The Motley Fool has been making successful stock picks for many years, but we don’t always agree on what a great stock looks like. That’s what makes us “motley,” and it’s one of our core values. We can disagree respectfully, as we often do. Investors do better when they share their knowledge.

In that spirit, we three Fools have banded together to find the market’s best and worst stocks, which we’ll rate on The Motley Fool’s CAPS system as outperformers or underperformers. We’ll be accountable for every pick based on the sum of our knowledge and the balance of our decisions. Today, we’ll be discussing Green Mountain Coffee Roasters Inc. (NASDAQ:GMCR), the single-serve coffee company, which we currently have an outperform call on.

Green Mountain Coffee Roasters by the numbers

Here’s a quick snapshot of the company’s most important numbers:

| Statistic | Result (most recent available) |

|---|---|

| Revenue | $4.04 billion |

| Net Income | $365.8 million |

| Market Cap | $9.2 billion |

| Forward P/E | 13.8 |

| Price/Book | 2.9 |

| Key Products | Keurig brewers, K-Cups, Vue packs |

| Key Competitors | Starbucks (NASDAQ:SBUX) Dunkin’ Brands (NASDAQ:DNKN) Peet’s Coffee & Tea (NASDAQ:PEET) |

Sources: Yahoo! Finance.

Travis’ take

When we made our outperform call on Green Mountain Coffee Roasters in July, the stock had been beaten up by short-seller David Einhorn, giving us a great buying opportunity. The forward P/E ratio was just 5.1 and price/book was 1.3, levels you don’t usually see in growing companies. We all saw it as an opportunity to buy on the idea that the market had overshot too far. But we all agreed that the leash on Green Mountain would be short.

Today, we’re sitting on a 150% gain and a CAPScall that has outperformed the market by 138 points. But the stock isn’t nearly as attractive as it was seven months ago.

My concern today is that the company doesn’t have nearly as much upside going forward as Starbucks in the home brewing space. This holiday season there were K-Cups everywhere but they were always heavily discounted. Sales growth is great, but when you’re doing it at discounted prices I have red flags popping up in my head. Margins didn’t take a huge hit because of discounting, but that’s in part because coffee costs fell in the fourth quarter.

Don’t get me wrong, I don’t hate the stock here. Sixteen percent sales growth in the fourth quarter and a 21% increase in non-GAAP net income are positive, and paying 19 times trailing earnings isn’t a bad price. If this were a cash portfolio I would probably cut my position in half and take more than my initial investment out and let the rest ride. But on CAPS we have to make a call one way or the other.

Considering our huge win in GMCR, I think we should cash in our chips and lock in a great gain. The stock may continue to go up, but if it falls after a bad quarter or two I would hate to lose a 135-point gain right now.

Alex’s take

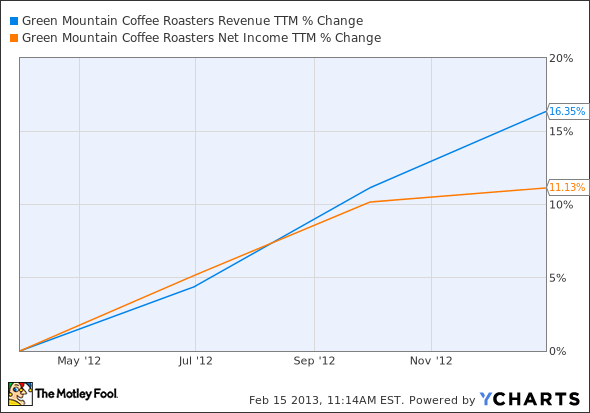

I admit that I’ve had a hard time deciding whether to let this ride or to close it out. Since July, we’ve had three financial reports released: one 10-K and two quarterly filings. In those three reports, Green Mountain’s trailing-12-month revenue has grown at a faster rate than its net income, but neither has been particularly compelling compared to its earlier growth:

GMCR Revenue TTM data by YCharts.