Cisco Systems, Inc. (NASDAQ:CSCO) has announced new innovations that enable providers to acquire intelligence about mobile internet networks and maximize profits with their connections. Cisco’s Quantum, which consists of four solution suites, aims at maximizing profits over data and delivering richer and better network experiences.

In this article, I will discuss how the trends in the mobile internet market will favor Cisco’s new solutions. This will act as a growth catalyst for Cisco Systems, Inc. (NASDAQ:CSCO) and enable it to sell more of its product and improve the company’s price multiples.

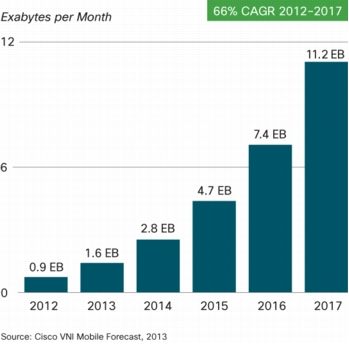

The question investors are asking is how Cisco will achieve sales growth with the new mobile internet solution. Mobile cloud traffic is on the rise all over the world. According to Cisco research, it reached 885 petabytes per month at the end of 2012, up from 520 petabytes per month at the end of 2011. In this chart, Cisco Systems, Inc. (NASDAQ:CSCO) forecasts still greater yearly increases. The global mobile data traffic will rise from 1.6 Exabytes in 2013 to 11.2 Exabytes in 2017. In other words, companies with dominant mobile internet solutions will have the opportunity to compete in a bigger market in the next few years.

In the second chart, IDATE-LTE Watch Service, a respected research firm, reveals its research results for the global LTE market, which is dependent on the mobile internet. The research report predicts astronomical growth in the sector. The market will grow from 119 million subscribers in 2013 to over 830 million subscribers by 2016. This trend will likely affect the numbers of Cisco Systems, Inc. (NASDAQ:CSCO)’s new mobile internet solutions.

Financials

For fiscal 2012, Cisco reported net sales of $46.1 billion, an increase of 7% compared to fiscal 2011. Fiscal 2012 product sales were $36.3 billion, up 5% compared to fiscal 2011. Net income for fiscal 2012 was $8.0 billion, representing an increase of 24% from fiscal 2011. Its Wireless category, which is dependent on the mobile internet, was up 19% in fiscal 2012. Its Data Center category, which is transiting to the mobile internet, grew revenue by 87%, as compared to fiscal 2011.

“Market transitions have never occurred at a faster pace than we are seeing today. At the heart of each of these transitions – cloud, mobility, video, any device, social networking, and virtual networks – is the network. Make no mistake about it: Cisco is focused on driving the opportunities created by these transitions, and in our view we have never been more relevant than we are today,” said John Chambers, Cisco’s CEO. Cisco Systems, Inc. (NASDAQ:CSCO) reported second quarter net sales of $12.1 billion, net income of $3.1 billion, and non-GAAP net income of $2.7 billion. Cash flows from operations were $3.3 billion for the second quarter of fiscal 2013, compared with $2.5 billion for the first quarter of fiscal 2013, and compared with $3.1 billion for the second quarter of fiscal 2012. Sales at Cisco’s fastest-growing segment, Wireless, were up 27%, resulting in the fifth-consecutive quarter of record top-line growth. Data center revenues expanded 65%, led by Cisco’s Unified Computing System.

“Cisco delivered record earnings per share this quarter and record revenue for the 8th quarter in a row in a challenging economic environment,” said Chambers. “As new markets grow and are created, such as the Internet of Everything, it’s very easy to see how the intelligent network is at the center of that future.”

Cisco and mobile internet solutions

Cisco Systems, Inc. (NASDAQ:CSCO) made numerous mobile internet initiatives within the last year. It delivered its mobile multimedia platform to VimpelCom, a Russian telecoms service provider. It announced that Magyar Telecom, Hungary’s largest telecommunication company, was deploying Cisco’s mobile internet solutions to its network. In March, it announced that du, a telecommunications service provider in the UAE, was deploying a mobile network enabled by a Cisco mobile internet solution. The just-released mobile internet solutions are to make service providers monetize information in their connections. They include the Cisco Quantum, which provides a network opportunity for data collection to enhance information in all network decision making processes. Another is Cisco Quantum Policy Suite, which enables service providers to customize service on any network. The company’s analytics suite provides capabilities that simplify policy decisions making processes.

