Apple Inc. (NASDAQ:AAPL)’s share price plunged 12% to $450 after posting an 18% sales increase, its weakest in 14 quarters and reporting the slowest profit growth in almost a decade.

The company itself is poised for growth, just not the phenomenal growth it had over the past few years. Apple Inc. (NASDAQ:AAPL)’s price decline has made it an excellent buy opportunity. Now that the company is trading at attractive valuations, it the most attractive mobile device investment on the market today.

Putting Smartphone Growth and Value in Perspective

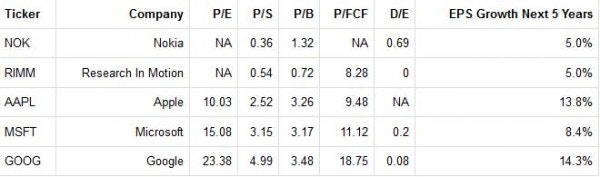

Apple Inc. (NASDAQ:AAPL) has the cheapest trailing earnings multiple of any profitable stock in the device space:

Apple Inc. (NASDAQ:AAPL) is clearly a better value than Google Inc (NASDAQ:GOOG) or Microsoft Corporation (NASDAQ:MSFT). It is trading at a price-to-earnings ratio that is lower than its peers and the market average. In addition, Apple trades at a solid price-to-free cash flow multiple and benefits from the most valuable brand on the planet. Yes, its price-to-sales multiple will probably fall as it lowers prices, but it will remain higher than industry and market averages based on consumer perceptions of brand value.

Nokia Struggling

Research In Motion, now Research In Motion Ltd (NASDAQ:BBRY), and Nokia Corporation (ADR) (NYSE:NOK) are speculative since neither one has made a net profit for the trailing twelve months. They are risky bets on the success of their new product launches.

Unfortunately, Nokia’s Lumia smartphones are not helping in the company’s bid to make a comeback in the U.S. It’s been the seventh straight drop in quarterly sales for the company. These desperate times marked the first time the company did not pay a dividend in nearly 150 years.

Tough competition from both Apple Inc. (NASDAQ:AAPL)‘s iPhone and smartphones that run on Google’s Android OS limited the sales of the Finland-based company to only 700,000 units during the fourth quarter. This is a significantly lower number than several analysts’ sales forecast of at least 1 million Lumias. Around the world, there were 4.4 million Lumias sold during the holiday quarter, just a fraction of the nearly 48 iPhones sold, or the gargantuan 136 million Android-running devices now on customer’s hands.

One of the reasons might be that the Lumia smartphones are trailing far behind their competitors in the number of applications available. As well, Nokia hasn’t been able to give their prospective buyers reasons to switch from Android or Apple handsets, as credit analyst at Danske Bank (DANSKE) Louis Landeman said , “Customers just don’t have a natural attraction to the name. The 700,000 unit sales in North America need to improve if Nokia is ever going to have a chance to boost its market share”.

Apple Already Ahead

Unlike its peers, Apple is already ahead in the smartphone game.

Fiscal first quarter income increased about 1% to $13.1 billion, equivalent to $13.81 per share. Sales for the same period grew 73% versus a year earlier. Although Chief Executive Officer Tim Cook steered Apple to record revenues through iPad and iPhone sales, investors are wary that management may not be able to sustain coming up with hit products more than a year after Steve Jobs’ death. The recent quarter results also fueled concerns that increased competition from Samsung Electronics and mounting costs amid a maturing smartphone will continue to curtail growth.