In a previous article, I showed why you should invest in three firms. I still won’t budge.

The business landscape is rapidly shifting, but the outlook still seems bright for those who utilize the day, fundamental, or technical trading approaches. However, if you’re a true Graham follower, then you likely have already missed the boat. Take a look.

| Firm | Date | Recommended Buy Price | % Growth to Now |

|---|---|---|---|

| Best Buy (NYSE:BBY) | March 11, 2013 | $20.08 | over 27% |

| Home Depot (NYSE:HD) | March 11, 2013 | $71.32 | around 12% |

| Wal-Mart (NYSE:WMT) | March 11, 2013 | $72.98 | around 5.5% |

Strategy pending investment

Even with the recently reported $0.24 loss per share, Best Buy Co., Inc. (NYSE:BBY) is making waves. Under the leadership of Joly, the firm continues to properly execute its “Renew Blue” strategic plan. Revenue decreases are beginning to slow, costs are being streamlined and controlled, and a light is near the end of the tunnel. Since the last quarterly announcement, for instance, Joly has cut over $175 million in annualized costs.

With a market cap of $8.69 billion and sales just over $49 billion, Best Buy Co., Inc. (NYSE:BBY) is only valued at about 0.18 times its annual revenue. Amazon.com, Inc. (NASDAQ:AMZN) and Apple Inc. (NASDAQ:AAPL) are each, respectively, valued at 1.87 and 2.45 times their revenues, indicating that Best Buy Co., Inc. (NYSE:BBY) could be undervalued compared to its competitors.

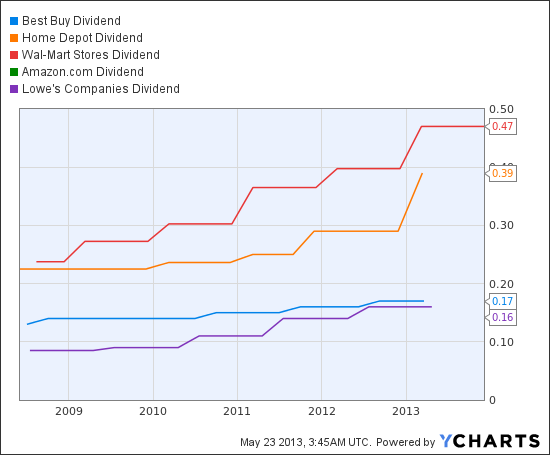

Additionally, Best Buy Co., Inc. (NYSE:BBY) recently announced a $0.17 quarterly dividend payment, leading investors to wonder one of three scenarios. Will the dividend cripple the firm’s cash position, attract new investors, or reveal that executives are preparing for long-term growth? I’m not sure.

But, because of its 120% growth thus far in 2013 and recent media coverage, I simply say, “No thank you” to this buy. But, if you’re interested in a dividend stock with upswing potential, you have yourself a winner.

BBY Dividend data by YCharts

Still worth a look

The Home Depot, Inc. (NYSE:HD) is beating Lowe’s Companies, Inc. (NYSE:LOW), posing as the sure winner as the housing market continues to climb. Why?

According to UBS analyst Michael Lasser, “The explanation is likely wrapped in a combo of the distraction that Lowe’s is experiencing from its merchandise resets, its less favorable geographic exposure and a lower penetration of commercial sales.”

Here’s the deal.

The Home Depot, Inc. (NYSE:HD) boasts a greater number of stores, especially along the Western shoreline. The additional commercial sales are a direct result from The Home Depot, Inc. (NYSE:HD)’s emphasis on acquiring relevant technology start-ups and developing contractor relationships as discussed here. Now, combine these tactical moves along with the aforementioned dividend payments and the following data.

| Profit Margin | Operating Margin | ROA | ROE | |

|---|---|---|---|---|

| Home Depot | 6.07% | 10.57% | 12.10% | 25.42% |

| Lowe’s | 3.88% | 7.22% | 6.89% | 12.89% |

Clearly, The Home Depot, Inc. (NYSE:HD)’s operating efficiency is a major benefit, further distinguishing the two firms. For example, after the most recent quarterly report, Home Depot’s SG&A expenses relevant to gross profit were 7% less than those of Lowe’s — a pretty impressive number given that The Home Depot, Inc. (NYSE:HD) has over 2x the employees and market cap of its closest competitor.

Furthermore, the unfortunate, recent, and destructive natural disasters requiring relief efforts, tools, and equipment will likely boost the retailer’s sales.

The overall result: One happy Home Depot shareholder.

Not going anywhere

Imagine waking up without a Wal-Mart Stores, Inc. (NYSE:WMT) — you’re right, it’s not even thinkable. But why?

Unlike competitor Amazon.com, Inc. (NASDAQ:AMZN), Wal-Mart Stores, Inc. (NYSE:WMT) has built a sustainable business model that offers products and services needed by the masses. Amazon is a great firm that offers phenomenal value to customers, but I don’t think its rapid growth is sustainable (the only exception would be regarding the content found here).

For example, Wal-Mart boasts a net operating profit after taxes of about 4% while Amazon’s NOPAT is just above 1%. Given its business model and need to retain customers, Amazon cannot increase its margins. So, Amazon must win on price and convenience. But, why would customers come back if they could receive the same service or product for the same price through Wal-Mart? Further, consider the potential exodus of Amazon customers if taxes are added to the bottom line of purchases.

As the King of retail, Wal-Mart is poised to gain. For example, Wal-Mart’s barriers to entry are minuscule compared to Amazon trying to open brick and mortar locations. Wal-Mart’s Innovation Lab is already narrowing the gap. Further, the “buzz” around Amazon is leading to immense (and even undesired) attention — resulting in an inflated price.

As shown below, Amazon’s market cap exceeds its enterprise value. What’s this mean? Well, consider enterprise value as the price a firm would pay to acquire another firm. It is primarily calculated by adding market cap, debt, minority interest, and preferred sharers minus all cash. The reason is because the “acquirer” would keep the cash while absorbing the responsibilities for the debt.

WMT Enterprise Value data by YCharts

Given this information, would you want to acquire Amazon today?

Me neither. However, Wal-Mart’s consistent dividend and continued growth provide a remarkable alternative.

Conclusion

Even though Graham would likely not invest in any of the above firms, you can. Pick a plan and stick with it!

And remember, Wal-Mart and Home Depot are here to stay.

The article Pick a Winner and Stick to Your Guns originally appeared on Fool.com and is written by Brendan Marasco.

Brendan is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.