The landscape of a swath of southern Texas has seen some radical change lately. Oil derricks are popping up all over the bushy ranch land. Storage facilities, terminals and oil equipment sheds are all dotting along Interstate 37 and US 281. Never has it been as busy as it is now.

A major oil unconventional oil discovery in the Eagle Ford shale formation has caused all this. For the last three years, oil and gas companies have been rushing in to buy up mineral rights and get in on this apparent bonanza. Nobody is exactly sure how long it will last, but most believe it will be between 20 and 30 years. In fact, it may prove to be the biggest unconventional oil play in North America, already rivaling the Bakken in North Dakota.

EOG Resources (NYSE:EOG) June 2013 Investor Presentation

Let’s take a look at three ways to participate in this boom, all of them upstream oil and gas, all with differing market caps, different risk levels and different exposures to the Eagle Ford. I believe these three companies represent the best way to be in this play.

A focused mid-cap play

Carrizo Oil & Gas, Inc. (NASDAQ:CRZO) is a mid-cap energy company operating in a few premier resource oil locations in the lower 48 states. The majority of its operations, however, are in the Eagle Ford. It is the smallest company of the three and has the most relative Eagle Ford exposure: Of Carrizo’s 95 net wells, 68 of them are in the Eagle Ford. Its market cap is the smallest of my three picks at $1.2 billion.

Carrizo Oil & Gas, Inc. (NASDAQ:CRZO)’s internal rate of return in the Eagle Ford is an amazing 90%. Will it be able to keep growing Eagle Ford production at this rate? Possibly. It did add acreage in the adjacent Pearsall Shale as early as last quarter.

Despite this dramatic growth, Carrizo Oil & Gas, Inc. (NASDAQ:CRZO) does have a few downsides. First is the $870 million in debt it holds on its balance sheet – quite a bit considering its $1.2 billion market cap. Perhaps more importantly is its funding gap: Capital expenditure is much higher than cash flow. Although it does have ways to fund that gap for now, it is something that must be taken into account.

A large-cap, diversified dividend payer

ConocoPhillips (NYSE:COP) is a former “supermajor” oil and gas company. After spinning off its refining division in 2012, it became an independent oil and gas company. If Carrizo Oil & Gas, Inc. (NASDAQ:CRZO) is the small, focused yet risky play, then ConocoPhillips is the large, diversified and safer way to be in the Eagle Ford. Conoco also pays a nice dividend of 4.4%.

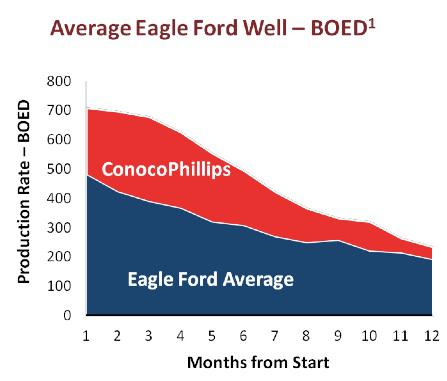

On a path to higher margins and higher growth through 2017, the company has been pouring significant capital into “development projects” in North American resource plays to meet this goal. Eagle Ford is an important lynchpin in this effort: It is perhaps Conoco’s most prolific growth project in North America. ConocoPhillips (NYSE:COP) is now one of the biggest producers in the Eagle Ford.

Source for graphics: ConocoPhillips Investor Update

The Eagle Ford has a tight window of oil. The rest is liquid gas and dry gas, the latter of which is out of favor. So, not all Eagle Ford acreage is equal. Fortunately, ConocoPhillips (NYSE:COP) was an early entrant and seems to have some of the better land here, its wells outlasting and outproducing Eagle Ford averages.