Tale of the tape

Chevron Corporation (NYSE:CVX) has only been a current Dow component since 2008, but it first joined way back in 1930, when it was still Standard Oil of California. Chevron Corporation (NYSE:CVX)’s dubious 1999 removal hindered the index’s growth for years, but investors who held on enjoyed gains of nearly 150% before the oil supermajor was reinstated. Chevron Corporation (NYSE:CVX) has ranked as America’s third largest company on the Fortune 500 for several years running, a position befitting one of the largest integrated oil and gas companies in the world.

Johnson & Johnson (NYSE:JNJ) might be only a fraction of Chevron’s size — it was 41st on the most recent Fortune 500 — but it’s got every bit as much of a historical pedigree as one of the world’s oldest and largest diversified medical products companies. Johnson & Johnson (NYSE:JNJ) joined the Dow Jones Industrial Average (Dow Jones Indices:.DJI) only two years before Chevron Corporation (NYSE:CVX) was taken off, in 1997, but it’s remained a part of the index ever since.

| Statistic | Chevron | Johnson & Johnson |

|---|---|---|

| Market cap | $233.6 billion | $246.8 billion |

| P/E Ratio | 8.9 | 23.5 |

| Trailing 12-month profit margin | 10.9% | 15.2% |

| TTM free cash flow margin* | 1.2% | 17.3% |

| Five-year total return | 43.7% | 59.9% |

Source: Morningstar and YCharts.

*Free cash flow margin is free cash flow divided by revenue for the trailing 12 months.

Johnson & Johnson (NYSE:JNJ) certainly has a margin advantage over Chevron, but the oil company is so inexpensive relative to the drugmaker that it could be a better investment solely on the possibility of higher valuations in the future. But will the market warm to Chevron, or are its glory days behind it?

Round one: endurance

Chevron Corporation (NYSE:CVX)’s long streak of dividend payments isn’t accurately recorded by any of today’s most popular investor sites, but we know from historical records that the company has been paying out its profits to investors since the legendary 1911 Standard Oil antitrust decision that first created it. Johnson & Johnson (NYSE:JNJ) has been paying shareholders back without interruption since 1944, which is certainly impressive in its own right, but not quite as venerable as Chevron’s streak.

Winner: Chevron, 1-0.

Round two: stability

Paying dividends is well and good, but how long have our two companies been increasing their dividends? The same dividend payout year after year can quickly fall behind a rising market, and there’s no better sign of a company’s financial stability than a rising payout in a weak market (as long as it’s sustainable, of course). Chevron recently joined the Dividend Aristocrats, as 2013 marks the 25th straight year it’s increased its payouts. That can’t quite hold a candle to Johnson & Johnson (NYSE:JNJ), which has been raising its payouts for a full half-century.

Winner: Johnson & Johnson, 1-1.

Round three: power

It’s not that hard to commit to paying back shareholders, but are these payments enticing, or merely tokens? Let’s take a look at how both companies have maintained their dividend yields over time as their businesses and share prices grow:

CVX Dividend Yield data by YCharts

The past five years have seen a lot of movement in Chevron Corporation (NYSE:CVX)’s yield, but it’s been relatively stable for two years. However, it was only quite recently that the oil company pulled ahead of Johnson & Johnson (NYSE:JNJ) on this metric, and the two companies have been neck and neck for years. Let’s call this one a …

Round four: strength

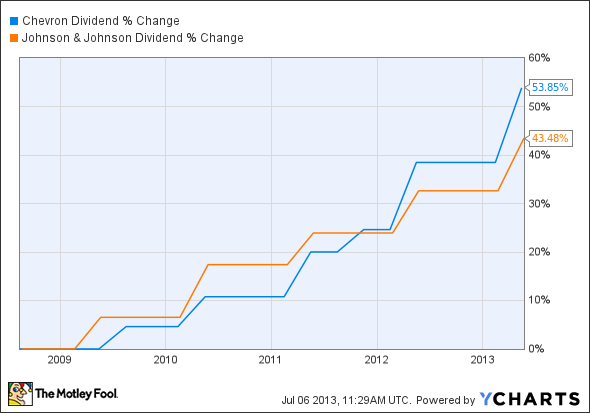

A stock’s yield can stay high without much effort if its share price doesn’t budge, so let’s take a look at the growth in payouts over the past five years. If you bought in several years ago and the company’s grown its payout substantially, your real yield is likely look much better than what’s shown above.

CVX Dividend data by YCharts

Winner: Chevron, 2-1.

Round five: flexibility

A company — even one as well positioned as either of these — needs to manage its cash wisely to ensure that there’s enough available for tough times. Paying out too much of its free cash flow in dividends could be a warning sign that the dividend is at risk, particularly if business weakens. This next metric analyzes just how much of their free cash flows our two companies have paid out in dividends over the past four quarters:

CVX Cash Div. Payout Ratio TTM data by YCharts

Winner: Johnson & Johnson, 2-2.

We’ve got to have a tiebreaker, as each company has posted two victories at the end of our five-round contest. Let’s take a look at their debt-to-equity ratios, which can help us figure out how much flexibility each company really has with its cash:

CVX Debt to Equity Ratio data by YCharts

Winner: Chevron, 3-2.

Chevron Corporation (NYSE:CVX) pulls ahead, but just barely, after our overtime round. Don’t discount Johnson & Johnson (NYSE:JNJ), though — its superior free cash flow gives its dividend the appearance of greater sustainability, despite its ultimate loss today. Do you agree with this analysis, or would you rather own a drugmaker than an oil driller?

The article Chevron vs. Johnson & Johnson: Which Dow Stock’s Dividend Dominates? originally appeared on Fool.com and is written by Alex Planes.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool recommends Chevron and Johnson & Johnson and owns shares of Johnson & Johnson.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.