The ‘Tepper Rally’

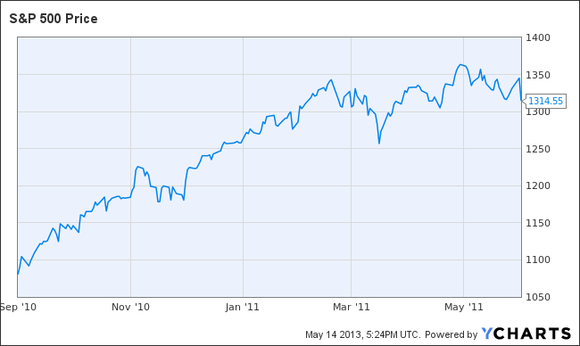

In recent years, Tepper is mostly known for the so-called “Tepper Rally” that took place from the fall of 2010 to the summer of 2011. In September 2010, Tepper made a simple observation: either the economy would recover, in which case stocks would rally, or the Federal Reserve would inject more stimulus, in which case stocks would rally.

He received a fair amount of criticism for the call (mostly from Fed skeptics), yet it proved to be stunningly accurate. From the beginning of September 2010 to the end of the May 2011, the S&P 500 rallied from about 1100 to over 1300.

Case dismissed

Despite the fact that the S&P 500 has rallied nearly 50% from Tepper’s original bull call in 2010, he continues to love the market. In his CNBC appearance, he remarked that the evidence for the rally continuing was “overwhelming.” Specifically, Tepper cited:

- Easing by other central banks: Australia, ECB, Korea and Japan

- The US economy is rebounding

- The US deficit is set to shrink dramatically in the next six months

On the last point, Tepper noted that given current projections, the Fed would be injecting more money into the economy than the federal government was looking to borrow. Consequently, these additional funds have to go somewhere — possibly into stocks, or the real economy.

Could the Fed quit easing?

Of course, a popular notion among market bears continues to be a belief that the Fed will cut back on its easing. Given that the market has moved higher mostly on Fed policy (not economic fundamentals), any tapering of Fed bond purchases would, in the minds of bears, lead to a drop in the markets.

But Tepper doesn’t buy that. In fact, Tepper hopes that Fed does begin tapering, as he believes the healthiest markets rally gradually. According to Tepper, if the Fed doesn’t start tapering its asset purchases, we could see a repeat of the end of 1999.

If that happens, Tepper warns that bears will have to find themselves a shovel to dig out of their “graves.”

How to play the Tepper rally

So, if investors buy into Tepper’s logic, how can they play the rally?

Tepper’s largest holding is Citigroup Inc (NYSE:C). As a major financial, it’s a direct play on the equity market and a broader economic recovery. Although shareholders were absolutely destroyed during the financial crisis, shares of the bank are up nearly 80% in the last year.

Most notably, the bank replaced its former CEO Vikram Pandit with Michael Corbat last October. Corbat has generally been regarded as a more genuine banker, whereas Pandit had his roots in trading and hedge funds.

Analysts at Sterne Agee liked the change, and upgraded shares of the bank to Buy back in January. In a note, they called the switch to Corbat a “game changer.” At the time, Sterne Agee had given Citigroup Inc (NYSE:C) shares a $50 price target, which is roughly where shares are trading at today.

Buy an index fund

A more simple alternative would be to buy an index, such as the SPDR S&P 500 ETF Trust (NYSEMKT:SPY). The ETF is a direct play on the underlying index — the S&P 500 — and should provide good returns for investors if the market continues to power higher.

For those who are more adventurous, a leveraged cousin of SPY might be a more attractive alternative.

The ProShares UltraPro S&P 500 offers a way for investors to juice their returns through leverage. For example, as I write this, the SPY is up roughly 0.85%, whereas the UPRO is up roughly three times as much, better than 2.50%.

Of course, that leverage comes at a price. Holding leveraged ETFs for long periods of time can be deadly, particularly if the market sells off. Traders using leveraged ETFs should be careful to use appropriate stops.

Will Tepper be right yet again?

Many commentators have characterized this rally as the most hated one ever. To be certain, there have been plenty of critics along the way. (David Rosenberg, for example, has stubbornly remained bearish over the last four years.)

But Tepper has been a bull, and at times, the only bull. Will his bullish prognosis prove accurate once again? Or has he simply gotten lucky in recent years?

The article Billionaire Hedge Fund Manager: The Market Can Only Go Up! originally appeared on Fool.com and is written by Salvatore “Sam” Mattera.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.