Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Universal Display Corporation (NASDAQ:OLED) fit the bill? Let’s look at what its recent results tell us about its potential for future gains.

What we’re looking for

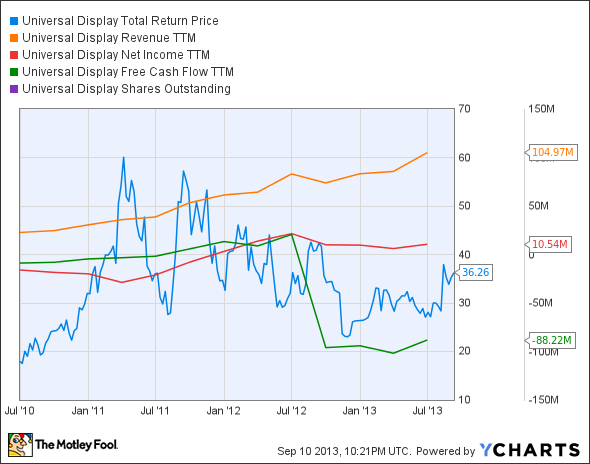

The graphs you’re about to see tell Universal Display Corporation (NASDAQ:OLED)’s story, and we’ll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let’s look at Universal Display Corporation (NASDAQ:OLED)’s key statistics:

OLED Total Return Price data by YCharts

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Revenue growth > 30% | 362.6% | Pass |

| Improving profit margin | 114.3% | Pass |

| Free cash flow growth > Net income growth | (897.2%) vs. 166.1% | Fail |

| Improving EPS | 152.3% | Pass |

| Stock growth (+ 15%) < EPS growth | 101.7% vs. 152.3% | Pass |

Source: YCharts.

*Period begins at end of Q2 2010.

OLED Return on Equity data by YCharts

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Improving return on equity | 159.8% | Pass |

| Declining debt to equity | No debt | Pass |

Source: YCharts.

*Period begins at end of Q2 2010.

How we got here and where we’re going

Universal Display Corporation (NASDAQ:OLED) puts together a strong performance, missing out on a perfect score only because of a collapse in free cash flow that’s yet to be reversed. The company’s share price has been extremely volatile due to various factors, one of which is certainly related to free cash flow — you can see both share price and free cash flow fall in tandem in mid-2012. Will Universal Display be able to move past this weakness around and rebound, or is the display manufacturer going to fade to black? Let’s dig a little deeper to see what the future may hold

QUALCOMM, Inc. (NASDAQ:QCOM) is also getting on board the wrist-worn bandwagon with the launch of its own smart watch, Toq. This is built with Qualcomm’s proprietary Mirasol touchscreen display, which could crowd out Universal Display Corporation (NASDAQ:OLED) if the chip-maker’s deep client base decides to stay with an old ally. Moreover, Universal Display will also be looking to leverage the recent OLED-TV trend, as LG Display Co Ltd. (ADR) (NYSE:LPL) has recently launched large-screen OLED televisions at selected Best Buy Co., Inc. (NYSE:BBY) stores. Samsung also unveiled an OLED television at a price of $13,500, which is cheaper than LG’s OLED offerings. “Cheaper,” of course, is certainly relative — it’s going to be a while before this new technology catches on, and it’s got to come down in price quite a bit first.

Fool contributor Steve Symington notes that Samsung and LG Display Co Ltd. (ADR) (NYSE:LPL) have both been ramping up their production efforts to reduce prices for their curved OLED TVs, a necessary step toward properly leveraging economies of scale. According to the Korea Times, Google Inc (NASDAQ:GOOG) has also agreed to utilize high-end OLED screens in its Google Glass offerings. There are a number of opportunities just over the horizon for Universal Display Corporation (NASDAQ:OLED), but much will hinge on its technology becoming cost-competitive with existing options.

Putting the pieces together

Today, Universal Display Corporation (NASDAQ:OLED) has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy — or to stay away from a stock that’s going nowhere.

The article Is Universal Display Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool recommends Apple, Google, and Universal Display and owns shares of Apple, Google, Qualcomm, and Universal Display.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.