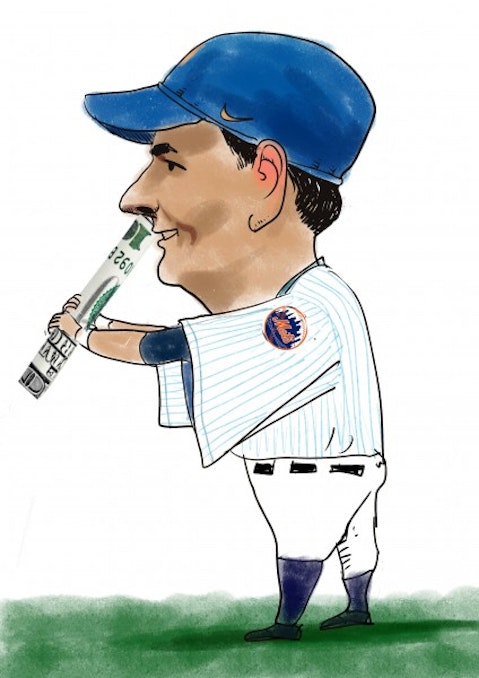

David Einhorn‘s Greenlight Capital has been outperforming most other major hedge funds this year. Thru the end of June, the fund has returned 6.7%, compared to the 6% returned by the widely followed S&P 500 Index. So, let’s take a look at its most valuable holdings in order to elucidate if any of them stand as attractive investment options.

First off is Apple Inc. (NASDAQ:AAPL), the $578 billion market cap consumer electronics manufacturer that saw its stock price escalate almost 20% since the beginning of the year. Einhorn is amongst the company’s largest hedge fund shareholders, with 1.993 million shares, worth more than $1 billion. Although the fund trimmed its exposure to Apple Inc. (NASDAQ:AAPL) by 17% over the first quarter of 2014, this position is still the largest in its equity portfolio.

Carl Icahn seems more bullish than Einhorn. His fund, Icahn Capital LP, last declared having upped its stake in to Apple Inc. (NASDAQ:AAPL) by 59%, to 7.54 million shares, worth more than $4 billion.

Micron Technology Inc (NASDAQ:MU), the second largest position in Einhorn’s equity portfolio, also saw its stakes decrease. After reducing its exposure by 8% over Q1, Greenlight Capital owns 44 million shares of the $35.2 billion market cap semiconductor manufacturer. This stake, worth more than $1 billion, accounts for more than 15% of the fund’s total equity portfolio’s value, and makes it the second largest hedge fund shareholder (amongst those we track) at Micron Technology Inc (NASDAQ:MU), only trailing Seth Klarman’s Baupost Group. Mr. Klarman’s fund owns roughly 51.655 million shares of Micron Technology Inc (NASDAQ:MU), a stock that returned almost 50% since the end of Q1.

Marvell Technology Group Ltd (NASDAQ:MRVL), a $7.4 billion market cap fabless semiconductor provider, occupies the third spot in this list, even though Greenlight last declared having cut its exposure to the stock by 11%. The fund’s 39.429 million shares of Marvell Technology Group Ltd (NASDAQ:MRVL) have lost almost 6% since the end of Q1, but have been pretty much flat, year-to-date. Nonetheless, this position is still worth more than $620 million.

In addition to Mr. Einhorn, other funds like Peter Rathjens, Bruce Clarke And John Campbell’s Arrowstreet Capital also hold millionaire stakes in Marvell Technology Group Ltd (NASDAQ:MRVL). Arrowstreet owns more than 7 million shares, worth more than $100 million.

Cigna Corporation (NYSE:CI) escalated one position in relation to the previous quarter. Greenlight’s 4.21 million shares make it the fourth most valuable holding at the fund’s equity portfolio. This $24.8 billion market cap health services organization saw its stock price rise only 5.6% year-to-date. However, Mr. Einhorn’s position at Cigna Corporation (NYSE:CI) has remained unchanged.

A fund that seems particularly bullish about Cigna Corporation (NYSE:CI) is Richard S. Pzena’s Pzena Investment Management, which last declared having upped its stake in the company by 16%, to 4.82 million shares, worth more than $400 million.

Finally, there’s a small-cap company: Oil States International, Inc. (NYSE:OIS), a $3.37 billion market cap worldwide provider of specialty products and services to oil and gas drilling and production companies. As reported in late June, Greenlight Capital’s position in Oil States International, Inc. (NYSE:OIS) remained unchanged over the last reported quarter. However, a series of stock sales that Barry Rosenstein’s Jana Partners made over June have transformed Mr. Einhorn’s fund in the largest hedge fund shareholder at the company –amongst the 700 funds that we track. Its 2.75 million Oil States International, Inc. (NYSE:OIS) shares are worth more than $270 million, and account for roughly 4% of its total equity portfolio’s value.

Following the June disposals, Jana Partners owns 2.6 million shares, down from the 6.1 million shares held by the end of Q1. Another fund with big bets on Oil States International, Inc. (NYSE:OIS) is Alexander Roepers’ Atlantic Investment Management, which last declared having increased its exposure to the company by 29%, holding a total of 2.47 million shares.

Disclosure: Javier Hasse holds no position in any stocks or funds mentioned.