The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Derma Sciences Inc (NASDAQ:DSCI).

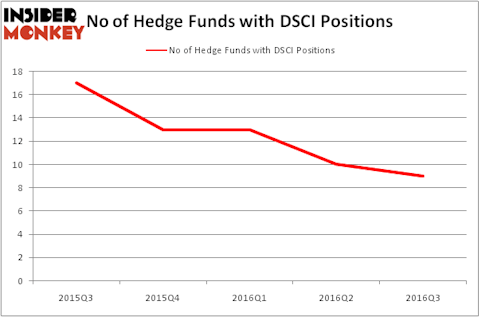

Derma Sciences Inc (NASDAQ:DSCI) shareholders have witnessed a decrease in hedge fund sentiment in recent months. DSCI was in 9 hedge funds’ portfolios at the end of the third quarter of 2016. There were 10 hedge funds in our database with DSCI holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Anthera Pharmaceuticals Inc (NASDAQ:ANTH), Virtus Total Return Fund (NYSE:DCA), and Anavex Life Sciences Corp. (NASDAQ:AVXL) to gather more data points.

Follow Derma Sciences Inc. (NASDAQ:DSCI)

Follow Derma Sciences Inc. (NASDAQ:DSCI)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

What does the smart money think about Derma Sciences Inc (NASDAQ:DSCI)?

At the end of the third quarter, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a 10% drop from the second quarter of 2016, as hedge fund ownership continues to slide. The graph below displays the number of hedge funds with bullish position in DSCI over the last 5 quarters, which have fallen by over 40% during that time. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Julian Baker and Felix Baker’s Baker Bros. Advisors has the largest position in Derma Sciences Inc (NASDAQ:DSCI), worth close to $17.5 million. On Baker Bros. Advisors’ heels is Broadfin Capital, led by Kevin Kotler, which holds a $12 million position; the fund has 1.1% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish comprise Renaissance Technologies, one of the largest hedge funds in the world, Nathan Fischel’s DAFNA Capital Management, and Chuck Royce’s Royce & Associates. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Derma Sciences Inc (NASDAQ:DSCI) has faced falling interest from the entirety of the hedge funds we track, it’s safe to say that there is a sect of hedgies that slashed their entire stakes by the end of the third quarter. It’s worth mentioning that Richard Mashaal’s RIMA Senvest Management dumped the biggest stake of all the hedgies watched by Insider Monkey, valued at close to $0.9 million in stock. Phill Gross and Robert Atchinson’s fund, Adage Capital Management, also cut its stock, about $0.4 million worth.

Let’s also examine hedge fund activity in other stocks similar to Derma Sciences Inc (NASDAQ:DSCI). These stocks are Anthera Pharmaceuticals Inc (NASDAQ:ANTH), Virtus Total Return Fund (NYSE:DCA), Anavex Life Sciences Corp. (NASDAQ:AVXL), and Endocyte, Inc. (NASDAQ:ECYT). This group of stocks’ market valuations are similar to DSCI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ANTH | 9 | 14393 | 0 |

| DCA | 4 | 25711 | 0 |

| AVXL | 4 | 722 | 2 |

| ECYT | 6 | 7231 | 0 |

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $12 million. That figure was $36 million in DSCI’s case. Anthera Pharmaceuticals Inc (NASDAQ:ANTH) is the most popular stock in this table. On the other hand Virtus Total Return Fund (NYSE:DCA) is the least popular one with only 4 bullish hedge fund positions. Derma Sciences Inc (NASDAQ:DSCI) is tied as the most popular stock in this group and has more money invested in it than any of the stocks on the list, but hedge fund interest is falling. This is a slightly positive signal overall, but we’d rather spend our time researching stocks that have better recent sentiment. In this regard ANTH might be a better candidate to consider taking a long position in.

Disclosure: None