A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Exponent, Inc. (NASDAQ:EXPO) .

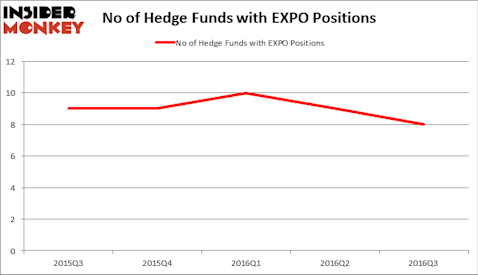

Is Exponent, Inc. (NASDAQ:EXPO) ready to rally soon? Prominent investors are categorically in a bearish mood. The number of bullish hedge fund investments were trimmed by 1 recently. EXPOwas in 8 hedge funds’ portfolios at the end of the third quarter of 2016. There were 9 hedge funds in our database with EXPO positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Wesco Aircraft Holdings Inc (NYSE:WAIR), Central Garden & Pet Co (NASDAQ:CENT), and Hollysys Automation Technologies Ltd (NASDAQ:HOLI) to gather more data points.

Follow Exponent Inc (NASDAQ:EXPO)

Follow Exponent Inc (NASDAQ:EXPO)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

ImageFlow/Shutterstock.com

Keeping this in mind, let’s analyze the key action surrounding Exponent, Inc. (NASDAQ:EXPO).

Hedge fund activity in Exponent, Inc. (NASDAQ:EXPO)

At Q3’s end, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of -11% from the second quarter of 2016. By comparison, 9 hedge funds held shares or bullish call options in EXPO heading into this year. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Jim Simons’s Renaissance Technologies has the largest position in Exponent, Inc. (NASDAQ:EXPO), worth close to $28.7 million, accounting for 0.1% of its total 13F portfolio. The second largest stake is held by Royce & Associates, led by Chuck Royce, which holds a $23.2 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other members of the smart money that are bullish encompass Andrew Sandler’s Sandler Capital Management, Paul Hondros’s AlphaOne Capital Partners and one of the biggest hedge funds in the world, D E Shaw. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that sold off their entire stakes in the stock during the third quarter. At the top of the heap, J. Alan Reid, Jr.’s Forward Management sold off the biggest stake of all the investors studied by Insider Monkey, totaling close to $1 million in stock. Peter Muller’s fund, PDT Partners, also dropped its stock, about $0.7 million worth.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Exponent, Inc. (NASDAQ:EXPO) but similarly valued. We will take a look at Wesco Aircraft Holdings Inc (NYSE:WAIR), Central Garden & Pet Co (NASDAQ:CENT), Hollysys Automation Technologies Ltd (NASDAQ:HOLI), and WMS Industries Inc. (NYSE:WMS). This group of stocks’ market caps are similar to EXPO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WAIR | 12 | 277830 | -1 |

| CENT | 21 | 114884 | 4 |

| HOLI | 15 | 84096 | 1 |

| WMS | 13 | 312542 | 2 |

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $197 million. That figure was $61 million in EXPO’s case. Central Garden & Pet Co (NASDAQ:CENT) is the most popular stock in this table. On the other hand Wesco Aircraft Holdings Inc (NYSE:WAIR) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Exponent, Inc. (NASDAQ:EXPO) is even less popular than WAIR. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.