After borrowing money from the government (or banks) in 2008-2009, am I really telling you that there is a car company worth buying right now? Yes, and while Ford Motor Company (NYSE:F) still owes bank loans, there is a car company out there that is dreaming about the future. It only took in $127 million in revenue those two years, but now it appears to be the best buy around.

Are it serious?

Since Ford Motor Company (NYSE:F)’s loan in 2009, Tesla Motors Inc (NASDAQ:TSLA) has seen revenues increase by 369%, including an increase of 202% last year. That growth can’t continue, can it? Not forever, no. However, with 2012’s revenues sitting at $413 million, and the past 12 months of revenues at $945 million, it doesn’t appear this growth will stop anytime soon.

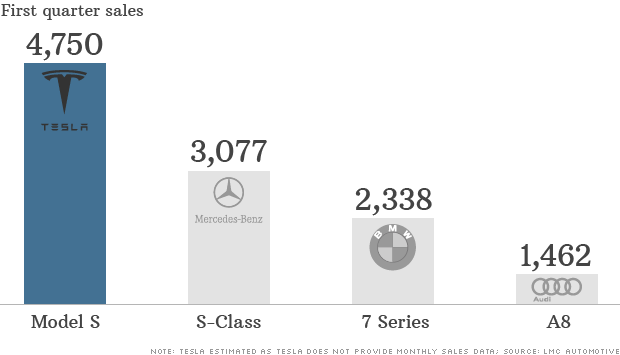

Obviously, more and more people are buying Tesla Motors Inc (NASDAQ:TSLA) vehicles every day, but here is the kicker. The company hasn’t come out with a cheap version of its vehicles yet! The Model S starts at $62,400 and goes up to nearly $90,000. No one can afford a car that averages just over $70,000, right? Wrong. People are paying for these cars.

Tesla Motors Inc (NASDAQ:TSLA)’s Model S had more sales in the first quarter than any of these other luxury vehicles in its price range. If this doesn’t convince you, consider the three stages that Elon Musk, Tesla’s CEO, has talked about for a while now. His plan is to basically divide Tesla’s growth into three stages. 1) Sell expensive, luxury cars, knowing not many will sell. 2) Sell cheaper luxury cars knowing that more people will buy them. 3) Sell affordable cars that virtually everyone can afford, and sell a lot of them.

Currently, Tesla Motors Inc (NASDAQ:TSLA) has barely entered the second stage. Imagine its growth potential over the next several years as it moves through stage 2 and into stage 3. This should be fun.

Performance of gas vs electric

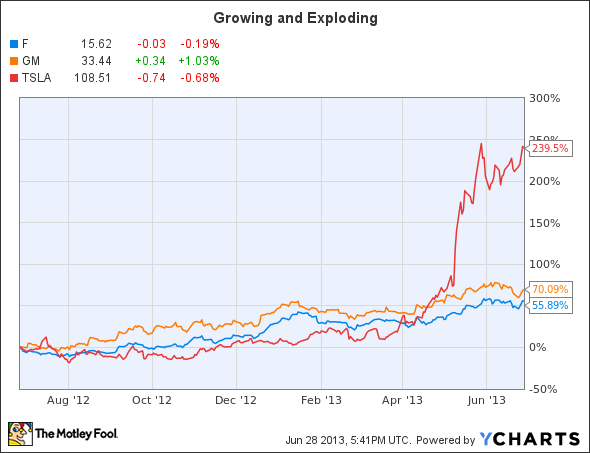

No, I’m not talking about the Model S Performance, which will go from 0-60 in 4.2 seconds, I am talking about the companies stocks. Tesla Motors Inc (NASDAQ:TSLA), Ford, and General Motors Company (NYSE:GM) are all American based companies with far different performance. One of the biggest differences is how they are powered. Most of In all reality, shareholders should be happy with any of the performances of these companies in the past year. Just because Tesla’s stock has more than tripled that of General Motors Company (NYSE:GM)’s doesn’t mean GM and Ford are having a bad run. They aren’t.

Valuation

So, it is obvious these three companies are experiencing impressive growth, but are they valued well? Should it be?

Tesla is a very young company, and I wouldn’t want it to have tons of cash. At this stage of growth, investors should want money being poured into Capital Expenditures (Cap Ex) and other ways that will benefit them long term. This is something Tesla has certainly done, even more than most young companies. How much? How about a 2,017% increase since 2009? Typical metrics of valuation are not fair to use on a company spending this much money on long term answers.