Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Brocade Communications Systems, Inc. (NASDAQ:BRCD) fit the bill? Let’s look at what its recent results tell us about its potential for future gains.

What we’re looking for

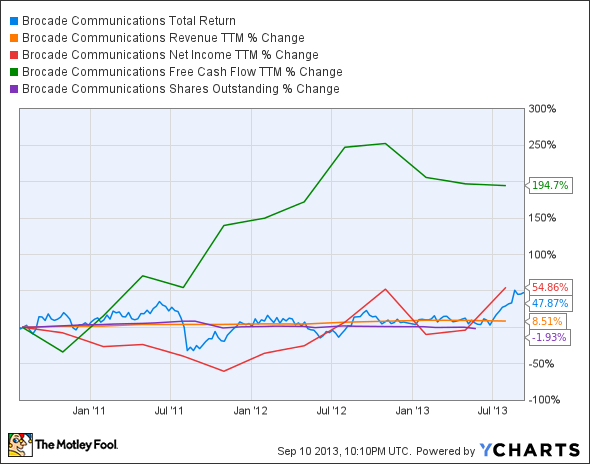

The graphs you’re about to see tell Brocade Communications Systems, Inc. (NASDAQ:BRCD)’s story, and we’ll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let’s look at Brocade Communications Systems, Inc. (NASDAQ:BRCD)’s key statistics:

BRCD Total Return Price data by YCharts

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Revenue growth > 30% | 8.5% | Fail |

| Improving profit margin | 42.7% | Pass |

| Free cash flow growth > Net income growth | 194.7% vs. 54.9% | Pass |

| Improving EPS | 41.3% | Pass |

| Stock growth (+ 15%) < EPS growth | 47.9% vs. 41.3% | Pass |

Source: YCharts.

*Period begins at end of Q2 (July) 2010.

BRCD Return on Equity data by YCharts

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Improving return on equity | 28.3% | Pass |

| Declining debt to equity | (45.5%) | Pass |

Source: YCharts.

*Period begins at end of Q2 (July) 2010.

How we got here and where we’re going

Brocade Communications Systems, Inc. (NASDAQ:BRCD) got off to a great start, but its mediocre revenue growth cost it a perfect score. However, there’s no reason why a few strong quarters couldn’t nudge this company up from its six out of seven passing grades and into truly elite territory. Everything else on our analysis indicates a strong performer, but how might Brocade Communications Systems, Inc. (NASDAQ:BRCD) push its revenue even higher over the coming year? Let’s dig a little deeper.

Shares of networking storage specialist Brocade recently surged by 15% after posting better-than-expected quarterly results. However, Brocade Communications Systems, Inc. (NASDAQ:BRCD)’s has been facing ferocious competition from Cisco Systems, Inc. (NASDAQ:CSCO) and Oracle in storage-area networking, which has forced it to refocus on its proprietary Ethernet-fabric business over other core offerings. My fellow Fool Dan Caplinger points out that this technology is purpose-built for virtualized data centers, which could offer a killer edge when it comes to partnering up with the group of elite technology companies aggressively expanding into virtualization.