Avago Technologies Ltd (NASDAQ:AVGO) recently reported its preliminary financial results based on which we provide a unique peer-based analysis of the company. Our analysis is based on the company’s performance over the last twelve months (unless stated otherwise). For a more detailed analysis of this company (and over 40,000 other global equities) please visit www.capitalcube.com.

Avago Technologies Ltd (NASDAQ:AVGO)’s analysis versus peers uses the following peer-set: Texas Instruments Incorporated (NASDAQ:TXN), Analog Devices, Inc. (NASDAQ:ADI), Infineon Technologies AG (PINK:IFNNY), STMicroelectronics N.V. (NYSE:STM), Skyworks Solutions Inc (NASDAQ:SWKS), LSI Corporation (NYSE:LSI), Hittite Microwave Corp (NASDAQ:HITT), Vishay Intertechnology (NYSE:VSH), RF Micro Devices, Inc. (NASDAQ:RFMD) and TriQuint Semiconductor (NASDAQ:TQNT). The table below shows the preliminary results along with the recent trend for revenues, net income and returns.

| Annual (USD million) | 2012-10-31 | 2011-10-31 | 2010-10-31 | 2009-10-31 | 2008-10-31 |

|---|---|---|---|---|---|

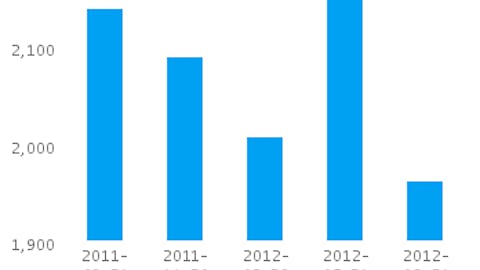

| Revenues | 2,364.0 | 2,336.0 | 2,093.0 | 1,484.0 | 1,699.0 |

| Revenue Growth % | 1.2 | 11.6 | 41.0 | (12.7) | 11.3 |

| Net Income | 563.0 | 552.0 | 415.0 | (44.0) | 57.0 |

| Net Income Growth % | 2.0 | 33.0 | N/A | (177.2) | N/A |

| Net Margin % | 23.8 | 23.6 | 19.8 | (3.0) | 3.4 |

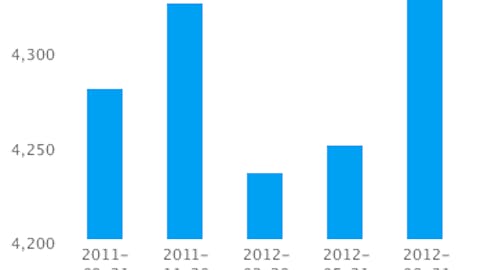

| ROE % | 25.4 | 31.4 | 32.6 | (4.8) | 7.7 |

| ROA % | 21.2 | 24.0 | 20.1 | (2.3) | 3.0 |

Valuation Drivers

Avago Technologies Ltd.’s current Price/Book of 3.5 is about median in its peer group. We classify AVGO-US as Harvesting because of the market’s low expectations of growth (PE of 15.2 compared to peer median of 19.7) despite its relatively high returns (ROE of 25.4% compared to the peer median ROE of 12.4%).

The company has a successful operating strategy with above median net profit margins of 23.8% (vs. peer median of 11.1%) and relatively high asset turns of 0.9x (vs. peer median of 0.7x). This suggests that the company has a dominant operating model relative to its peers. AVGO-US’s net margin is its highest relative to the last five years and compares to a low of -14.4% in 2007.

Economic Moat

The company enjoys both better than peer median annual revenue growth of 1.2% and better than peer median earnings growth performance 2.0%. AVGO-US currently converts every 1% of change in annual revenue into 1.7% of change in annual reported earnings. We view this company as a leader among its peers.

AVGO-US’s return on assets is above its peer median both in the current period (21.2% vs. peer median 8.1%) and also over the past five years (13.2% vs. peer median 6.3%). This performance suggests that the company’s relatively high operating returns are sustainable.

The company’s gross margin of 54.0% is around peer median suggesting that AVGO-US’s operations do not benefit from any differentiating pricing advantage. However, AVGO-US’s pre-tax margin is more than the peer median (24.7% compared to 11.1%) suggesting relatively tight control on operating costs.

Growth & Investment Strategy

While AVGO-US’s revenues growth has been above the peer median (16.8% vs. 7.4% respectively for the past three years), the stock’s PE ratio of 15.2 is less than the peer median. This implies that the company’s earnings are peaking and the market expects a decline in its growth expectations.

AVGO-US’s annualized rate of change in capital of 13.9% over the past three years is around the same as its peer median of 13.9%. This investment has generated a better than peer median return on capital of 26.5% averaged over the same three years. The greater than peer median rate of return suggest that the company may be under investing in growth.