Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the first 6 weeks of the fourth quarter we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Zions Bancorporation, National Association (NASDAQ:ZION) to find out whether it was one of their high conviction long-term ideas.

Zions Bancorporation, National Association (NASDAQ:ZION) investors should pay attention to a decrease in support from the world’s most elite money managers lately. Our calculations also showed that ZION isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are seen as underperforming, old investment tools of yesteryear. While there are over 8,000 funds in operation at the moment, We choose to focus on the aristocrats of this club, approximately 700 funds. These hedge fund managers shepherd most of all hedge funds’ total capital, and by watching their matchless equity investments, Insider Monkey has come up with several investment strategies that have historically outstripped Mr. Market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s view the latest hedge fund action encompassing Zions Bancorporation, National Association (NASDAQ:ZION).

What does the smart money think about Zions Bancorporation, National Association (NASDAQ:ZION)?

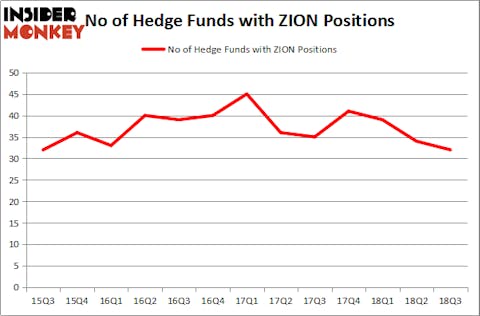

At Q3’s end, a total of 32 of the hedge funds tracked by Insider Monkey were long this stock, a change of -6% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in ZION over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Citadel Investment Group was the largest shareholder of Zions Bancorporation, National Association (NASDAQ:ZION), with a stake worth $207 million reported as of the end of September. Trailing Citadel Investment Group was Millennium Management, which amassed a stake valued at $77.1 million. Balyasny Asset Management, Highbridge Capital Management, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Zions Bancorporation, National Association (NASDAQ:ZION) has experienced a decline in interest from the entirety of the hedge funds we track, we can see that there is a sect of fund managers that elected to cut their full holdings heading into Q3. Interestingly, D. E. Shaw’s D E Shaw cut the largest stake of the “upper crust” of funds monitored by Insider Monkey, valued at an estimated $5.5 million in call options. Dmitry Balyasny’s fund, Balyasny Asset Management, also cut its call options, about $5.3 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 2 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Zions Bancorporation, National Association (NASDAQ:ZION) but similarly valued. We will take a look at W.R. Berkley Corporation (NYSE:WRB), Torchmark Corporation (NYSE:TMK), Bunge Limited (NYSE:BG), and Perrigo Company plc (NASDAQ:PRGO). All of these stocks’ market caps are closest to ZION’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WRB | 17 | 425023 | 1 |

| TMK | 21 | 762817 | -2 |

| BG | 39 | 1301171 | 0 |

| PRGO | 21 | 1045562 | -4 |

| Average | 24.5 | 883643 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.5 hedge funds with bullish positions and the average amount invested in these stocks was $884 million. That figure was $798 million in ZION’s case. Bunge Limited (NYSE:BG) is the most popular stock in this table. On the other hand W.R. Berkley Corporation (NYSE:WRB) is the least popular one with only 17 bullish hedge fund positions. Zions Bancorporation, National Association (NASDAQ:ZION) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BG might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.