“Data in motion presents a major monetization opportunity for service providers. As this data traverses access, core and cloud networks, the close orchestration between intelligent infrastructure and software enables our customers to optimize network resources through granular visibility at all levels,” said Kelly Ahuja, Cisco Systems, Inc. (NASDAQ:CSCO)’s general manager, Service Provider Mobility Group.

It is clear that the mobile internet solutions are among Cisco’s products expected to make big impact in 2013. Fortunately, this product line is proving popular over time, and gaining a head start over its rivals will prove profitable to Cisco in both the short and long run.

When we recall the performance of the wireless, data center, and other relevant categories in Cisco’s recent earning reports, it is clear the company has been improved in comparison to its 2011 reports, so it can be said that the company is operating at an efficient level.

Competition

Cisco Systems, Inc. (NASDAQ:CSCO) is in a better position than its closest competitors when looking at gross margins and earnings per share. Cisco has a gross margin of 60.70%, compared with 30.34% for Alcatel Lucent SA (ADR) (NYSE:ALU) and 24.19% for Hewlett-Packard Company (NYSE:HPQ), and earnings per share of $1.74, compared with -$0.79 for Alcatel-Lucent and -$6.41 for Hewlett-Packard.

Cisco is also looked at more favorably than these competitors in terms of market position and stock growth. Alcatel-Lucent’s Instant Convergent Charging Suite will provide competition to Cisco’s Quantum products, but will have limitations. The Instant Convergent Charging suit allows users to manage voice, data, video, content and commerce services. Users can process up-to-the-minute revenue streams in order to monetize network bandwidth. However, Cisco’s products are designed to enable wireless service providers to better analyze and monetize data in motion in 3G, 4G and WiFi networks, resulting in lower total cost of ownership when compared to Alcatel-Lucent’s product.

Looking ahead, Alcatel-Lucent’s recent launch of OpenTouch, a cloud-based enterprise for smartphones, tablets and other mobile devices, should keep Cisco Systems, Inc. (NASDAQ:CSCO) on edge. This new platform will make it easier for businesses to transition to the cloud in order to meet the growing demand for communications services geared toward a mobile workforce. While Alcatel-Lucent is a formidable competitor to Cisco, it is facing major cost cutting issues and has been lacking in revenue growth. In its latest earnings report, Alcatel Lucent reported a 3.8% decline in revenue year-on-year. Investors should use caution when considering an investment in Alcatel-Lucent.

Hewlett-Packard’s Autonomy analytics software challenges Cisco’s Quantum Analytics. But it only parses large amounts of data for insight into businesses, while Cisco’s effort is part of a program to monetize data in motion and enhance the ‘Internet of Everything.’ HP Autonomy recently received a boost after Maricopa Integrated Health System chose the company’s Data Protector and StoreOnce products in order to help meet its needs for disaster recovery and data protection. The Maricopa Integrated Health System is one of many health systems that is burdened by a massive volume of data.

Hewlett-Packard reported first quarter results recently, with sales falling 6% to $28.4 billion, which beat analyst estimates of $27.8 billion. Sales in five of its major business segments fell by at least 4%. Revenue from the company’s Financial Services segment rose 1% to $957 million. I see more negatives than positives for Hewlett-Packard in the coming months. Investors should watch closely for new developments in its strategy and business segments.

Conclusion

Looking at the previous performance of Cisco’s mobile internet solutions, the bright forecast for the sector, and the improving margins, I can say that Cisco Systems, Inc. (NASDAQ:CSCO)’s new product will improve price multiples. Conclusively, the stock is a good buy at the moment.

The article Cisco Is Ready To Ride The Mobile Market Higher originally appeared on Fool.com and is written by Maxwell Fisher.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.