It all started with a large purchase of Terra Nitrogen by CF Industries. The end result was a near 100% payout ratio from Terra Nitrogen to its parent company CF Industries. Normally I’m against high payout ratios but in this case CF Industries gets much needed capital for expansion and M&A while Terra Nitrogen gets the support and insulation from its much larger parent while still maintaining some autonomy. On top of that, Terra Nitrogen is highly profitable, has zero debt, and $180 million in cash on hand which are all key components to sustaining a high payout ratio. So even if there is a quarterly miss, the dividend payout shouldn’t be in jeopardy.

Both companies I believe could possess potential for long term plays in the ever growing fertilizer market. However, they represent two distinct approaches to long term investing. One aims to create monetary gains through expanding operations, therefore increasing revenue, and consequently, the stock price. The other seeks to return current income to the investor in a more timely manner.

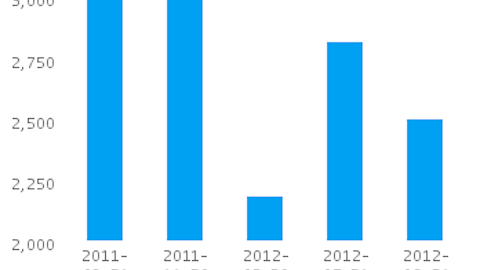

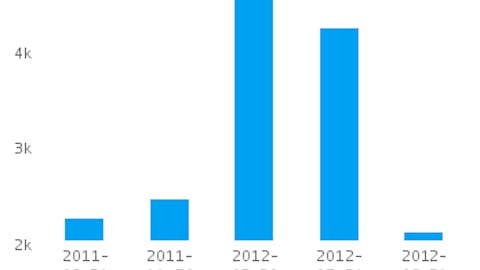

So which is the better choice between the two? One important factor makes Terra Nitrogen the winner in my book. Terra Nitrogen is still expanding its own operations as evidenced by the 13% capital re-investment rate. Compare that to the industry average of only 8%. Making this company both a growth story and a solid dividend payer. Looking at a 3 year chart of both companies (Figure 2) we can see little divergence between the two.

Figure 2:

With a $14 billion market cap CF Industries is going to find it more difficult to grow in this competitive space. But with only a $4 billion market cap Terra Nitrogen has room for near exponential growth.

Finally, Terra Nitrogen boasts a superior 5 year net profit margin average of 43.50%. Compare that to the industry average of 17% and we can see that management takes their margins very seriously.

Conclusion

Fertilizer is a growth industry. Increasing population, a growing global middle class, and higher quality diets are all key macro components that will benefit this sector. Terra Nitrogen looks to be fundamentally sound, growing consistently, and paying solid dividends. Though the small cap nature of this stock might lend itself to some large percentage swings over the long run this looks to be destined to go higher while paying you handsomely the whole time.

The article Clean Up With These Dirty Stocks originally appeared on Fool.com and is written by James Catlin.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.