In the third quarter, China’s gross domestic product (GDP) grew at a decelerated pace of 7.4%. While slower than growth in earlier quarters, this rate still compares to paltry rates of growth in the developed economies. Now, a slew of indicators, such as exports, retail sales, fixed income investments, and industrial production suggest that China’s growth could accelerate this quarter and beyond. Some experts suggest that slow growth in China has bottomed, and that stimulus measures are beginning to boost economic activities in the most populous nation. Despite the International Monetary Fund’s (IMF) trimmed projections for China, which sees annual growth at rates of 7.8% this year and 8.2% next year, some analysts are forecasting growth at a faster 9% annualized growth next year.

While the fears of the Chinese hard landing look overblown, there are risks to the rapid economic expansion in China. Still, the nation has been an engine of global growth and its strong demand is expected to sustain global economic output in the next few years at least. While many stocks with exposure to China have seen price declines in response to expectations of a weaker growth, there may be an opportunity at current prices to pick some potential winners in the China growth story. Several dividend payers should be considered. Here is a closer look at five dividend stocks that are likely to benefit from the expected stronger growth of the Chinese economy.

Chart 2

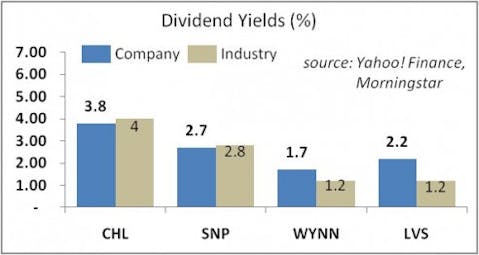

China Mobile Ltd. (NYSE:CHL), the world’s largest cellular provider by subscribers, is a play on the Chinese mobile market, which is expected to grow robustly with income and service growth. In terms of sales, the company is fully exposed to the Chinese wireless market, servicing some 693 million subscribers and controlling 70% of the China’s telecom market. Over the past five years, the firm’s EPS and dividends grew at average annual rates of 13.7% and 11.8%, respectively. The company is forecast to see its EPS growth contract at an average rate of 2.5% per year for the next half decade. Still, this forecast is likely misplaced, even though there are problems with declining average revenues per subscriber. While some analysts are skeptical about the company’s potential deal with Apple regarding iPhone sales with China Mobile service, the deal could go through despite the requirement for higher phone subsidies. In terms of valuation, China Mobile Ltd. (NYSE:CHL) is trading at a P/E of 11x, while its peers China Unicom Ltd. (NYSE:CHU) and China Telecom Corp. Ltd. (NYSE:CHA) have P/Es of 52x and 20.3x, respectively. The stock has a dividend yield of 3.8% and a dividend payout ratio of 41%. Its rivals China Unicom Ltd. and China Telecom Corp. Ltd. pay dividend yields of 0.8% and 1.6%, respectively. Fund managers Peter Rathjens (Arrowstreet Capital) and John Kleinheinz (Kleinheiinz Capital Partners) hold sizable positions in the stock.

China Petroleum & Chemical Corp. (NYSE:SNP), or otherwise known as Sinopec, is China’s largest producer and supplier of oil and petrochemical products. The company specializes in the exploration and production of oil and natural gas, oil refining and distribution, and production and sales of chemicals. In 2011, Sinopec was as the 5th largest company by sales in Forbes Global 2000. The increasing industrialization and urbanization, as well as population and income growth in China, bode well for higher petroleum and chemical demand. Over the past five years, the company saw its EPS shrink at an average annual rate of 5.6%, while its dividends increased at an average rate of 15.6% per year. The company is forecast to boost its EPS at an average rate of 5.6% per year for the next five years. In terms of valuation, Sinopec is trading at a P/E of 10.5x, compared to its industry’s average ratio of 9.7x. Peer PetroChina Co. Ltd. (NYSE:PTR) has a higher P/E of 12.5x, while CNOOC Ltd. (NYSE:CEO) has a P/E of 9.2x. Currently, Sinopec’s dividend is yielding 2.7% on a payout ratio of 28%. For the reference, PetroChina is yielding 3.3% and Exxon Mobil Corporation (NYSE:XOM) is yielding 2.4%. Sinopec’s stock is up 14% over the past 12 months. Billionaire and quantitative trading king, Jim Simons, has a small stake in the company.

Wynn Resorts Inc. (NASDAQ:WYNN) is a play on the China’s income growth story and the rise in spending on travel, entertainment, and gambling. The company derives as much as 72% of its revenues from China, through its Macao (Special Administrative Region of China) resort and casino. Wynn Resorts (NASDAQ:WYNN) saw its EPS shrink at an average rate of 4.8% per year over the past five years. Wynn’s dividends grew at an average rate of 3.1% per year over the same period. Growth worries dominating this summer seem to have dissipated. After two months of single-digit gaming revenue growth, Macao’s gambling revenues registered a 12.3% jump during September 2012. The Macao market is now up 15% year-over year. Analysts forecast EPS growth averaging 15.6% annually for the next half decade. Wynn’s Macau facilities (Wynn Macau and the Encore at Wynn Macau) generate substantial discretionary free cash flow of between $900 million and $1 billion per year, according to Fitch Ratings, a credit rating agency. That money is expected to be spent on funding the new $4 billion Wynn resort in Macau’s Cotai district and paying dividends to shareholders. Wynn Resorts is trading at a forward P/E of 20.3x, which compares to the ratio of 18.7x for its main rival Las Vegas Sands (NYSE:LVS). The company’s dividend yield of 1.7% is lower than that of Las Vegas Sands’ at 2.2%. Wynn’s dividend payout ratio is 39%. The stock is down 11% over the past year. Hedge fund managers John Burbank (Passport Capital) and James Crichton (Scout Capital Management) are big fans of the stock.

Las Vegas Sands Corp. (NYSE:LVS) derives as much as 57% of its revenue from China (based on the second-quarter totals), through its resort and casino facilities in Macao. The stock is another play on the increase in incomes in China and the increased propensity of the rising middle class in China and Southeast Asia to spend on discretionary items such as travel and gambling. This resorts and casino operator faces the same opportunities and headwinds in Macao’s gaming market as its rival Wynn Resorts. Over the past five years, due to the weak performance during the global financial crisis, the company’s EPS grew at a moderate average annual rate of 4.7%. Analysts forecast robust EPS growth for the next five years, averaging 24.3% per year, faster than Wynn Resorts. In terms of its valuation, on a forward P/E basis, Las Vegas Sands’ stock is trading at a small discount to Wynn Resorts. Las Vegas Sands started paying a dividend in the first quarter of this year. Its annualized dividend is currently yielding 2.2% and a payout ratio of 58%. Wynn Resorts pays a lower dividend yield, while MGM Resorts International does not pay any dividends. Among fund managers, billionaire and value investor Ken Fisher has as much as $390 million invested in this stock.