The Dow Jones Industrial Average is jam-packed with great dividend stocks. All 30 of the elite index’s members pay a dividend today, with an average yield of 2.6%. The twin telecom giants, AT&T Inc. (NYSE:T) and Verizon Communications Inc. (NYSE:VZ), lead the pack with respective yields of 5.1% and 4.2%. Good luck finding a savings account or CD matching these annual payouts. Even the least generous yield on the Dow blows today’s money market accounts out of the water.

But when the prudent income investor digs deeper into the Dow telecoms’ dividend policies, there’s a bit of a shock waiting just under the surface. Verizon Communications Inc. (NYSE:VZ)’s payout ratio is a massive 508%, meaning that the company spends its net income five times over just to keep the quarterly checks coming. Ma Bell’s ratio is a still-eyebrow-raising 135%. Is this an unsustainable trend, or is there a perfectly logical explanation for these sky-high payout ratios?

As it turns out, there’s no need to panic. Switch the ratio calculation from bottom-line earnings to free cash flows, and AT&T Inc. (NYSE:T)’s ratio drops to a minuscule 17%. Verizon Communications Inc. (NYSE:VZ) funds its generous dividend with 11% of its free cash flow.

You see, the cash flows at the big telecoms utterly dwarf their modest GAAP and non-GAAP earnings. Over the last four quarters, AT&T Inc. (NYSE:T) saw $7.4 billion in net income but $39.5 billion of operating cash flows and $19.8 billion of free cash. The gap between cash profit and accounting income is even larger at Verizon Communications Inc. (NYSE:VZ), where $1.1 billion in trailing earnings turns into $16.9 billion of free cash flows.

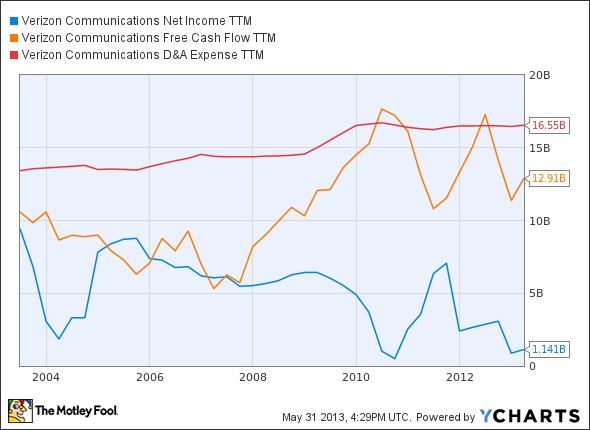

This sleight of hand largely comes from massive amounts of depreciation and amortization expenses, which reduce the tax-liable operating and net incomes but don’t factor into cash flow calculations. From the cash perspective, those charges are handled as the cash is spent on capital expenses, rather than rolled out over decades of accounting deductions. Take a look at this Verizon Communications Inc. (NYSE:VZ) chart to see how big a difference these charges make:

VZ Net Income TTM data by YCharts.

This is one reason why true Fools need to understand the difference between earnings and cash flows — and one reason for AT&T Inc. (NYSE:T) or Verizon investors to relax about those insane income-based payout ratios. The numbers are simply a byproduct of sensible tax strategies — not a red flag for the staying power of their dividends.

The article Are the Richest Dow Dividends Totally Unsustainable? originally appeared on Fool.com and is written by Anders Bylund.

Fool contributor Anders Bylund holds no position in any company mentioned. Check out Anders’ bio and holdings or follow him on Twitter and Google+.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.