If you’re a contrarian, don’t just buy the worst performers.

Chasing after BDCs with the worst performance (in hopes of a rebound) isn’t always advisable. For example, the two worst performers in our table, Medallion Financial Corp (NASDAQ:MFIN) and Crossroads Capital Inc (NASDAQ:XRDC), have both declined over 50% this year, and they are facing very significant challenges.

For example, they’ve both cut their dividends within the last year (the yields in our table are based on dividends paid over the last 12 months). Also, they don’t benefit from the same operational economies of scale as other BDCs as their market caps are only a miniscule $80 million and $15 million, respectively. Medallion finances loans for taxi cab medallions (an industry that’s faced new challenges from the likes of Uber and Lyft). And Crossroads is simply trying to preserve capital and maximize shareholder value as it attempts to sell off its portfolio investments. These are examples of distressed companies that we are not interested in owning.

Follow Medallion Financial Corp (NASDAQ:MFIN)

Follow Medallion Financial Corp (NASDAQ:MFIN)

Receive real-time insider trading and news alerts

Consider the short interest.

Short interest (the percent of shares outstanding that are being sold short) can be another important consideration when considering a BDC. For example, Ares Capital (a BDC we like) has a relatively large amount of short interest. However, we suspect the short interest is likely related to its upcoming acquisition of American Capital Ltd. (NASDAQ:ACAS) considering it first spiked when the acquisition was announced. And whether or not the acquisition goes through (it’s expected to close as early as the first week of January) the short-interest will likely subside placing some upward pressure on the price as short sellers cover their positions. Regardless of Ares, short interest can be an important guidepost reflecting the market’s view (positive or negative) on a BDCs prospects.

Follow American Capital Ltd (NASDAQ:ACAS)

Follow American Capital Ltd (NASDAQ:ACAS)

Receive real-time insider trading and news alerts

A discount to NAV can be good or bad

There is a general tendency for investors to believe that it is a good thing (a buying opportunity) when a BDC trades at a discount to its net asset value. In reality, this can be good or bad depending on the situation. It can be good if the company is healthy and you’re buying it on the cheap. However, it can also be bad in the sense that it can be a signal of distress if it gets too low. For example, it can become difficult for BDCs to borrow money to grow if their net asset value has fallen so low that they no longer have enough collateral for their loans. As an example, Medallion Financial Corp (NASDAQ:MFIN) price to book value has fallen to only 0.3, a level we consider unattractive.

Be aware of beta.

Investors may want to be cognizant of a BDCs beta because low beta securities are often good risk reducers in the context of a diversified investment portfolio. Many BDC have attractively low betas (anything below a 1 is relatively low, and above a 1 is relatively high). Additionally, if a security’s beta is increasing it can be a sign of distress. For example, Crossroads Capital Inc (NASDAQ:XRDC)’s 3-year beta is only 0.4 but its 1-year beta has increased to 0.9.

We view this a sign of distress as it no longer provides as much performance based on its uniqueness, but rather moves with the market in an indication that it’s a weaker firm more sensitive to the overall winds of the economy. Also keep in mind, sometimes companies have unique one-time things happening that can make beta somewhat meaningless, so it’s important to understand a company’s business situation when considering an investment.

Follow Crossroads Capital Inc. (NASDAQ:XRDC)

Follow Crossroads Capital Inc. (NASDAQ:XRDC)

Receive real-time insider trading and news alerts

Quarterly vs. Monthly Dividends.

The frequency of divided payments is another consideration for investors. Most BDCs pay dividends quarterly but some pay monthly, perhaps as an indication that they are more sensitive to individual investor needs. For example, the following BDCs offer monthly dividend payments: Fifth Street Finance, Fifth Street Senior Floating Rate, Full Circle Capital, Gladstone Capital, Gladstone Investment, Harvest Capital Credit Corp, Horizon Technology Finance, Main Street Capital, PennantPark Floating Rate Capital, Prospect Capital, Solar Senior Capital and Stellus Capital Investment.

External vs. Internal Management.

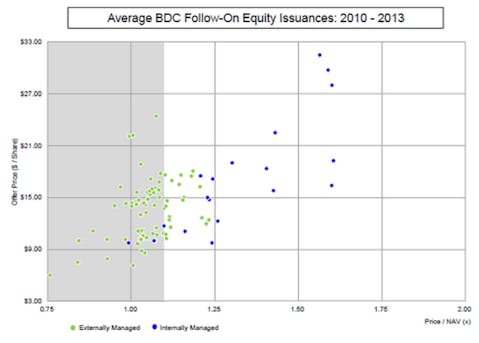

Another important consideration is whether a BDC is internally or externally managed. Conflicts of interest may exist when BDCs are run by external management teams, and data suggest internally managed BDCs are better. For example, external managers are often compensated as a percent of assets under management, so they are incentivized to take on new business (whether or not it is profitable business) because it increases the amount they get paid. Whereas internally managed BDCs are (if incentivized properly) driven to create profitable growth. The following chart shows new equity issuance for internally managed (blue dots) versus externally managed (green dots) BDCs.

The noticeable observation is that internally managed BDCs have a track record of issuing new shares at a premium to their net asset values (suggesting investors expect a strong return on assets) whereas externally managed BDCs have a track record of issuing new shares at a discount to their net asset values (suggesting they’re more interested in growing assets under management instead of profitability). Another reason why internally managed BDCs are often more profitable is simply because their management expenses are often lower.

Conclusion

As long-term investors, we believe the recent pullback in BDC prices has created some attractive opportunities. For example, here is a link to our Top 4 Big-Dividend BDCs Worth Considering. Generally speaking, we prefer well-run BDCs (internally managed if possible), trading at a reasonable valuation relative to their book value, without any large unexplainable short-interest, and with big steady dividends (monthly payments can be nice).

Note: This article was written by Blue Harbinger. At Blue Harbinger, our mission is to help you identify exceptional investment opportunities while avoiding the high costs and conflicts of interest that are prevalent throughout the industry. We offer additional free reports and a premium subscription service at BlueHarbinger.com. If you are ever in the Naperville, IL, USA area, our founder (Mark D. Hines) is happy to meet you at a local coffeehouse to talk about investments. Please feel free to get in touch.