For more than two years, I’ve called out one or more stocks per month that I will be putting my real Roth IRA money into. Over that time frame, these picks have returned an average of 27%, which is beating the S&P 500 by 12 percentage points over the same time frame.

Today, I’m telling you why E Commerce China Dangdang Inc (ADR) (NYSE:DANG), a player in China’s e-commerce scene, will be my stock to buy for the month of September.

Positive momentum

My investing thesis is rather simple: I believe that current trends show that E Commerce China Dangdang Inc (ADR) (NYSE:DANG) is gaining traction with Chinese consumers — having originally differentiated itself by focusing on books — and it is spending money now in all the right areas to stay competitive in the future.

The company breaks down revenue into three categories: media (think e-books), general merchandise (stuff that’s actually sent to your doorstep), and other (usually fulfillment services for third-party vendors). Over the last three-and-a-half years, revenue has jumped 51% per year!

Source: SEC filings.

As you can see, what started out as a predominantly media-focused business has expanded to selling just about anything. And though the margins might be lower, “anything” sales have been booming.

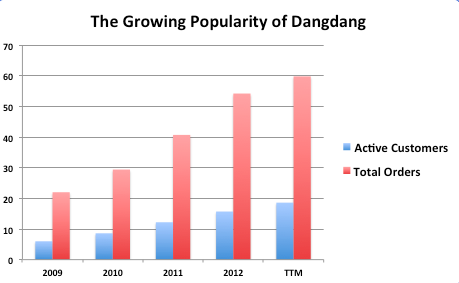

Another way to measure the company’s popularity is via the number of active members it has, and how many orders those members are placing. The Internet age in China isn’t in its infancy anymore, but it’s still in the adolescent stage. As of May 2013, the Internet was available to approximately 42% of mainland China. Companies like E Commerce China Dangdang Inc (ADR) (NYSE:DANG) need to work hard to capture new Internet users as they come online.

As you can see below, since 2009, E Commerce China Dangdang Inc (ADR) (NYSE:DANG) has been able to grow active customers by 38% and total orders by 33% per year.

Source: SEC filings , all figures in millions.

Equally encouraging, between 2009 and 2012, the average revenue per active customer increased from about $37 per year to $53 per year.

Where’s the profit?

One of the big red flags investors are worried about is that E Commerce China Dangdang Inc (ADR) (NYSE:DANG)’s once-profitable business model has been in the red for more than two years now. Normally, this would be a cause for concern, but I think the business is actually doing the right thing by spending lots of money now.

The vast majority of Dangdang’s jump in expenses has come in the form of building out fulfillment centers. These centers can be extremely expensive, but they represent a crucial advantage. By spreading fulfillment centers throughout China, E Commerce China Dangdang Inc (ADR) (NYSE:DANG) can get its products to customers’ doorsteps much quicker. That’s the kind of convenience that keeps customers coming back.