Veritas Asset Management (UK) Ltd. is an independent asset management firm wholly owned by its employees. Its investment philosophy focuses on growing and protecting the real value of its clients’ assets. The firm manages funds and portfolios through long-only or long-short strategies with an objective to deliver real returns for its clients in the long term. It is also known for its strong risk management controls. After its merger with Real Return Group in 2004, Veritas has made remarkable progress commercially. Among the well-known products of Veritas are the Veritas Global Equity Income and Veritas Global Focus. Both funds have been outperforming the MSCI World Index for many years already and have been awarded the Morningstar European Fund Manager of the Year for Global Equity in 2012.

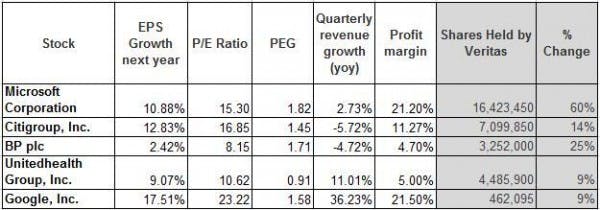

Sources: Finviz.com and whalewisdom.com; prices as of Jan. 31, 2013

Microsoft Corporation (NASDAQ:MSFT)

Veritas increased its stake in Microsoft by 60 percent in the fourth quarter, bringing the shares of Microsoft to 14.01% of its portfolio. It is currently the firm’s top holding. Veritas had concretely exhibited the discipline of buying low when the company’s stock price went into a dive during the end of the year. The share price has improved ever since; a brilliant move so far for Veritas.

Source: Finviz.com

Microsoft’s growth prospects are encouraging. The EPS growth estimate for the next year is 10.88%, a significant recovery from the contraction in its EPS this year. The company remains a highly attractive addition to every portfolio with a resurrected profit margin of 21.20%, a sound financial state, and healthy pricing (as shown by a P/E ratio of 15.30 and a forward P/E of 8.81). These add to the fact that it is one of the stocks highly favored for its impressive dividend payment record. The annualized payment has been increasing consistently by an average of about 14% within the last 7 seven years.

Citigroup Inc. (NYSE:C)

Veritas also increased its stake in Citigroup by 14 percent during the last quarter of 2012. The firm’s fourth-largest holding comprised 8.97% of its total portfolio. The fund manager initiated its position in Citigroup in the fourth quarter of 2011 and has been increasing its shares ever since.

Source: Finviz.com

Although the company experienced negative growth this year (-30.60%), the growth estimate for next year is 12.83%. The company faces challenges with its declining revenues. Nonetheless, it remains strong in terms of profitability. Also, while its operations are still largely financed by debt, the ratio has been declining. As of Jan. 30, 2013, the debt-equity ratio is 2.66, lower than last year’s first quarter-end ratio at 3.226. Citigroup currently has a healthy P/E ratio of 16.85 and a PEG of 1.45. Meanwhile, the dividend amount, which used to be as high as $0.54, has now stabilized at $0.01 per share.