After the close last Wednesday, Jack in the Box Inc. (NASDAQ:JACK) reported smashing results that easily beat analyst estimates. In fact the company has been on a tear lately of easily surpassing those estimates in each quarter during 2012.

The company operates and franchises Jack In the Box restaurants with more than 2,200 restaurants in 21 states. Additionally, the company operates and franchises Qdoba Mexican Grill with more than 600 restaurants in 44 states and Canada.

While the stock has been on a tear since November with the rest of the market, does the stock offer a bargain after the December quarter more than doubled earnings from last year?

Beating Earnings Yet Again

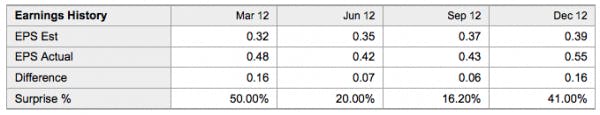

The stock is surging again after easily surpassing earnings for a fourth straight quarter. In fact, the company beat earnings by a combined $0.45 over the four separate quarterly periods in 2012 with the latest quarter providing the largest beat. See table below:

* Data from Yahoo! Finance

Conversely, competitors in both the hamburger and Mexican chain markets spent the majority of 2012 struggling to meet estimates. Both Chipotle Mexican Grill, Inc. (NYSE:CMG) on the Mexican side and McDonald’s Corporation (NYSE:MCD) and The Wendy’s Company (NASDAQ:WEN) on the hamburger side missed earnings estimates twice during the year. Even more interestingly is that Jack in the Box trades at a similar if not cheaper valuation to all these stocks.

Q4 2012 Earnings Highlights

The company provided the following highlights for Q4:

1). Operating earnings per share were $0.54 per share in the first quarter of fiscal 2013 compared with $0.25 per share in the prior year quarter.

2). Jack in the Box company same-store sales increased 2.1% and system same-store sales increased 1.9% in the first quarter.

3). Qdoba same-store sales in the first quarter increased 1.5% for company restaurants, driven by transaction and catering growth.

4). Consolidated restaurant operating margin improved by 220 basis points to 15.7% of sales in the first quarter of 2013, compared with 13.5% of sales in the year-ago quarter.

The company was able to drive higher profits by driving margins higher. Jack in the Box restaurants saw the operating margin increase by a smashing 320 basis points to 17.1%.

Growth Potential

The company is complex to value considering the combination of a fast food hamburger chain and a fast-casual Mexican chain. Though the previously mentioned chains easily swamp the combined store count of 2,800, both individual concepts are easily surpassed by the comparative concepts.

As an example, Chipotle operates over 1,400 restaurants and Wendy’s has over 6,500 stores in the US and 27 foreign countries. Naturally no comparison exists between Jack in the Box and McDonald’s, which has over 34,000 locations around the world.