Instead of building a complex earnings model using the reams of data provided in a bank’s 10-Ks, long-term investors can get away with using a handy shortcut. Since the value of a bank — or any company — is derived from the amount of cash it earns for shareholders, looking at long-term historical return on equity gives investors a sense of how well the company has met its objective in the past — and how likely it is to do so in the future.

Return on equity tells quite a story

This article only discusses the largest U.S. banks by assets — Bank of America Corp (NYSE:BAC), JPMorgan Chase & Co. (NYSE:JPM), Wells Fargo & Co (NYSE:WFC), and Citigroup Inc (NYSE:C) — but the method can be applied to any bank.

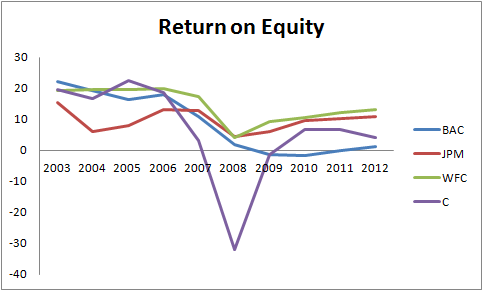

First, let’s look at each bank’s return on equity over the last 10 years. All four had high returns on equity before the financial crisis, but only two remained positive throughout the crisis and ensuing recession.

That JPMorgan Chase & Co. (NYSE:JPM) and Wells Fargo & Co (NYSE:WFC) maintained profitability during the financial crisis should come as no surprise to close followers of these companies. Chase’s rock-star CEO, Jamie Dimon, limited his bank’s exposure to the sub-prime loans and related securities that dragged other institutions into the red. Dimon has instilled a culture of prudent capital allocation that is reflected in the bank’s out-performance.

The same is true at Wells Fargo & Co (NYSE:WFC), only Wells Fargo’s culture runs deeper. Not only does the bank have a reputation as the most conservative among its mega-bank peers, its unique focus on customer service and cross-selling enables it to generate out-sized returns with less leverage than other banks. This enables the company to earn consistently higher returns on equity than any other major bank.

Not as simple as looking at ROE

The most important attribute to key in on is consistency. A high return on equity is valuable only if it is maintained. Looking at the last 10 years, it is clear that Bank of America Corp (NYSE:BAC) and Citigroup Inc (NYSE:C) are not nearly as consistent as JPMorgan Chase & Co. (NYSE:JPM) and Wells Fargo & Co (NYSE:WFC).

*Average divided by standard deviation equals variation coefficient (lower is better)

While Bank of America Corp (NYSE:BAC) averaged only a slightly lower return on equity than Chase, the measure varied widely from year to year. This is because the bank took out-sized risks during the credit boom and made several poor acquisitions in the resulting credit crunch.

Citigroup Inc (NYSE:C) not only under-performed its peers based on average return on equity, it also significantly under-performed on consistency. Citigroup Inc (NYSE:C) is the epitome of Wall Street risk-taking, with its massive bet on sub-prime mortgages triggering a bailout that plucked it from insolvency. Moreover, the bank is currently betting heavily on emerging markets, which are starting to see capital outflows. It is clear that Citigroup Inc (NYSE:C)’s high-beta earnings are here to stay.

What do we do with this?

Now that we know that Chase and Wells Fargo & Co (NYSE:WFC) earn high and consistent returns on equity due to prudence and conservatism, and that Bank of America Corp (NYSE:BAC) and Citigroup have historically had unpredictable earnings due to cultures of risk-taking, we can start to make investment decisions.

The first thing to do is to toss out Bank of America Corp (NYSE:BAC) and Citigroup Inc (NYSE:C) — how can we value companies without having any idea what their earnings are likely to be? Bank of America Corp (NYSE:BAC) may have averaged an 8.6% return on equity over the last 10 years, but that average is not useful due to the high degree of variability year to year.

So now we are left with just Chase and Wells Fargo & Co (NYSE:WFC) as possible investments. Both banks have historically earned stable returns on equity, and nothing that has happened in the last few years makes me think that is likely to change.

A good bank is probably worth 15 times normal earnings, but I only want to pay 10 times earnings. Chase averaged a 9.6% return on equity over the last 10 years, so I would pay close to 1 times book value and expect a 10% annualized return on investment. The stock currently trades for 1.1 times book — slightly higher than my buy range.

Wells Fargo averaged a 14.5% return on equity over the last 10 years, so I want to pay no more than 1.4 times book. The stock trades for 1.6 times book.

Both Chase and Wells Fargo trade at reasonable valuations and are probably a little undervalued. But, especially when investing in banks, I want to buy really cheap stocks. So I will sit and wait for them to get cheaper.

Bottom line

Investing in banks does not have to be a complicated task — you just have to be smart about it. Some banks do not lend themselves to valuation — at least not of the sort offered in this article. Focus on buying banks that you can value, and do it only when they are cheap.

The article A Simple Way to Value Banks originally appeared on Fool.com and is written by Ted Cooper.

Ted Cooper has no position in any stocks mentioned. The Motley Fool recommends Bank of America and Wells Fargo. The Motley Fool owns shares of Bank of America, Citigroup Inc (NYSE:C) , JPMorgan Chase & Co (NYSE:JPM)., and Wells Fargo. Ted is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.