Want your mind blown? The Motley Fool Rulebreakers released this report revealing the significance of what has now become referred to as “the cloud.” Give it a read.

What is the cloud?

To be clear, the definition of cloud computing is sometimes still debated among investing and technological professionals. In short, though, cloud computing is a new industry where services are offered and delivered via a network, primarily the internet. Most all firms providing cloud computing services utilize rental or pay as you models for charging users.

- Software (like accounting, information systems, or HR)

- Storage (benefits of data storehouses without owning the necessary tools)

- Infrastructure (benefits of hardware and structure without owning the assets)

Does the following image excite you?

It should.

A study performed by the global market intelligence firm IDC indicates that between 2012 and 2016 public IT services will boast a 26.4% annual compound growth rate. Also, consider what we experienced in 2011 when the First Trust ISE Cloud Computing Index Fund, the first ETF for the cloud computing space was born. This fund includes small tech startups to the behemoths Microsoft Corporation (NASDAQ:MSFT), Google Inc (NASDAQ:GOOG), Apple, and Oracle. While more detailed information about the fund can be found here, investors should anticipate that this ETF will grow with the demand for cloud computing services.

Interested Now?

Let’s look at the big three:

Amazon.com, Inc. (NASDAQ:AMZN) is dominating the industry. In 2006, Amazon released Amazon Web Services (AWS), a platform that enables users to run virtually any application in the cloud. McKinsey & Co. released a report stating that users would only be charged about $16 a month using AWS compared to $31.50 a month to buy and maintain a server. Forrester Research estimates that Amazon claims about 70% of the market for renting computing capacity and data.

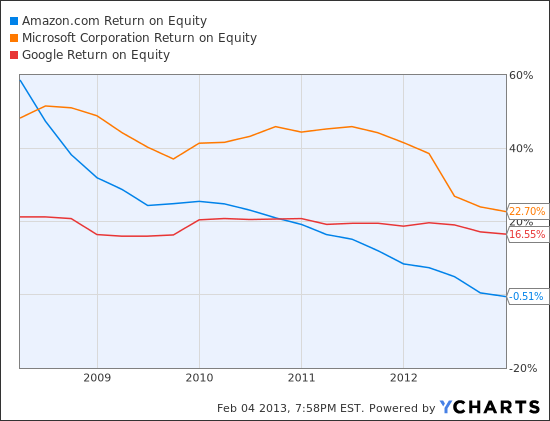

Additionally, Amazon is now re-positioning itself to sell its services to large companies which historically own their hardware—directly attacking Microsoft. However, Amazon has a much lower ROE than Google and Microsoft. The phenomenon is explained by its low profit margin. It posted a $39 million loss in 2012. Remarkably, Amazon reported total sales over $61 billion, up $13 billion from 2011. Overall, Amazon’s sales have quadrupled over the past 4 years.

Basically, Amazon is rapidly growing at the expense of generating profits. To date, this strategy has not seemingly hurt the giant. But, it won’t last long.

AMZN Return on Equity data by YCharts

Google and Microsoft are making a comeback.

In 2006, Google invested over $600 million to establish a state of the art, energy efficient data center that could potentially serve as the hub for the firm’s cloud war against Amazon. As the New York Times once reported, “In Google’s vision of the future of the Internet, the live streaming of 3-D medical images from a rural health clinic to a specialized medical center or the downloading of a full-length movie in a matter of minutes would become commonplace.”

Now, the search engine giant offers Google Compute Engine, an application which enables organizations to “run large scale computing workloads…hosted on Google’s infrastructure.”

Then, Microsoft released Windows Azure, a platform that “enables you to quickly build, deploy and manage application across a global network of Microsoft-managed datacenters….” While Amazon is still the clear leader in the market services sector of cloud computing, Microsoft and Google are poised to rock Amazon, particularly in data storage.

All three firms are undergoing price wars, and as of now, Azure seems to be winning. A quick look at the firm’s current cash position also reveals that Google and Microsoft have the means to continue to wage war on Amazon.

| Amazon | $11.45B |

| $48.09B | |

| Microsoft | $68.1B |

*data from Yahoo!Finance

AMZN Profit Margin Quarterly data by YCharts

As aforementioned, Amazon’s revenue is growing—without churning much of a profit. However, Google and Microsoft, simultaneously grow their revenue and profit. Unless Amazon makes some changes, investors should be wary about its potentially inflated stock price. While I do not think that Amazon is a bubble that will burst, I do expect to see Google and Microsoft further expand into the cloud computing industry—ripping Amazon of some market share.

Conclusion

Investors should be watching Amazon, Google, Microsoft, and even the Cloud Computing Index Fund for growth opportunities. Why? For one, the demand for the services is growing while the cost to provide the services is stable and even decreasing for some firms.

p.s. Fortunes will be made by smaller cloud firms in this industry as the big 3 continue to go head to head.

The article Cloud Computing, The Future, and Your Money originally appeared on Fool.com and is written by Brendan Marasco.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.