Teen fashion retailing is a tough business with cutthroat competition and uncertainty at every corner. Ubiquitous brands are necessary in order to compete, but provide no competitive advantage — one season of poor merchandising can set a company back over a year as it sheds inventory.

Retailers in general tend to have volatile stock prices; investors overreact to one quarter’s same-store-sales figure and push the stock higher or lower than it really should be based on extrapolating short-term data to create the long-term outlook.

The extreme myopia in retailing creates opportunity for the level-headed investor, even in a highly volatile industry. For instance, Guess?, Inc. (NYSE:GES) is trading at an unreasonably low multiple of earnings considering its high growth prospects.

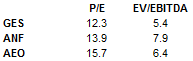

Low multiples

Guess is not the only retailer whose stock price is trading at below-average multiples; Abercrombie & Fitch Co. (NYSE:ANF) and American Eagle Outfitters (NYSE:AEO) also suffer from the market’s momentary disdain for the industry.

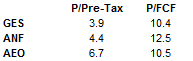

When analyzing an investment, it is important to always look at long-term figures; focusing on one-year or even three-year averages will make you as myopic as sell-side analysts.

Furthermore, it is important to figure out what the company’s current operating assets can generate on average before growth. This can be extrapolated from past results by applying average operating margins and average free cash flow margins to the current level of revenue.

All three companies look even cheaper based on normal operating earnings and free cash flow, but Guess?, Inc. (NYSE:GES) is still the cheapest.

Outlook

Not only is Guess the cheapest based on back-of-the-envelope measures, it also has the best growth prospects. While Abercrombie & Fitch Co. (NYSE:ANF) and American Eagle Outfitters (NYSE:AEO) suffer from plummeting margins in the wake of the recession, Guess?, Inc. (NYSE:GES) has reached scale in markets where it was previously underperforming. This has allowed the company to earn a stable operating margin despite the slowdown in the global economy.

Also contributing to Guess’ improved operating margin is the acceleration of its licensing segment. Licensing brands is akin to selling restaurant franchises; it requires little or no additional investment on the part of Guess and provides stable annuity-like cash flow.

The stock is cheap due to Guess?, Inc. (NYSE:GES)’ heavy concentration in Europe, which is undergoing a prolonged economic slowdown. While a rebound in Europe would send the stock soaring, Guess has more promising growth opportunities in Asia that should propel growth going forward despite troubles in Europe.