When it comes to banks to invest in for the long-run, few of the big banks fit the traditional criteria of what investors look for: stability, low-risk assets, good dividend yield, and a good record of growth. One bank that even after the financial crisis still meets those criteria is BB&T Corporation (NYSE:BBT). With the recent rejection of the company’s capital plan by the Federal Reserve and the slight dip in share price at a time when most financial stocks seem to be hitting new highs daily, BB&T may be worth a look for your portfolio.

About BB&T Corporation (NYSE:BBT)

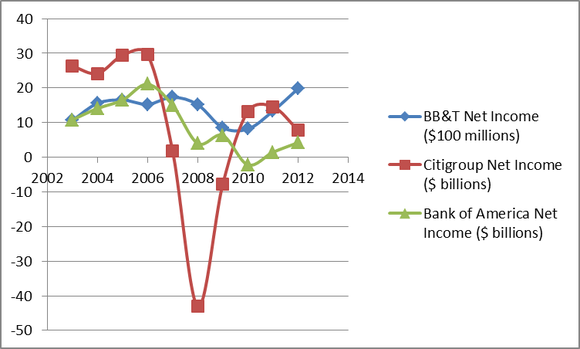

With assets of about $184 billion, BB&T is the 11th largest U.S. bank, operating mostly in the Southeast U.S. After a small dip as a result of the financial crisis, BB&T has grown its income to its highest level ever, without any losing years. Compare that to the performance of Citigroup Inc. (NYSE:C) and Bank of America Corp. (NYSE:BAC), who both took on considerably more risk than BB&T and paid the price for it when things got rough.

The above chart says one thing about BB&T as opposed to its bigger rivals: it is stable. As a result of its stability and better-than-average credit quality, it was able to capitalize on the misfortune of some weaker competitors and greatly strengthen and expand its presence in recent years.

Why BB&T is Stronger than Before the Crisis

First, in December 2008, BB&T Corporation (NYSE:BBT) purchased the assets of Haven Trust Bank, a small Georgia bank that had been closed by the FDIC. Then, BB&T made a larger move and acquired most of the assets of Colonial Bank, with 357 offices in Alabama, Florida, Georgia, Texas, and Nevada. This greatly improved BB&T’s market share in Florida and Alabama. Most recently, in 2012, BB&T acquired BankAtlantic Bank in Florida, which added 78 branches and $3.3 billion in deposits. It is because of savvy acquisitions like these that BB&T has been able to drastically increase its assets since before the crisis (see chart).

BB&T’s Capital Plan Drama

In a surprising move to most analysts and investors, the Fed rejected BB&T Corporation (NYSE:BBT)’s capital plan despite the fact that it was determined that BB&T would pass the government’s stress test. There is no clear reason for the rejection, and thus far both the Fed and the bank are being quiet about it. BB&T is one of the most well-capitalized banks in the country, which has led to speculation that the failure was a result of a qualitative issue such as flawed corporate governance or supervisory issues.

Regardless, this puts on hold the plans by BB&T for share buybacks and further dividend increases. They will resubmit the plan by the end of the 3rd quarter, and I foresee no major issues in gaining approval. I have full confidence that they will correct whatever was wrong, and will be able to put this behind them. Once their capital plan is improved, investors should get a nice pop in the share price from the news.

Alternatives

While I like Bank of America Corp. (NYSE:BAC) and Citigroup Inc. (NYSE:C) over the long run, there are compelling reasons why I want to wait-and-see before investing in these two.

Bank of America has not produced rising revenues since 2008-2009, and even though revenues are expected to rise and stabilize this year, there is too much uncertainty surrounding the bank right now. Plus, with shares doubling in value over the past year, I think the stock may have gotten ahead of the actual improvement in the fundamentals. While I certainly agree that things are improving, such as nonperforming loans making up 2.5% of all of the bank’s loans as opposed to 2.71% a year earlier, things have not improved enough to warrant a doubling of the shares. I’d wait for a significant pullback before considering Bank of America Corp. (NYSE:BAC).

Citigroup Inc. (NYSE:C) has had the same trouble with declining revenues, and their earnings actually fell last year from 2011. Still not allowed to pay significant dividends (1 cent per quarter), there is simply too much uncertainty and risk surrounding Citigroup to make it anything but a speculative move at this point.

For a more apples-to-apples comparison, let’s take a look at another big southeast regional bank, SunTrust Banks, Inc. (NYSE:STI). At first glance, SunTrust seems cheaper than BB&T Corporation (NYSE:BBT) at 7.9 times TTM earnings versus 11.4 times. However, SunTrust doesn’t have the credit quality of BB&T and has had difficulty growing its loans and revenues lately. SunTrust is actually projected to post lower earnings in 2013, a major red flag. They also don’t pay a significant dividend yield (0.71%), and haven’t since before the crisis.

Conclusion

With a stable, high-quality, and growing portfolio of assets, BB&T is a rare bright spot among the big banks. With a dividend yield of 3%, and only 1.24% of its loans classified as “nonperforming” (half of Bank of America’s), BB&T is a way to get exposure to the improving economy via the banking system, without taking on the risk levels associated with its peers.

The article A Smart Play On Regional Banking originally appeared on Fool.com and is written by Matthew Frankel.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.