Some of the best MLP investments, however, have been on the market for quite some time now, rewarding shareholders with clockwork-like distribution increases and market-thumping returns. Today I’ll take a look at three energy MLPs that have not only posted remarkable consistency in their investor payouts, but have crushed the market at the same time.

The top three

The three MLPs listed below are tops among all energy MLPs in maintaining a quarterly streak of increasing their distribution payouts to investors:

| Company | Quarterly Streak | Current Yield | Five-Year Total Return |

|---|---|---|---|

| Enterprise Products Partners L.P. (NYSE:EPD) | 36 | 4.30% | 194% |

| Holly Energy Partners, L.P. (NYSE:HEP) | 35 | 4.80% | 382% |

| Sunoco Logistics Partners L.P. (NYSE:SXL) | 33 | 3.90% | 434% |

Source: Company statements, Yahoo! Finance, and YCharts

Enterprise leads the way, increasing its distribution every quarter for the last nine years.

A couple of things stand out about the companies listed above. First, not a single one posts a yield above 5%. Many investors are drawn to the MLP space because of high yields; in fact, many MLPs currently sport yields much higher than 5%. However, all of our MLPs have also produced outsized returns over the past five years. There are few investors who will begrudge a 3.9% yield when shares have popped more than 400% in five years.

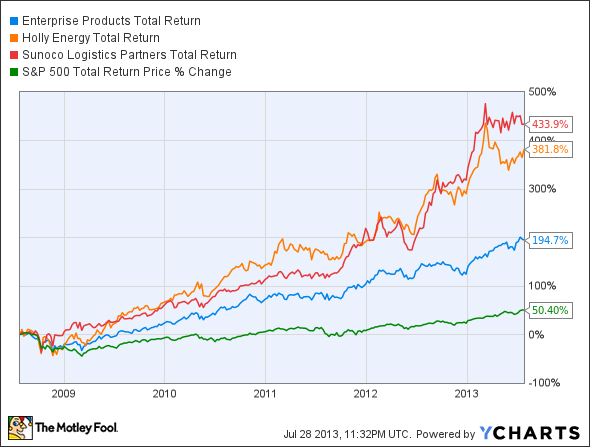

Of course, the last few years have been great for a lot of companies. With that in mind, let’s look at the total return of these three MLPs compared to the total return of the overall market over the last five years:

EPD Total Return Price data by YCharts

It’s really no contest here. The performance of these three MLPs blows away the rest of the market.

The other observation to note about these three MLPs is that two of them have, or initially had, parent companies driving supply. HollyFrontier and Sunoco, which is now owned by Energy Transfer Partners LP (NYSE:ETP), provided reliable business for both Holly Energy Partners and Sunoco Logistics, forming a strong foundation for equally reliable distributions to unit holders. Energy Transfer Partners LP (NYSE:ETP), for the record, has a 7% yield and a quarterly distribution increase streak of zero.

Market beaters

Listing distribution streaks is all well and good, but I’m going to give their performances some context to really drive home the point. Let’s recall the jump off the high dive the market took a few years back:

EPD Dividend data by YCharts

While the rest of the market cut back payouts, Enterprise, Holly Energy Partners, L.P. (NYSE:HEP), and Sunoco Logistics Partners L.P. (NYSE:SXL) continued to increase theirs, providing stability at one of the most volatile moments in economic history.

Yield of dreams

When it comes to the MLP space, investors are often rewarded not for chasing yield, but for seeking out stable, reliable, distribution payers like Enterprise Products Partners L.P. (NYSE:EPD), Holly Energy Partners, L.P. (NYSE:HEP), and Sunoco Logistics Partners L.P. (NYSE:SXL). This is something to keep in mind as the onslaught of MLP IPOs continues. Not all MLPs are created equally.

The article The Most Reliable MLPs on the Market originally appeared on Fool.com and is written by Aimee Duffy.

Fool contributor Aimee Duffy has no position in any stocks mentioned. The Motley Fool recommends Enterprise Products Partners L.P.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.