When done right, a stock buyback can be a beautiful thing. Management teams can deploy excess cash that’s earning next to nothing to buy higher returning assets, hopefully at a big discount. The problem is that most management teams simply aren’t very good at timing stock buybacks.

With a recent announcement to buy back up to $2 billion of its own shares, Apache Corporation (NYSE:APA) is just one of the latest companies joining the buyback parade. The company will soon have some extra cash at its disposal as it’s planning to unload as much as $4 billion in assets. In essence, what the company is doing is selling the assets it likes least so it can own more of what it likes best.

While it remains to be seen what assets Apache Corporation (NYSE:APA) will part with, once it is able to unload these assets, it plans to use about half of the proceeds to buy back around 30 million shares in addition to reducing its debt by about $2 billion. That would enable the company to trim its debt-to-equity ratio from about 39% closer to 33%. Both appear to be solid moves, especially when you consider that the company is buying back 7.5% of its outstanding shares.

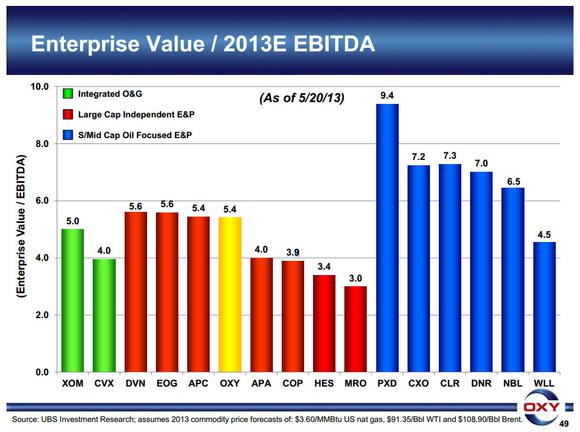

The question, though, is whether the company is buying back its stock because it needs to do something with the deal proceeds or if it sees value in its stock. For that, let’s take a look at the following chart ,which compares Apache Corporation (NYSE:APA) to its peer group of large-cap independent E&P companies:

Source: Occidental Petroleum Investor Presentation (opens in a PDF).

As you can see, Apache trades at a pretty compelling discount to its large-cap E&P peers like Devon Energy Corp (NYSE:DVN) and Occidental Petroleum Corporation (NYSE:OXY), which trade at about 5.5 times estimated 2013 EBITDA. By trading at just four times EBITDA, Apache is in line with ConocoPhillips (NYSE:COP), though it’s still not nearly as cheap as Marathon Oil Corporation (NYSE:MRO).

In shedding assets and announcing the buyback, Apache Corporation (NYSE:APA) is looking to unlock some value in order to bump its value closer to the 5.5 times that both Devon Energy Corp (NYSE:DVN) and Occidental are trading. What could that mean for investors? Given that shares are currently around $85 per share, that would imply that shares are worth upwards of $120 per share, meaning the stock could be 40% undervalued. Clearly, the buyback makes a lot of sense.

Why is Apache Corporation (NYSE:APA) so cheap? Unlike Marathon Oil Corporation (NYSE:MRO) and ConocoPhillips (NYSE:COP), it hasn’t repositioned by jettisoning refinery assets, which could explain why those stocks are so cheap. On the other hand, it is clearly a dominant North American liquids-focused onshore driller so it’s surprising that it doesn’t trade more in line with Devon or Occidental Petroleum Corporation (NYSE:OXY).