In the highly contested retailing arena, many companies compete for the lead. Although one would believe that retail giants like Wal-Mart Stores, Inc. (NYSE:WMT) or Costco Wholesale Corporation (NASDAQ:COST) would dominate the market, it’s dollar stores that have taken the lead over the last few years. These shops offer prices that are, on average, 20% lower than the supermarket mean, convenient locations, small-box format stores for a more comfortable shopping experience aimed at a targeted customer base.

The segment is less susceptible to the advance of internet shopping, too. Dollar Stores client base is mainly composed of lower-income households (under $30,000-$40,000 annually) that do fewer online shopping, according to surveys carried out by research firms The Pew and ComScore.

This out-performance has attracted numerous investors over the past few years. Nevertheless, doubt remains concerning what companies investors should consider. In this article, we’ll examine reasons to invest in each of the three biggest firms in a sector that’s far from reaching its growth limit. Expert calculations reveal that over 15,000 Dollar Stores can still be introduced successfully in the U.S. market.

Best-in-class execution giant

Its attractive business model, great administration, and impressive scale provide the company with the highest consensus growth estimates within the main player in the industry, reaching an estimate of 12.7% for the current year versus Dollar Tree, Inc. (NASDAQ:DLTR)‘s 10.8% and Family Dollar Stores, Inc. (NYSE:FDO)‘s 5.5%. Also top in the sector are revenue consensus estimates, as Dollar General is expected to deliver $17.6 billion during fiscal 2013, compared to Dollar Tree’s $7.94 billion and Family Dollar’s $10.54 billion.

Its efficient management (singled out as a best-in-class) has been reflected not only in general growth, but also in consistently increasing EBIT margins and sales productivity.

Expansion opportunities are far from capped. The company’s latest Management earnings call states that approximately $300 million will be invested in new shops, remodels, relocation, and the acquisition of pre-existing store locations. Around 50% of 2013’s capital expenditure will be allocated for store growth and development. Consequently, store base growth is expected to maintain the 7% CAGR that has been consistently reached since 2007.

Another issue that should be taken into account is the roll-out of tobacco in Dollar General stores. This initiative, combined with the incorporation of beer and wine sales in most of the stores, is expected to boost comps and profit, since it has proven effective in competing chains. Family Dollar Stores, Inc. (NYSE:FDO), for example, retrieved positive results as comps grew and is expected to continue to increase thanks to the impact of tobacco roll-outs.

Dollar Tree is poised to succeed

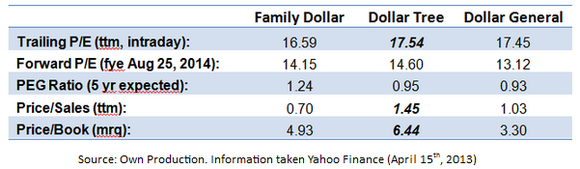

Dollar Tree, Inc. (NASDAQ:DLTR), on the other hand, is the smallest of the three main companies in the sector, withunder 5,000 stores (less than half as many shops as Dollar General Corp. (NYSE:DG), and about 3,000 less than Family Dollar). However, this firm is the most valued in the segment, offering the highest multiples: P/E, P/S and P/BV ratios reach 17.54, 1.45, and 6.44, respectively, for the trailing twelve months as of March 2013 (see Table 2 for compared multiples). Premiums paid indicate that investors and analysts are confident regarding the growth figures this company will deliver.

It’s highly differential retail model, even compared to other Dollar Stores (mainly because of its $1 price point), combines the comfort of small-box format shops with the low prices offered by large, but uncomfortable, discounters like Wal-Mart. This advantage has been crucial to the company’s success. Earnings per share have increased 62% between 2010 and 2012, and predictions indicate that they will grow another 23% in the next two years.

Dollar Tree, Inc. (NASDAQ:DLTR)’s significantly lower number of stores may also be seen as a growth factor, since opportunities abound to expand in both existing and new markets. In this context, maintaining its 7% square footage CAGR seems possible and likely.

Last but not least, two other items should be highlighted:

1) The advantaged position to resist Wal-Mart’s advance (Dollar Tree already experiences the highest Wal-Mart overlap in the sector, while still retrieving the highest operating margins).

2) The outstanding management team that has delivered great results, as sales CAGR grew by 12%, EBIDTA CAGR by 24%, and EPS CAGR by 30% between 2007 and 2011. In addition, leverage ratio is way below the sector’s average, and free cash flow is quite above it, allowing capital reinvestment and stock repurchases that result in EPS upsurges.

A potential out-performer

Family Dollar Stores, Inc. (NYSE:FDO) is just in between. It’s not as large as Dollar General Corp. (NYSE:DG), but bigger than Dollar Tree, Inc. (NASDAQ:DLTR). Nevertheless, the company’s stock is expected to outperform its main competitors this year, achieving an 18% increase in price (versus Dollar Tree’s 17% and Dollar General’s 9%), reaching a target price of $81.

Several reasons back this projection. In the first place, the aforementioned expansion opportunities of the sector provide a positive outlook for a company that has much room to occupy in the U.S., for it hasn’t yet penetrated numerous highly profitable markets.

Operating performance provides some extra advantages, as Family Dollar Stores, Inc. (NYSE:FDO) still offers plenty of places for improvement, given its $2 earnings-potential-per-share gap with Dollar General Corp. (NYSE:DG). Prospects to narrow this distance seem promising, as new initiatives, like the roll-out of tobacco, an aggressive remodel campaign, and a distribution agreement with McLane are implemented by a new, highly experienced management team. Even though completely closing the gap with Dollar General seems improbable in the short run, reducing it by half could add around 30% to the company’s income.

Conclusion

While the Dollar Store sector is expected to continue growing, the question is who will develop the most? Although Dollar General Corp. (NYSE:DG) currently leads the segment (in size), and Family Dollar Stores, Inc. (NYSE:FDO) is expecting the biggest up in stock price, it’s Dollar Tree, Inc. (NASDAQ:DLTR) that shows the most promising outlook (at least in the mid-term). Significantly higher multiples than its competitors strongly suggest that Dollar Tree is the company expecting the bigger boom. It’s highly differentiated concept makes it an interesting investment, as it doesn’t seem that growth will reach its limit any time soon.

The article My Analysis On The Leading Dollar Stores originally appeared on Fool.com and is written by Victor Selva.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.