To my way of thinking, only Samsung and Google are important competitors, especially in emerging markets. Just like Google competes against Apple in the software arena, Samsung competes in the hardware arena. And so far, Samsung is winning in market share, mainly due to the incredible growth that emerging markets saw in smartphone penetration.

Samsung’s smartphones sell incredibly well in emerging markets due to high price sensitivity. Furthermore, the Korean giant offers budget devices and has very solid relations with some of the biggest carriers in the world, something that Apple is in great need of.

The good news is that other companies have dozens of direct competitors. Apple has only two. And, of course, they are strong competitors. But by creating its own market ( the iTunes, iPad, and iPhone concepts were fantasy before Apple introduced them in our everyday life), Apple avoided fierce competition for a long time.

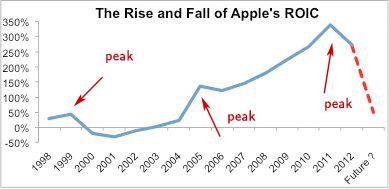

Notice also that there is another explanation to the “ROIC Has Peaked“ graphic provided by Trainer. Sure, ROIC was very high in 2011, a record number. But there were so many peaks before (1998 and 2005, to say the least)!

3) Group thinking and its benefits

According to Trainer, “an astounding 664 of the 7,000 ETFs and mutual funds I cover allocate at least 5% of their value to AAPL.”

You can understand this in many ways: for example, 664 funds are trying to copy the same idea. But this could also be seen as 664 fund managers and equity researchers arriving at the same conclusion!

That being said, group thinking is not necessarily a bad thing. Even if we assume that Trainer is right and that many fund managers want to allocate a decent proportion of their capital to Apple just to follow others, that demonstrates that the demand for Apple shares is not in danger.

New fund managers will try to copy their peers. Therefore, they will also have Apple in their portfolios. This creates a stable demand for Apple’s shares! And only a very strong negative catalyst could cause everybody to start selling the same stock on the same day.

Therefore, the remaining question is: is such a catalyst on its way? Stay tuned! I take care of this and other issues in the remaining articles

Coming soon

– Apple is not another computer company: Part 2 – 9 reasons to be a bull

– Apple is not another computer company: Part 3 – 1 very important reason to be a bear

Adrian Campos has no position in any stocks mentioned. The Motley Fool recommends Apple and Google. The Motley Fool owns shares of Apple and Google.

The article Apple Is Not Another Computer Company: Part 1 originally appeared on Fool.com and is written by Adrian Campos.

Adrian is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.