Eric Billings‘ Billings Capital Management is one of the 749 hedge funds in our database that filed a 13F for the June 30 SEC reporting period. It’s also one of the newest hedge funds added to our database and as part of our small-cap strategy, being added during the first quarter of this year. The fund held a public equity portfolio valued at $93.89 million at the end of June, which consisted of just 11 long positions.

Billings Capital’s performance has steadily improved in each of the three quarters since we added it, culminating with 21.6% returns for its nine long positions in companies valued at $1 billion or more on June 30. It should be noted that our calculations may be different from the fund’s actual returns, as they do not account for changes to positions made during the quarter, or positions that don’t get reported in 13F filings, like short positions.

In this article, we’ll take a look at Billings Capital’s top-four stock picks as of June 30 and see how they performed during the latest quarter.

We’ll kick off our examination with MasTec, Inc. (NYSE:MTZ), Billings Capital’s top stock pick after its former top pick Diamond Resorts International Inc. (NYSE:DRII) agreed to be acquired for $2.2 billion towards the end of June, which prompted the fund to close its position in that stock. In MasTec, Billings owned 886,413 shares at the end of June, up by 11% quarter-over-quarter. It was a big third quarter for MasTec, Inc. (NYSE:MTZ), as the stock returned 33%, pushing its year-to-date gains to nearly 70%.

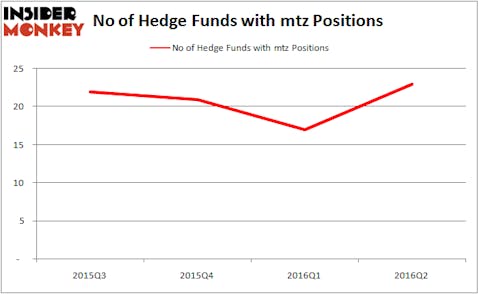

As you can see in the graph, the hedge funds tracked by Insider Monkey were buying back into MasTec during the second quarter, as 23 of them held shares of the stock at the end of June, up from 17 at the end of March. Peconic Partners LLC, managed by William Harnisch, held the largest position in MasTec, Inc. (NYSE:MTZ) among those funds, valued at $108.7 million. The second-most bullish fund manager was Mariko Gordon of Daruma Asset Management, with a $55.1 million position. Neil Chriss’ Hutchin Hill Capital and Chuck Royce’s Royce & Associates were among the other shareholders of MasTec.

Follow Mastec Inc (NYSE:MTZ)

Follow Mastec Inc (NYSE:MTZ)

Receive real-time insider trading and news alerts

Next up is Credit Acceptance Corp. (NASDAQ:CACC), which Billings Capital held 93,618 shares of on June 30, up by 13% quarter-over-quarter. The position was valued at $17.33 million and accounted for 18.45% of the value of the fund’s equity portfolio. It was a solid third quarter for the stock, as it gained about 8.6%. However, shares have slumped heavily in the fourth quarter, shedding about 16% of their value. Analysts aren’t big fans of the stock, as Compass Point recently downgraded it to ‘Sell’ from ‘Neutral’, while Stephens initiated coverage on it with an ‘Underweight’ rating.

A total of 21 of the hedge funds tracked by Insider Monkey were long Credit Acceptance Corp. (NASDAQ:CACC) at the end of June, a dip of 9% from a quarter earlier. Abrams Bison Investments, managed by Gavin M. Abrams, held the most valuable position in Credit Acceptance Corp. (NASDAQ:CACC), with a $210.6 million position in the stock, comprising 19.5% of its 13F portfolio. Other investors included Jonathan Bloomberg of BloombergSen, William von Mueffling’s Cantillon Capital Management, Edward Goodnow’s Goodnow Investment Group, and Thomas Bancroft’s Makaira Partners.

Follow Credit Acceptance Corp (NASDAQ:CACC)

Follow Credit Acceptance Corp (NASDAQ:CACC)

Receive real-time insider trading and news alerts

We’ll check out two more top stock picks of Billings Capital on the next page.

Billings Capital owned 195,875 shares of United Rentals, Inc. (NYSE:URI) on June 30, valued at $13.14 million, ranking it as the third-most valuable position in the fund’s equity portfolio. United Rentals also posted strong third-quarter returns, with gains of 17%, though the stock still trades down slightly for the year. Morgan Stanley sees little upside left in the shares, downgrading the stock to ‘Equal Weight’ from ‘Overweight’ in October.

At Q2’s end, a total of 37 of the hedge funds tracked by Insider Monkey were bullish on United Rentals, Inc. (NYSE:URI), owning 8.40% of its common shares. Hedge funds were bearish on the stock during the quarter though, as a net total of nine fewer hedge funds owned its shares on June 30 than did on March 31. Marcato Capital Management ($109.6 million position) and Stelliam Investment Management ($56 million position) held the two largest positions in United Rentals, Inc. (NYSE:URI) among those funds on June 30.

Follow United Rentals Inc. (NYSE:URI)

Follow United Rentals Inc. (NYSE:URI)

Receive real-time insider trading and news alerts

Lastly is auto-parts supplier Tenneco Inc (NYSE:TEN), in which Billings Capital owned a $10.92 million position on June 30 after cutting the size of it by 22% during the second quarter. After getting battered by the Brexit, shares of Tenneco Inc (NYSE:TEN) rebounded in a big way in the third-quarter, gaining 25%. Tenneco expects its growth to outpace the industry in each of the next two years.

When looking at the institutional investors followed by Insider Monkey, Mario Gabelli’s GAMCO Investors had the number one position in Tenneco Inc (NYSE:TEN) on June 30, worth close to $32.3 million. Ric Dillon of Diamond Hill Capital was next with a $27.1 million position. Israel Englander’s Millennium Management and John Overdeck and David Siegel’s Two Sigma Advisors were also among the 27 shareholders of the stock in our database at the end of the second quarter.

Follow Tenneco Inc (NYSE:TEN)

Follow Tenneco Inc (NYSE:TEN)

Receive real-time insider trading and news alerts

Disclosure: None