Crocs, Inc. (NASDAQ:CROX) is a company which grew its revenue from just $1 million in 2003 to $847 million by 2007 on the back of an unorthodox footwear product. I’m talking about the original Crocs, Inc. (NASDAQ:CROX) shoe, which looks like this:

This fantastical growth caused the stock to skyrocket, hitting a peak in 2008 of about $72 per share. This was about 36 times 2007 earnings, suggesting that the market believed that strong growth would continue.

But after seeing 138% revenue growth the year before sales decreased in 2008 by 15% and decreased again in 2009, a combination of the financial crisis and the fad-like nature of the product being the culprits. The stock plummeted.

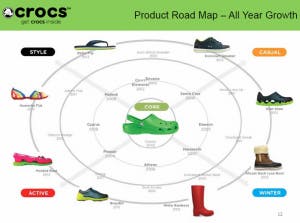

Since then the company has greatly diversified its product line, adding styles which don’t look as ridiculous as the original, and was able to grow revenue by 12% in 2012.

Gross margin has recovered nearly to the pre-crisis levels and both net income and free cash flow have turned strongly positive. Now that the stock trades at about $15 per share, is Crocs a good value?

Strong balance sheet

At the end of 2012 Crocs had $294 million in cash and only $10 million in debt and capital leases, leaving a net cash position of $284 million. This is about $3.16 in cash per share, which represents a little over 20% of the total market capitalization. This means that the market is valuing all of Crocs, Inc. (NASDAQ:CROX) future profits at about $12 per share.

Crocs, Inc. (NASDAQ:CROX) has been using some of this cash to buy back shares, with 1.9 million shares repurchased since November 2012 and 3.4 million shares remaining on its share repurchase authorization. This most recent burst in buybacks followed a steep drop in the share price, leading me to believe that the company is tactically buying back shares at low prices. Many companies overpay for their own shares, but it looks like Crocs has avoided that trap.

Profitability

EPS became turned positive in 2010 and has almost doubled in the two years since, growing from $0.76 per share to $1.44 per share in 2012. EPS growth grew by 16% in 2012 to $1.44 per share, leading to an adjusted P/E ratio of about 8.33 (after subtracting net cash from the market cap).

Instead of using net income for valuation purposes in many cases I prefer to look at owner earnings. This is similar to free cash flow but removes the effects of fluctuating working capital, which can cause the FCF to be extremely volatile. Owner earnings have grown from $73 million in 2010 to $107 million in 2011 and $137 million in 2012. On a per-share basis the 2012 value is $1.52, slightly higher than EPS and significantly higher than the free cash flow. This puts the adjusted Price/Owner Earnings ratio at about 7.9.

Data from Morningstar