Mattress Firm Holding Corp. (NASDAQ:MFRM) is on a three month run from $23.97 per share to $29.86 as of March 14, 2013. It announces fourth quarter and annual earnings on March 26 after hours. Does this short term bull run foretell strong earnings?

Mattress Firm is a specialty store that sells mattresses and mattress accessories in the United States. It operates 1,011 stores nationwide. Mattress Firm does not manufacture mattress; it only sells them. The two main suppliers to Mattress Firm are Tempur-Pedic International Inc. (NYSE:TPX) and Select Comfort Corporation (NASDAQ:SCSS). These two companies partially depend on the success of Mattress Firm and other retailers.

Tempur-Pedic International Inc. (NYSE:TPX) has four separate divisions: retail, third party, healthcare and direct. Of the $1.4 billion the company had in sales in 2012, 87% was from retail. 24% of all sales were from the top 5 customers. 10% of all sales in 2012 were directly form Mattress Firm. This represents more than $140 million in 2012. With margins at 7.6%, the company cannot command a stock price of $46 per share without continued growth at Mattress Firm.

Select Comfort, on the other hand, isn’t tied as strongly to Mattress Firm as Tempur-Pedic International Inc. (NYSE:TPX) is. Select Comfort Corporation (NASDAQ:SCSS) operates its own retail stores, which contribute 96.7% of all sales. Just $30 million of sales in 2012 came from non-company owned stores. It trades the dependence on other retailers for increased risk in operating its own stores. With this risk comes a concentration in return, though. In 2012, same store sales were up 24%. In 2011, they were up 29% from the year before.

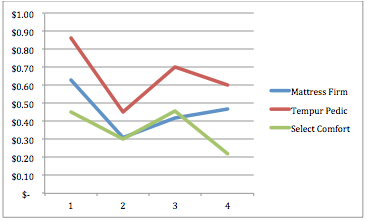

When looking at the last four quarters for each of these companies, the earnings per share follow a similar trend. The only exception is in the most recent quarter, when Mattress Firm increased its earnings by 11.9%.

In May of 2012, Mattress Firm acquired Mattress Giant and its 181 stores. Since this acquisition, Mattress Firm’s top line has grown by 32%. In addition to this acquisition, the company also purchased Mattress Xpress – a regional chain operating in Florida and Georgia. The company has been able to acquire existing business to grow its top line.

In the last year, though, the company’s selling general and administrative expenses have risen by 43%. This means that the company is paying more money to run its stores. The top line growth has been 32%, but just one line-item of operating expenses has risen by 43%. The company has been struggling to keep up with the growth. The third quarter net profit margin was only 4.4%, compared to 9.1% before the acquisitions.

New store acquisitions have also caused an increase in debt. The quick ratio is only .64 and the current ratio is only .90. The company’s net receivables have also been growing each quarter. Mattress Firm’s ability to convert receivables into cash could fuel issues in the future with increased capital expenditures from store acquisition and store rebranding.

With rising costs and increased debt, earnings shouldn’t be too high this past quarter. Some analysts are expecting a 31% decline in earnings from last quarter. The stock is already down 2.2% at the time of this writing on March 15, 2013. This decline in earnings is already being reflected in the stock price.

Mattress Firm – and other specialty home goods retailers – is tied directly to the housing market and the general economy. As 2013 and 2014 stabilize and lead to growing markets, Mattress Firm has the potential to increase its earnings and profitability.

The key to future success with Mattress Firm is reducing its SGA growth and strengthening its net profit margin. Look for this stock to have a flat or slow gain over the next few months. Within the year Mattress Firm could see a price of $32-$33 based on its growing revenue from acquisitions and store rebranding. If the net profit margin and SGA rate does not improve in the next two quarters and liquidity issues are still around, the price target may come down.

Austin Higgins is the Principal Consultant for Avant Venture Group. and focuses on building businesses through innovation, growth and investment. Read his company’s blog at BuildInvestGrow.com and follow him on Twitter @Austin_Higgins.

The article Do Mattress Companies Look Comfortable to Investors? originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.