Only a handful of people would disagree that hedge funds’ 13F filings reveal high-potential stocks, especially billionaires’ quarterly filings. Hedge fund powerhouse Avenue Capital Group, founded by Marc Lasry and Sonia Gardner in 1995, recently filed its quarterly report,which surely hides several stock winners. Billionaire Marc Lasry believes that “energy today is a once-in-a-lifetime opportunity” and he even raised money for an energy-oriented portfolio earlier this year. His investment firm primarily focuses on investing in distressed debt and undervalued securities across a wide array of industries. However, Avenue Capital is currently among the hedge fund firms that identify the energy sector as being full of investment opportunities, although Lasry does not necessarily anticipate that his energy bets will pay off in the short-run. The New York-based Avenue Capital has $13.2 billion in assets under management as of September 30, while its equity portfolio has a market value of $626.75 million. The billionaire hedge fund manager and his team significantly cut their exposure to the U.S equity markets during the third quarter, as they reduced positions in 12 stocks, sold out of three positions, and lifted their position in only one stock. Considering this massive portfolio rebalancing process, it would be worthwhile to take a look at Avenue Capital’s top stock picks at the end of the third quarter.

Professional investors like Marc Lasry spend considerable time and money conducting due diligence on each company they invest in, which makes them the perfect investors to emulate. However, we also know that the returns of hedge funds on the whole have not been good for several years, underperforming the market. We analyzed the historical stock picks of these investors and our research revealed that the small-cap picks of these funds performed far better than their large-cap picks, which is where most of their money is invested and why their performances as a whole have been poor. Why pay fees to invest in both the best and worst ideas of a particular hedge fund when you can simply mimic the best ideas of the best fund managers on your own? A portfolio consisting of the 15 most popular small-cap stock picks among the funds we track has returned 102% and beaten the market by more than 53 percentage points since the end of August 2012 (see the details).

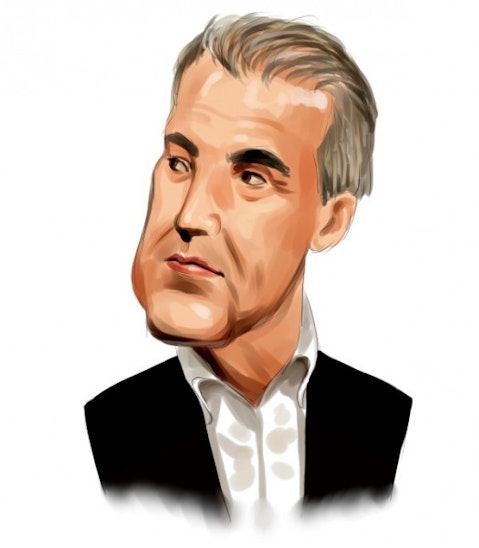

Follow Marc Lasry's Avenue Capital

#5 Euronav NV (NYSE:EURN)

– Shares Owned by Avenue Capital Group (as of September 30): 3.63 Million

– Value of Holding (as of September 30): $50.48 Million

Avenue Capital cut its overall holdings in Euronav NV (NYSE:EURN) by 200,000 shares during the three-month period that ended September 30. The independent tanker company that engages in the ocean transportation of crude oil and petroleum products has seen its shares advance by 10% since the start of the year. The robust demand for oil, the moderate vessel supply, and the massive supply of crude oil are some of the factors that assisted the company in delivering a strong financial performance in the third quarter. Euronav NV pays an annualized dividend of $1.24 per share, which gives the stock a current dividend yield of 9.12%. It is also worth pointing out that the tanker company has a trailing price-to-earnings ratio of only 8.30, which compares with a mean of 23.12 for the S&P 500 companies. Balyasny Asset Management, founded by Dmitry Balyasny, reported owning 4.06 million shares of Euronav NV (NYSE:EURN) via its 13F filing for the latest quarter.

#4 Meritor Inc. (NYSE:MTOR)

– Shares Owned by Avenue Capital Group (as of September 30): 7.21 Million

– Value of Holding (as of September 30): $76.62 Million

Lasry did not touch his position in Meritor Inc. (NYSE:MTOR) during the September quarter, which remained comprised of 7.21 million shares as of September 30. In 2013, the global supplier of a wide product portfolio of integrated systems, modules and components to original equipment manufacturers implemented a three-year plan aimed at improving its EBITA margin, strengthening its balance sheet by reducing debt, and boosting revenue growth organically. Meritor’s stock performance over the past several years seems to suggest that the company’s management has been successful in implementing the aforementioned plan. However, the downturn in the global economy has put downward pressure on the company’s operations and stock performance in the past several months. The stock is down by 34% for the year, but it is still 33% in the green over the past two-year period. Larry Robbins’ Glenview Capital upped its stake in Meritor Inc. (NYSE:MTOR) by roughly 3% during the third quarter to 7.67 million shares.

Follow Meritor Inc. (NYSE:MTOR)

Follow Meritor Inc. (NYSE:MTOR)

Receive real-time insider trading and news alerts