A concept you are most likely familiar with is the slang term “catching a falling knife”–buying a stock that has fallen precipitously in the hopes that share prices will eventually rise. Unfortunately, falling knives can end up severely cutting into the returns of anybody who tries to grab one.

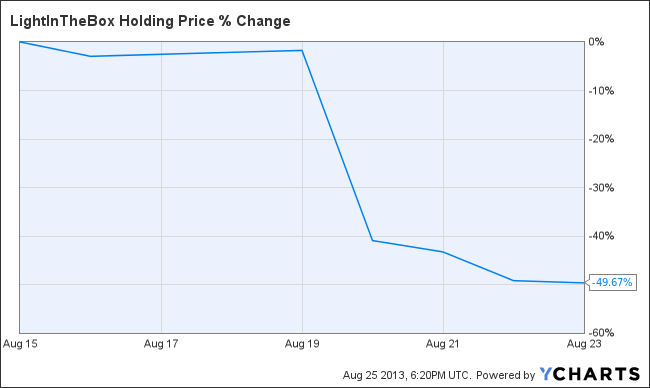

Well, it seems that our friend, Mr. Market, has decided to punish one Chinese online retailer with the falling-knife syndrome – LightIn TheBox . After the company went public in June, the stock soared; it later plunged an astonishing 50% in only eight days.

LightIn TheBox data by YCharts

Is this a sign that LightIn TheBox has underlying long-term weaknesses in its business model, or is this a market overreaction? After all, several falling-knife companies deserve to see their stock prices depreciate, so why would LightIn TheBox be an exception?

LightIn TheBox provides investors looking to profit off of China’s e-commerce trade a comparatively better option than competitor E Commerce China Dangdang Inc (ADR) (NYSE:DANG). However, Vipshop Holdings Ltd – ADR (NYSE:VIPS) might give LightIn TheBox some trouble if management doesn’t continue to innovate and respond to consumer needs.

Consideration #1: LightIn TheBox is profitable and growing

LightInTheBox is a Chinese online retailer that is often nicknamed the Chinese Amazon or eBay. The company derives most of its revenue from — surprise! Europe. Europe accounted for 61% of LightIn TheBox’s revenue, with North America and South America clocking in at 19%.

Shares soared in the run-up to its first quarterly report as a public company. LightIn TheBox’s unorthodox business model turned the heads of several investors. Expectations were flying sky-high, but those hopes were apparently not to be realized.

The company’s earnings per share of $0.10 topped analyst estimates, but revenue growth of 53% to $72.2 million missed the consensus estimate by about $4 million. LightIn TheBox also downgraded its yearly revenue estimate, but enjoyed a whopping 140% user increase.

So let me get this straight. You have a profitable, growing online-retail company that has an advantageous market position and hundreds of thousands of consumers doing business with it…and the stock gets annihilated on the day of a quarterly report that missed one statistical expectation by $4 million? Doesn’t seem to make much sense when you compare LightIn TheBox’s profitability with E Commerce China Dangdang Inc (ADR) (NYSE:DANG)’s current inability to dig itself out of a negative revenue hole.

Consideration #2: Vipshop Has Large Appeal

While I believe LightIn TheBox shares have fallen below a fair valuation of the company, there are some significant risks that investors should take into account. I encourage prospective investors to research LightIn TheBox further before initiating a long position in the stock.

LightIn TheBox’s management has openly admitted that the company’s high-end business model did hurt sales in the last quarter. Vipshop Holdings Ltd – ADR (NYSE:VIPS) has successfully been able to market more to the middle class. While Vipshop did offer a slightly softened outlook for the rest of 2013, it posted very robust numbers in the last quarter.

What’s good about this is that LightIn TheBox’s management has recognized the problem and is hopefully working on the solution to that problem. Vipshop Holdings Ltd – ADR (NYSE:VIPS) and E Commerce China Dangdang Inc (ADR) (NYSE:DANG) mainly have their operations centered in China anyway, while as already mentioned LightIn TheBox derives most of its revenue from overseas. What is bad about this is that LightIn TheBox could lose the massive Chinese market to Vipshop Holdings Ltd – ADR (NYSE:VIPS) and E Commerce China Dangdang Inc (ADR) (NYSE:DANG) if management doesn’t focus on developing its domestic operations.

Conclusion

If you want to effectively play the Chinese e-commerce market for the long haul, I would encourage you to take a look at both Vipshop Holdings Ltd – ADR (NYSE:VIPS) and LightIn TheBox. E Commerce China Dangdang Inc (ADR) (NYSE:DANG)’s 30% run-up over the past year might not be sustainable if the company can’t come out of the red. What Dangdang proved in the last quarter is that it is narrowing the gap and might soon return to the black, but LightIn TheBox and Vipshop Holdings Ltd – ADR (NYSE:VIPS) are already in the black, and thus far ahead of E Commerce China Dangdang Inc (ADR) (NYSE:DANG)’s game.

I do believe Mr. Market has unfairly punished LightIn TheBox since expectations got too carried away and many investors have become short-sighted about long-term priorities. Remaining LightInTheBox investors should hold onto their shares for the time being. Macroeconomic improvements in Europe’s economy will also hopefully boost LightIn TheBox’s bottom line. If you’re in for a volatile ride that might produce big returns in the future, then LightIn TheBox and Vipshop are the stocks for you.

The article 2 Long-Term Plays on Chinese E-Commerce originally appeared on Fool.com and is written by Evan Buck.

Evan Buck has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.