And finally, the last chapter in my series about Apple Inc. (NASDAQ:AAPL)! In the first part, I introduced a reply to a famous Apple bear case by David Trainer and explained why I believe that Apple is not “just another computer company.” In the second part, I introduced 9 reasons to be bullish. And, as promised in the first article, in this final article, I will introduce the one and only one reason to be bearish, but strong enough to make me overall neutral about the stock.

And the reason is:

Android and market share in emerging economies

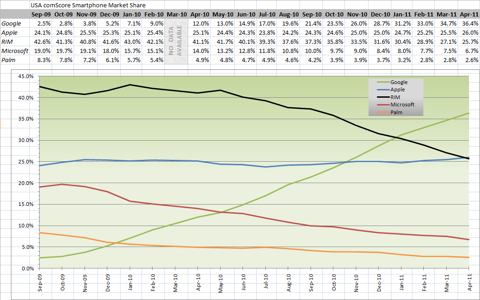

Let’s be clear. I’m not talking about U.S. market share here. As the following graph suggests, Apple Inc. (NASDAQ:AAPL) has done a superb job in the U.S. even after the release of the iPhone 5, by keeping both a 25% constant share and its traditionally high margins.

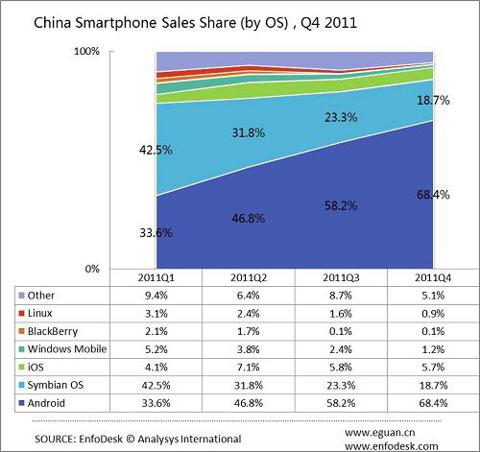

Briefly speaking, I believe that Apple needs to improve its competitive advantage in emerging markets, which are extremely price elastic when it comes to smartphones. For example, Apple Inc. (NASDAQ:AAPL)’s performance in China has been very disappointing if you compare it with the progress of Android. Like in the U.S., Apple has also managed to keep a constant proportion of the market, about 5%. But keeping a market share constant is not strategic, specifically in emerging markets.

These markets are under transition: heavy growth combined with a change in consumption patterns. By 2017, the size of most smartphone markets in emerging economies will double. The average amount of money spent per device will rise too as economic growth increases the average monthly income. The time to act is now, before these markets achieve their real potential.

Some have criticized me saying that Apple is all about margins. I think that such opinions underestimate the real size and the prospects of these markets.

As I mentioned before, ABI Research estimates that by 2017, budget smartphones will equal half of all smartphone shipments. This size is simply too big to ignore. Not only ABI Research, but also Gartner expects the smartphone market to double from 2011 to 2014. The thing is that most of this growth will occur in emerging markets, where smartphone penetration rate is still low.

Furthermore, the $200-$300 price band is where most of the revenue is at. This price interval shows a healthy balance between margins and market share, and should be targeted in the near future, either by introducing comfortable payment plans in cooperation with big carriers or by launching a new “budget device,” a sort of iPhone mini.

The “iPhone 5 Failure” and other apparently unrelated worries

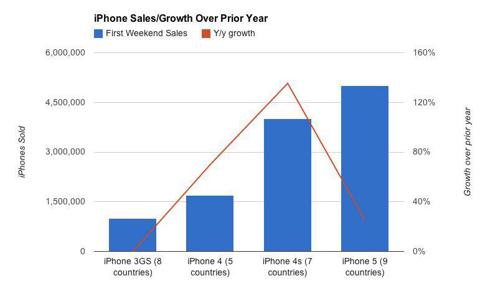

The iPhone 5 is the first iPhone sales growth failure. Remember the opening weekend sales back in September 2012? Apple Inc. (NASDAQ:AAPL) reported it sold about 5 million devices. Considering that most analysts estimated the number to be somewhere between 6 million and 9 million, it was very disappointing. Opening weekend sales grew 70% between the 3GS and the iPhone 4, 135% between the 4 and 4S, but only 25% between the 4S and the iPhone 5.

The recent earnings call confirmed that the iPhone 5 sales figures are not as impressive in terms of growth as the previous models.

Now, try to visualize the iPhone 5 in your mind and then brainstorm some possible reasons for the poor sales performance. Some examples given by users and collected from various websites include:

1. It is a good product but not a killer product.

2. Demand for the iPhone 4S remains stronger than expected, especially in emerging economies.

3. Price sensitivity in emerging economies.

4. Market saturation.

5. Increased high quality competition.

The first reason is, perhaps, the most controversial one. What is important, though, is to notice that the remaining four reasons fall into the same category: Android and market share worries, specifically in emerging economies. I believe this is the most important issue Apple Inc. (NASDAQ:AAPL) faces in the short-term and the reason why many investors are still bearish on the stock.

Everybody is targeting emerging markets aggressively, except Apple. Let me give you some examples: it is common knowledge that China is Android territory. Android handsets are approximately two-thirds cheaper, while an iPhone’s average price is 4523 yuan ($725.25, or about 9% of the PPP GDP per capita), the average price of an Android handset is just 1393 yuan ($223.36, 2.5%).

Nokia Corporation (ADR) (NYSE:NOK) is also trying to join the party. It recently launched two budget smartphones in India. The Asha 501 handset has a suggested retail price tag of just $99. Furthermore, the positive effects of addressing emerging markets properly are already showing in the stock price movements. A long time ago, Nokia was a dominant supplier of handsets. However, it missed out on the smartphone revolution. This caused the stock price to decrease from $35 per share in the beginning of 2008 to $3.20 per share by mid 2012.

Luckily for Nokia, its historical strength in emerging markets never disappeared. So, when it decided to enter into a business partnership with Microsoft Corporation (NASDAQ:MSFT) to make smartphones based on the Windows Phone OS, it also decided to market its new cheap smartphone devices aggressively in emerging economies. This helped Nokia add some revenue. As a consequence, stock price in the past year has increased 31%.

How about Samsung ? Samsung’s strategy involves releasing dozens of phone models per year, including many which are specifically targeted at the low end smartphone market. At the same time, it keeps excellent relations with most mobile carriers in the world. This helps Samsung make its devices very affordable, not only in terms of device price, but also in terms of monthly payments and plans.

I’m not suggesting that Apple tries to copy either Nokia or Apple’s market strategy in emerging markets. Apple is different and should design its own strategy. But, for example, I think that releasing two devices per year wouldn’t hurt Apple’s brand and at the same time, could have a positive effect on revenue growth: one of them being the flagship iPhone and the other a sort of “iPhone mini,” a budget device in the $200-$300 price band.

There is no such strategy. I have not heard of any official new budget device announcement. This is the main reason why, despite being an Apple fan and despite having a much higher fair price estimate for the stock, I am neutral. And like many other investors, the launch of a lower priced phone in Asia would cause me to consider this stock a buy and become long.

Adrian Campos has no position in any stocks mentioned. The Motley Fool recommends Apple. The Motley Fool owns shares of Apple.

The article Apple Is Not Another Computer Company: Part 3 originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.