If you believe in the economic recovery as much as I do, you may want to think about investing in one of the exchanges. A better economy means people make more money and invest more, giving more business to the exchanges that facilitate investment.

About CME Group Inc (NASDAQ:CME)

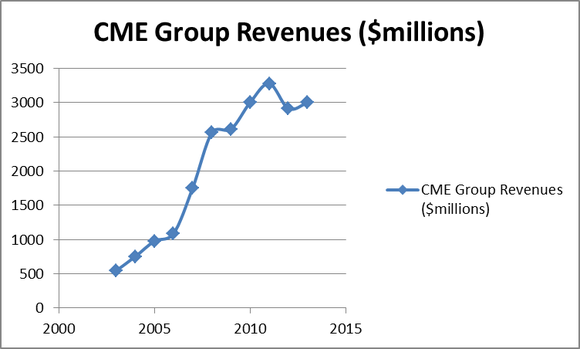

As mentioned, CME Group Inc (NASDAQ:CME) is the largest futures exchange in the world, operating on both its CME Group Inc (NASDAQ:CME) Globex trading platform and on its trading floors. To illustrate how futures trading has grown, consider CME Group Inc (NASDAQ:CME)’s revenues over the past decade:

One of CME’s biggest competitive advantages is that it operates its own clearing house, which allows the company to get revenue from the trades themselves and the clearing of those trades. Expanding its clearing services should be one of the major drivers of growth going forward.

CME derives 81% of its revenues from fees associated with the trading of the futures and options-on-futures it offers. Over 87% of the company’s trades are conducted electronically through its Globex platform, and fees are based on the product being traded, how the trade was done, and whether or not the customer conducting the trade is a member of the exchange

Growth and Valuation

CME Group looks to be highly valued at first glance, trading for 18.9 times forward earnings. However, 2013’s projected earnings of $3.16 per share are expected to grow quickly to $3.64 and $4.08 over the next two years, for annual earnings growth of 15.2% and 12.1%, respectively, which more than justifies the valuation. Also worth considering is the company’s very competitive 3% dividend yield, which has been raised consistently and rapidly over the past decade from just 13 cents per share in 2003 to $1.80 per share today. If trading activity continues to pick up, I see no reason why this trend shouldn’t continue in the years ahead.

Other Exchanges

Alternatives to CME Group include NYSE Euronext (NYSE:NYX), NASDAQ OMX Group, Inc. (NASDAQ:NDAQ), and CBOE Holdings, Inc (NASDAQ:CBOE).

NYSE Euronext (NYSE:NYX) operates six different exchanges, which make up the world’s largest and most liquid group of exchanges. I thought the company was extremely attractive and undervalued for years, and had recommended it as one of the best buys in the market several times. Apparently other companies agreed, as in December it was announced that IntercontinentalExchange Inc. agreed to buy out NYSE Euronext (NYSE:NYX) for a cash and stock deal. After the announcement, shares shot up and currently trade just below $40, a long way from the $25 range before the announcement. I think that at this point NYSE Euronext (NYSE:NYX) is fairly valued, and the only profitable way to play it is as an arbitrage trade as the deal gets closer to closing. More on that in a future article…

NASDAQ OMX Group, Inc. (NASDAQ:NDAQ), on the other hand, may be worth a look. While not expected to grow its earnings quite as rapidly as CME Group, shares are trading at a very reasonable 10.4 times forward earnings. NASDAQ has underperformed its peers since the financial crisis, and because of this, market pessimism may be the cause for the lower valuation. Regardless, a company with 10.4 times earnings with 10% forward growth projected is at least worth a look.

CBOE Holdings, Inc (NASDAQ:CBOE) owns the Chicago Board Options Exchange and several other options exchanges, and also deals in a rapidly growing form of investing (options). While I don’t advocate the trading of options unless you really know what you’re doing, CBOE Holdings, Inc (NASDAQ:CBOE) does have the leading position in index option contracts and other options products. A relatively new public company (IPO in 2010), CBOE trades at 20 times forward earnings with 14% forward growth projected. CBOE also pays a decent dividend of 1.6% annually. One of my concerns is the disproportionate amount of ownership by CBOE members, effectively taking control away from shareholders. Even so, this one may be worthy of consideration as well.

The Bottom Line

CME is a leader in a very fast-growing area of investing and trading, however there are alternatives that are worth considering before jumping in. With a high dividend yield, low debt, and $1.6 billion in cash, and the increasing need for traders to enter futures contracts for oil, gas, and precious metals, CME Group is my personal favorite out of the publicly traded exchanges.

The article The Economic Recovery Should Help Out This Exchange originally appeared on Fool.com and is written by Matthew Frankel.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.