Earlier this year The Boeing Company (NYSE:BA) reported a net income increase of 3 percent in the second quarter (relative to the second quarter 2011) largely thanks to strong commercial aircraft sales. CapitalCube analyzes the Earnings Quality for the company. Our analysis include comparisons of The Boeing Company (NYSE:BA) against its peer group — to check if the company is being more aggressive or conservative than its peers. Our peer set for The Boeing Company (NYSE:BA) comprises: United Technologies Corporation (NYSE:UTX), Honeywell International Inc. (NYSE:HON), Lockheed Martin Corporation (NYSE:LMT), General Dynamics Corporation (NYSE:GD), Raytheon Company (NYSE:RTN), Northrop Grumman Corporation (NYSE:NOC), and Embraer SA (NYSE:ERJ).

If you missed our earlier reports on Boeing Co. (BA) this week you can find them on our blog: Fundamental Analysis,Corporate Actions, Dividend Quality.

Accounting Quality

Management of Reserves

Material Categories

Earnings: From Accounting or Cash Flow?

Net Income = Net Operating Cash Flow – “Accruals”

Recent trend for BA-US’s accruals

Accounting Quality

Financials suggest possible overstatement of net income.

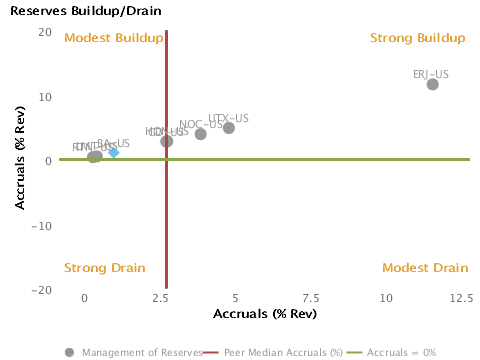

Management of Reserves

BA-US’s accounting suggests some amount of building in its reserves.

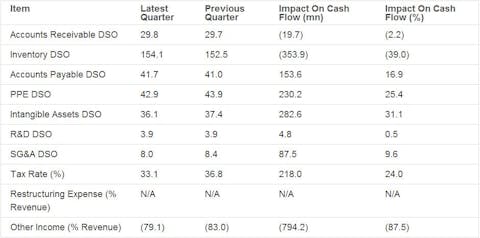

Key Items Impacting Cash Flow

Other Income, Inventory and Intangible Assets have the most material impact on the movement of net income.

Supporting Tests and Analytics

Company Profile

The Boeing Co. is an aerospace company, which manufactures commercial airplanes and defense, space and security systems. The company offers commercial and military aircraft, satellites, weapons, electronic and defense systems, launch systems, advanced information and communication systems, and performance-based logistics and training. The firm operates its business through three segments: Commercial Airplanes, Boeing Defense, Space & Security and Boeing Capital Corporation. The Commercial Airplanes segment develops produces and markets commercial jet aircraft and offers a family of commercial jetliners designed to meet a broad spectrum of passenger and cargo requirements of domestic and non-U.S. airlines. This segment also offers aviation services support, aircraft modifications, spares, training, maintenance documents and technical advice to commercial and government customers worldwide. The Boeing Defense, Space & Security segment’s operations principally involve the research, development, production, modification and support of products and related systems, such as global strike systems, including fighters, bombers, combat rotorcraft systems, weapons and unmanned systems; global mobility systems, including transport and tanker aircraft, rotorcraft transport and tilt-rotor systems; airborne surveillance and reconnaissance aircraft, including command and control, battle management and airborne anti-submarine aircraft; network and tactical systems, including information and battle management systems; intelligence and security systems; missile defense systems; and space and intelligence systems, including satellites and commercial satellite launching vehicles. This segment consists of three capabilities-driven businesses: Boeing Military Aircraft, Network & Space Systems and Global Services & Support. The Boeing Military Aircraft segment is engaged in the research, development, production and modification of manned and unmanned military weapons systems for the global strike, mobility and surveillance and engagement markets, as well as related services. The Network & Space Systems segment is engaged in the research, development, production and modification of products and services to assist its customers in transforming their operations through network integration, information, intelligence and surveillance systems, communication, architectures and space exploration. The Global Services & Support segment is engaged in the operations, maintenance, training, upgrades and logistics support functions for military platforms and operations. The Boeing Capital Corporation segment facilitates, arranges structures and provides selective financing solutions for its commercial airplanes customers. In the space and defense markets, it primarily arranges and structures financing solutions for its Boeing Defense, Space & Security government customers. Its portfolio consists of equipment under operating leases, finance leases, notes and other receivables, assets held for sale or re-lease and investments. The company was founded by William Edward Boeing in 1916 and is headquartered in Chicago, IL.

Disclaimer

The information presented in this report has been obtained from sources deemed to be reliable, but AnalytixInsight does not make any representation about the accuracy, completeness, or timeliness of this information. This report was produced by AnalytixInsight for informational purposes only and nothing contained herein should be construed as an offer to buy or sell or as a solicitation of an offer to buy or sell any security or derivative instrument. This report is current only as of the date that it was published and the opinions, estimates, ratings and other information may change without notice or publication. Past performance is no guarantee of future results. Prior to making an investment or other financial decision, please consult with your financial, legal and tax advisors. AnalytixInsight shall not be liable for any party’s use of this report. AnalytixInsight is not a broker-dealer and does not buy, sell, maintain a position, or make a market in any security referred to herein. One of the principal tenets for us at AnalytixInsight is that the best person to handle your finances is you. By your use of our services or by reading any of our reports, you’re agreeing that you bear responsibility for your own investment research and investment decisions. You also agree that AnalytixInsight, its directors, its employees, and its agents will not be liable for any investment decision made or action taken by you and others based on news, information, opinion, or any other material generated by us and/or published through our services. For a complete copy of our disclaimer, please visit our website www.analytixinsight.com.

This article was originally written by abha.dawesar, and posted on CapitalCube.