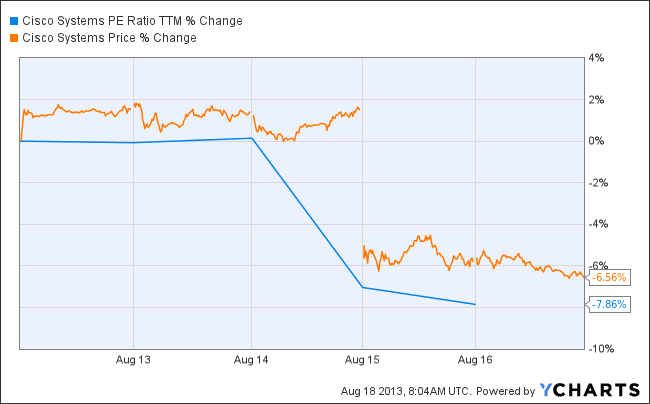

Cisco Systems, Inc. (NASDAQ:CSCO) went down 7% after the latest earnings call on August 14. Considering that Cisco Systems, Inc. (NASDAQ:CSCO)’s latest quarter was pretty solid, with revenue rising 6.2% year-over-year and GAAP earnings per share increasing to $0.42 for the quarter, up from $0.36 in the same period last year, could this be market overreaction? More importantly, does the current negative market sentiment represent an excellent entry point for investors or is it the beginning of a bearish year?

Explaining the latest quarter and the weak forecast

Cisco Systems, Inc. (NASDAQ:CSCO) stated at the beginning of the fiscal year that it aimed for a 5%-7% revenue growth rate. This was achieved in the fourth quarter, with revenue growing 6.2% year over year to $12.4 billion. Product revenue grew 6.4%, the fastest growth rate in the last six quarters.

Cisco Systems, Inc. (NASDAQ:CSCO)’s main businesses, routers and switches, grew just 3%. These are, after all, mature businesses. The remainder of Cisco’s portfolio grew 11% according to Morningstar. The Data Center business grew an amazing 43%.

These results were strong enough to beat analyst estimates. However, probably because CEO John Chambers guided for 3%-5% revenue growth next quarter, the stock plummeted.

Source: Cisco Investors Relations, Presentation slides

However, there’s an explanation for the moderate forecast. The business will account for a slow and consistent recovery of the global IT demand.

Also, Cisco Systems, Inc. (NASDAQ:CSCO)’s portfolio transition isn’t over yet. In the short run, the negative effect of decreasing growth rates coming from core businesses is expected to offset the positive effect of increasing growth rates coming from new segments. Also, bear in mind that this is the beginning of a new fiscal year, and the first quarter is always challenging. That’s why setting up a conservative short-term growth rate looks very responsible.

The upside is that in the long run, Cisco’s forecast remains optimistic. The company expects revenue growth through calendar year 2017 in the 5% to 7% range. And in theory, the Data Center business could become the main revenue component in the next decade, adding more speed to growth.

The fact that the long run business forecast remains intact shows that the firm probably has not experienced any fundamental change in its competitive position.

Cisco’s real value

Without taking into consideration the figures of the latest earnings calls, I ran a discounted cash flow valuation using Oldschoolvalue financial spreadsheets under the following assumptions: a 10% growth rate for the next 10 years (believe it or not, the past 10 year average growth rate is about 10%), a 12% discount rate, and a terminal growth rate of 3%.

With a net cash position of approximately $5.75 per share, Cisco Systems, Inc. (NASDAQ:CSCO)’s balance sheet shows very small default risk. That could be seen as a reason to use a lower discount rate. But I am using a relatively higher discount rate to explicitly decrease the margin of safety, because Cisco’s a big industry leader. Notice that Buffett is said to use a 15% discount rate when buying big companies.

I obtained a fair value estimate of $33.82 per share, well above the current price of $24 per share. Because an average 10% growth rate for the next decade was assumed, the fair-value estimate is above Morningstar’s estimate ($26) and the Street estimate. According to Yahoo! Finance, Cisco’s average sell-side price target is $28 per share.

However, this value is consistent with the strong balance sheet of the company. Cisco ended the fourth quarter with $50.6 billion in cash and only $16.2 billion in debt. Management is using the cash to make strategic acquisitions in order to fuel growth. It is also increasing the dividends to shareholders and keeping share repurchases active. The stock yields ~2.8% at a 37% payout ratio.

Why Cisco shouldn’t be afraid of competitors

Cisco’s business portfolio has exposure to many segments, from core businesses that include modular switches and IP phones to new investments in technology that will deliver integrated solutions for mobile carriers and data centers. The upside is that even if Cisco’s hardware becomes outdated, new technology could offset any negative effect on revenue.