Micron Technology, Inc. (NASDAQ:MU) recently reported its preliminary financial results based on which we provide a unique peer-based analysis of the company. Our analysis is based on the company’s performance over the last twelve months (unless stated otherwise). For a more detailed analysis of this company (and over 40,000 other global equities) please visit www.capitalcube.com.

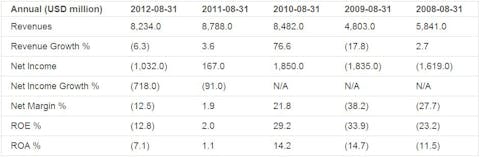

Micron Technology Inc.’s analysis versus peers uses the following peer-set: SanDisk Corporation (NASDAQ:SNDK), STMicroelectronics N.V. (NYSE:STM), Spansion Inc. (NYSE:CODE), Melexis NV (EBR:MELE), Rambus Inc. (NASDAQ:RMBS) and STEC, Inc. (NASDAQ:STEC). The table below shows the preliminary results along with the recent trend for revenues, net income and returns.

Valuation Drivers

Micron Technology Inc.’s current Price/Book of 0.7 is about median in its peer group. MU-US’s PE multiple is negative now so EBITDA ratios provide better peer comparisons. MU-US’s share price implies less than peer median growth (Price to Ebitda multiple of 3.5 compared to peer median of 7.9). The market seems to expect MU-US’s around median rates of return (EBITDA return on equity of 20.2% compared to the peer median of 19.5%) to decline.

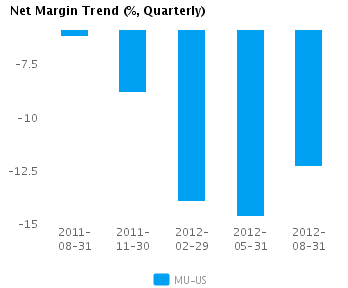

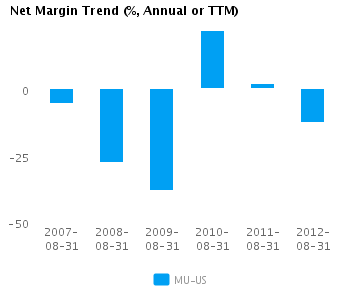

The company’s profit margins are below peer median (currently -12.5% vs. peer median of -5.5%) while its asset efficiency is about median (asset turns of 0.6x compared to peer median of 0.6x). MU-US’s net margin continues to trend downward and is below (but within one standard deviation of) its five-year average net margin of -9.6%.

Economic Moat

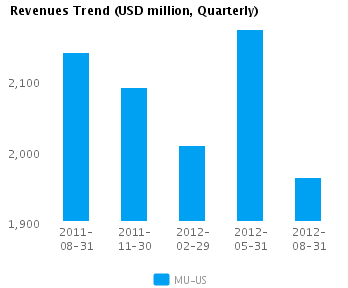

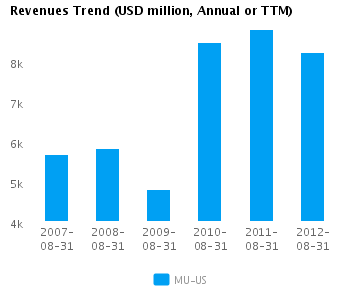

Changes in the company’s annual top line and earnings (-6.3% and -718.0% respectively) generally lag its peers. This implies a lack of strategic focus and/or inability to execute. We view such companies as laggards relative to peers.

MU-US’s return on assets is less than its peer median currently (-7.1% vs. peer median -4.4%). It has also had less than peer median returns on assets over the past five years (-3.6% vs. peer median -1.2%). This performance suggests that the company has persistent operating challenges relative to peers.

The company’s gross margin of 38.7% is around peer median suggesting that MU-US’s operations do not benefit from any differentiating pricing advantage. In addition, MU-US’s pre-tax margin of -9.2% is also around the peer median suggesting no operating cost advantage relative to peers.

Growth & Investment Strategy

While MU-US’s revenues growth has been above the peer median (19.7% vs. 10.6% respectively for the past three years), the stock’s Price/EBITDA ratio of 3.5 is less than the peer median (Note: We use Price/EBITDA instead of PE due to negative earnings). This implies that the company’s earnings are peaking and the market expects a decline in its growth expectations.

MU-US’s annualized rate of change in capital of 12.2% over the past three years is around its peer median of 12.2%. This median investment has likewise generated a peer median return on capital of 4.1% averaged over the same three years. This median return on investment implies that company is investing appropriately.

Earnings Quality

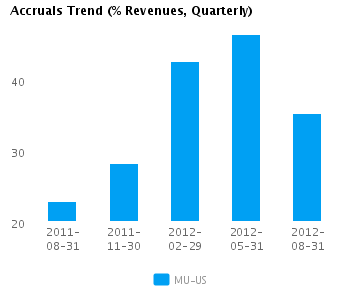

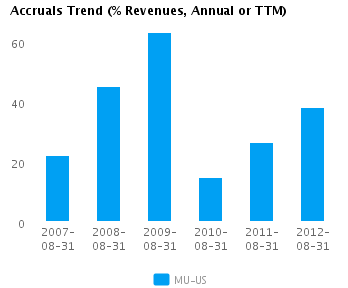

MU-US reported relatively weak net income margins for the last twelve months (-12.5% vs. peer median of -5.5%). This weak margin performance and relatively conservative accrual policy (38.2% vs. peer median of 13.8%) suggest the company might likely be understating its net income, possibly to the extent that there might even be some sandbagging of the reported net income numbers.

MU-US’s accruals over the last twelve months are positive suggesting a buildup of reserves. In addition, the level of accrual is greater than the peer median — which suggests a relatively strong buildup in reserves compared to its peers.

Trend Charts