Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility and underperformance. The time period between the end of June 2015 and the end of June 2016 was one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have been underperforming the large-cap indices. However, things have dramatically changed over the last 5 months. Small-cap stocks reversed their misfortune and beat the large cap indices by almost 11 percentage points since the end of June. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Cemex SAB de CV (ADR) (NYSE:CX).

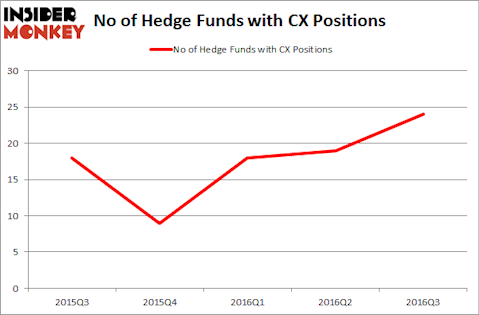

Cemex SAB de CV (ADR) (NYSE:CX) was in 24 hedge funds’ portfolios at the end of September. CX investors should pay attention to an increase in support from the world’s most elite money managers of late. There were 19 hedge funds in our database with CX holdings at the end of the previous quarter. At the end of this article we will also compare CX to other stocks including Juniper Networks, Inc. (NYSE:JNPR), CDK Global Inc (NASDAQ:CDK), and The Valspar Corporation (NYSE:VAL) to get a better sense of its popularity.

Follow Cemex S A B De C V (NYSE:CX)

Follow Cemex S A B De C V (NYSE:CX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Thanapun/Shutterstock.com

Hedge fund activity in Cemex SAB de CV (ADR) (NYSE:CX)

At the end of the third quarter, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a 26% rise from the second quarter of 2016, and the third-straight quarter with a rise in hedge fund ownership of the stock. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Thomas E. Claugus’ GMT Capital has the most valuable position in Cemex SAB de CV (ADR) (NYSE:CX), worth close to $83.1 million, comprising 1.7% of its total 13F portfolio. On GMT Capital’s heels is Balyasny Asset Management, led by Dmitry Balyasny, holding a $69.1 million position. Other members of the smart money that are bullish consist of John Burbank’s Passport Capital, Ken Fisher’s Fisher Asset Management, and Howard Marks’ Oaktree Capital Management.

As aggregate interest increased, key money managers were breaking ground themselves. GMT Capital initiated the most outsized position in Cemex SAB de CV (ADR) (NYSE:CX). Passport Capital also initiated a $64.7 million position during the quarter. The other funds with brand new CX positions are Guy Shahar’s DSAM Partners, Jos Shaver’s Electron Capital Partners, and Jacob Rothschild’s RIT Capital Partners.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Cemex SAB de CV (ADR) (NYSE:CX) but similarly valued. We will take a look at Juniper Networks, Inc. (NYSE:JNPR), CDK Global Inc (NASDAQ:CDK), The Valspar Corporation (NYSE:VAL), and Jazz Pharmaceuticals plc – Ordinary Shares (NASDAQ:JAZZ). All of these stocks’ market caps match CX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JNPR | 27 | 477518 | 0 |

| CDK | 42 | 2747540 | -3 |

| VAL | 26 | 552761 | 1 |

| JAZZ | 41 | 1007087 | -5 |

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $1.20 billion. That figure was $533 million in CX’s case. CDK Global Inc (NASDAQ:CDK) is the most popular stock in this table. On the other hand The Valspar Corporation (NYSE:VAL) is the least popular one with only 26 bullish hedge fund positions. Compared to these stocks Cemex SAB de CV (ADR) (NYSE:CX) is even less popular than VAL. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news, as hedge fund ownership is rising rapidly, which we view as a positive development. We’ll be interested to see how hedge funds play the stock this quarter to give us a better idea of how to play this stock.

Disclosure: None