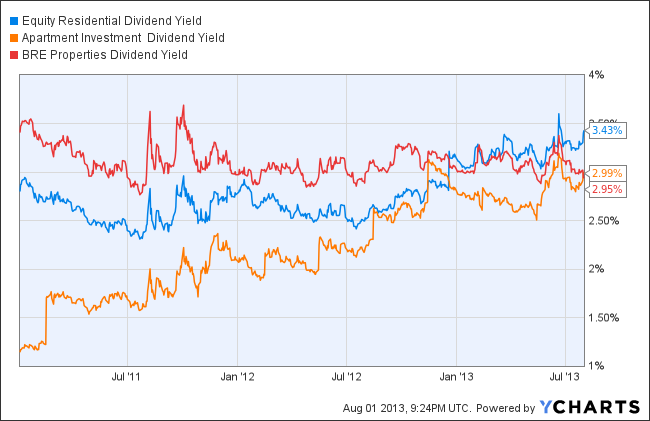

Even as the mortgage-financing market rebounds, there will likely remain a glut of Gen-Y’ers that continue to rent. One of the big strengths of all these apartment operators is their dividends. Equity Residential (NYSE:EQR) has a dividend yield that’s more than 40 basis points above its top peers…

What’s more is that Equity Residential (NYSE:EQR) also trades the cheapest…

I like Equity Residential the best given its superior dividend and valuation, not to mention the fact that its properties are located in some of the top rental markets in the U.S., where renting makes more sense than buying, i.e. New York City and Washington, D.C.

The article Playing the Demise of the American Dream originally appeared on Fool.com and is written by Marshall Hargrave.

Marshall Hargrave has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Marshall is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.