Contrarian Capital Management is a Greenwich-based hedge fund established in 1995 by Jon Bauer, Janice Stanton and Gil Tenzer. The fund focuses on distressed investing, and manages an equity portfolio of over $145.72 million, according to the 13F filing reported for the end of the second quarter. In the third quarter, Contrarian Capital Management returned 19.76% from its 12 long positions in companies with a market cap of at least $1 billion, as we calculated.

While the $3 trillion hedge funds industry faces an investor exodus, with roughly $28 billion pulled out just in the third quarter, 627 out of about 660 hedge funds in our database posted positive returns in the third quarter, according to out calculations. This strategy helps in beating the market and comparing the overall returns of hedge funds with the targeted returns to gauge performance.

Let’s take a closer look at the top four bets of Contrarian Capital and see what other smart money investors think about each of these companies.

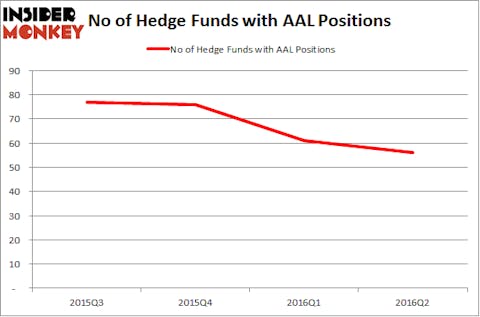

Contrarian upped its stake in American Airlines Group Inc (NASDAQ:AAL) by 6% to 699,848 shares worth $19.81 million in the second quarter. American Airlines Group Inc (NASDAQ:AAL)’s stock returned 29.7% during the third quarter. At the end of the second quarter, a total of 56 of the hedge funds followed by Insider Monkey were long this stock, down by 8% from the previous quarter. Among them, Adage Capital Management, led by Phill Gross and Robert Atchinson, held the number one position in American Airlines Group Inc (NASDAQ:AAL), which was worth $178.2 million. On Adage Capital Management’s heels was Stelliam Investment Management, managed by Ross Margolies, which amassed a $174 million position. Remaining hedge funds and institutional investors that held long positions included Mike Masters’s Masters Capital Management, Stephen C. Freidheim’s Cyrus Capital Partners, and James Dondero’s Highland Capital Management.

Follow American Airlines Group Inc. (NASDAQ:AAL)

Follow American Airlines Group Inc. (NASDAQ:AAL)

Receive real-time insider trading and news alerts

Vale SA (ADR) (NYSE:VALE) was a new addition in Contrarian’s portfolio in the second quarter. The fund loaded up on the Brazilian metals and mining company by buying 3.35 million shares valued at $16.25 million. Overall, a total of 24 of the hedge funds in our database held long positions in this stock at the end of June, down by two over the quarter. The largest stake in Vale SA (ADR) (NYSE:VALE) was held by Renaissance Technologies, which reported holding $75.4 worth of stock at the end of June. It was followed by Capital Growth Management with a $35.4 position. Other investors bullish on the company included Oaktree Capital Management, Luminus Management, and Renaissance Technologies. The stock gained 8.7% during the third quarter.

Follow Vale S A (NYSE:VALE)

Follow Vale S A (NYSE:VALE)

Receive real-time insider trading and news alerts

On the next page, we will continue our discussion of Contrarian Capital’s biggest bets of third quarter.