The wealth-building power of compound interest will never cease to amaze me. It’s a story of patience and attention to detail, where small, short-term differences add up to massive divergence over decades. And in the end, the biggest winners don’t always deliver the fattest share-price returns.

Today, I’m looking at the dividend history of health care all-arounder Johnson & Johnson (NYSE:JNJ).

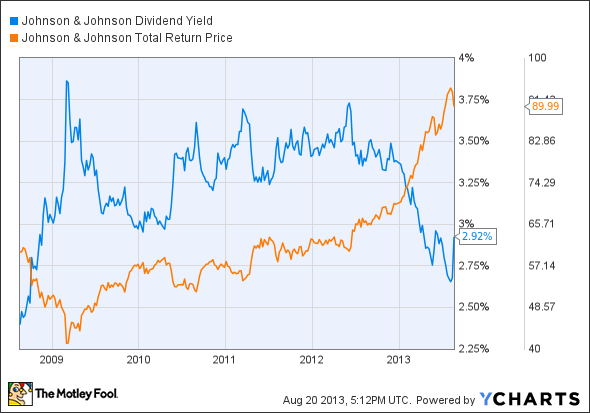

Among the 30 components of the Dow Jones Industrial Average (INDEXDJX:.DJI) index, Johnson & Johnson (NYSE:JNJ)’s 2.9% yield ranks just above the middle. It’s the 13th-most generous dividend yield on today’s Dow, not far from the 2.7% average yield.

But that’s an unusual position for the maker of Splenda, Band-Aids, and Tylenol. Johnson & Johnson (NYSE:JNJ) typically offers far higher dividend yields, and the reason for the currently modest payout is one most investors would never complain about:

JNJ Dividend Yield data by YCharts.

That’s right — Johnson & Johnson (NYSE:JNJ)’s dividend looks ordinary because the stock price is skyrocketing. Dividend-adjusted share prices have jumped 37% over the last year, behind only three other Dow stocks. The Dow itself has enjoyed a historical run in 2013, but that’s just a 13.5% rise in 12 months.

JNJ Total Return Price data by YCharts.

The company has boosted its dividend checks by an average of 11.3% over the last 10 years, and it has done in the most consistent way possible. The chart for this long-term trend is downright beautiful to income investors.

JNJ Dividend data by YCharts.

Shareholders reap the rewards of Johnson & Johnson (NYSE:JNJ)’s generous dividend policies in the long term. The stock has largely kept pace with the Dow’s total gains in the last decade, but reinvested dividends provided a serious rocket boost. Using the SPDR Dow Jones ETF (NYSEMKT:DIA) as a proxy for dividend reinvestments in the Dow, this is what you get:

For income investors with a yen for market-beating long-term results, Johnson & Johnson (NYSE:JNJ) is pretty much the ideal Dow stock to own. This is a rare combination of respectable share-price returns, generous dividend increases, and rock-solid fundamentals — yes, even when measured against the elite club of Dow members.

The article How Dividends Change the Game for Johnson & Johnson Stock originally appeared on Fool.com and is written by Anders Bylund.

Fool contributor Anders Bylund holds no position in any company mentioned. Check out Anders’ bio and holdings or follow him on Twitter and Google+. Motley Fool newsletter services have recommended buying shares of Johnson & Johnson. Motley Fool newsletter services have recommended buying calls on Johnson & Johnson.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.