The exchange-traded products industry has provided investors with a new tactical tool for addingcommodities exposure to their portfolios. Investors can now choose between a variety of ETPs that offer both broad-based and targeted exposure without having to encounter the difficulties and drawbacks of opening a futures account. One of the more intriguing products on the market is the iPath Pure Beta Broad Commodity (NYSEARCA:BCM), which gives investors access to a basket of 24 different commodities [for more commodity ETF analysis subscribe to our free newsletter].

BCM’s structure and unique strategy make this ETN an appealing option for investors who wish to establish broad-based exposure to commodities over the long-haul.

Vital Stats

Here’s a quick overview of the basics of BCM:

Issuer: Barclays iPath

Index: Barclays Capital Commodity Index Pure Beta TR

Number of Commodities: 24

Largest Allocation:Gold (18.30%)

Inception Date: April 21, 2011

Expense Ratio: 0.75%

Assets: $19.3 million (as of 10/3/2012)

Structure: Exchange-Traded Note

Under The Hood

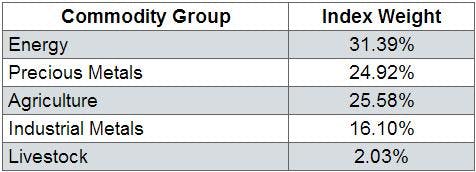

BCM is linked to the Barclays Capital Commodity Index Pure Beta TR, which is comprised of 24 different commodity futures contracts. The index breakdown by commodity family is presented in the following table (as of 9/30/2012) :

BCM features allocations across all of the major segments of the commodity market, including exposure to energy, precious metals, agriculture, industrial metals, and livestock. BCM separates itself from the competition as its underlying basket of holdings is broad-based and well-rounded with relatively equal allocations to each commodity family [see also Invest Like Jim Rogers With These Three Agriculture Stocks].

Noteworthy Features

BCM is one of the most unique new commodity ETPs on the market, offering investors exposure to a well-rounded portfolio of 24 different commodities. Unlike most commodity products that use a pre-determined roll schedule, BCM applies the Barclays Capital Pure Beta Series 2 Methodology, which allows the fund to roll into a number of futures contracts with varying expiration dates. Although this may seem like a trivial strategy nuance, historical performance suggests that a variable roll schedule may mitigate some of the negative impacts associated with two well-known phenomenons to commodity investors: contango and backwardation. As such, BCM presents itself as an appealing option for long-term, buy-and-hold, investors looking to add commodity exposure to their portfolios [see also Three Commodities Dividend Lovers Must Own].

Another noteworthy feature of BCM is that it is structured as an exchange-traded note; this means that investors are exposed to underlying credit risk of the issuing institution. While this added degree of riskmay deter some, investors should note that ETNs hold several advantages over ETFs when it comes to tapping into the commodity asset class. Unlike products that trade futures contracts, commodity ETNs do not require investors to fill out a K-1 form at the end of the year. This benefit implies that there is no annual mark-to-market that spurs a taxable event; as such, shareholders of BCM have to record a loss or gain only upon sale of their position.

How To Use

BCM’s advantageous tax treatments and unique Pure Beta methodology makes this ETN an appealing option for investors looking to add long-term commodity exposure to their portfolios. Unlike most ETPs in this space, BCM does not feature a bias towards the energy sector. Instead, this ETN maintains a well-diversified portfolio with fairly equal allocations to each of the major commodity segments. This ETN can serve as a viable instrument for those who wish to establish well-balanced commodity exposure in their portfolios but are wary of the potential drawbacks associated with “first generation” commodity ETPs [see also 25 Ways To Invest In Silver].

This article was originally written by Stoyan Bojinov, and posted on CommodityHQ.