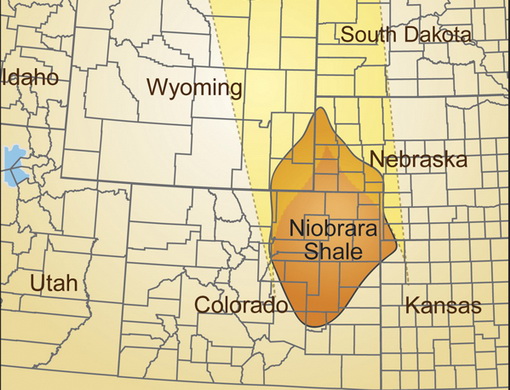

While the Bakken and Eagle Ford shale oil plays understandably attract the spotlight in the world of new oil production, a lesser known play in Colorado may soon make its presence felt. The Niobrara in northeastern Colorado (see map below) may contain more than 7 billion barrels of recoverable oil. Let’s look at three companies investing in this play.

Map courtesy of FrackingOil.com

Classic exploration and development

Two companies actively producing oil and natural gas in the Niobrara are Anadarko Petroleum Corporation (NYSE:APC) and Noble Energy, Inc. (NYSE:NBL). These companies are similar in that they boast multibillion dollar market capitalizations, own substantial worldwide assets, and plan to spend at least $1 billion in Colorado in the upcoming year.

As an investment, Noble Energy, Inc. (NYSE:NBL) represents a growth stock, and its dividend yields less than 1%. And grown it has; the stock climbed almost 50% in the past year and sells for roughly 23 times earnings. Driving these results has been an international portfolio of oil and gas assets. From the coasts of Israel, Mozambique, Equatorial New Guinea and the Gulf of Mexico, Noble Energy, Inc. (NYSE:NBL) generates oil, gas and profits for its investors. The future holds more of the same.

Anadarko Petroleum Corporation (NYSE:APC) plans to spend just over $1 billion in the Niobrara this year. Its holdings contain up to 1.5 billion barrels of oil or equivalent. With low development costs and expandable infrastructure in place, Anadarko Petroleum Corporation (NYSE:APC) believes its Colorado fields may be the single best onshore US asset the company owns. To monetize this asset, Anadarko Petroleum Corporation (NYSE:APC) plans to double the number of wells active in the Niobrara to 300 by the end of 2013.

Anadarko Petroleum Corporation (NYSE:APC) also represents a growth investment as its dividend yields less than 0.5%. The stock climbed over the past year, but lagged the growth of Noble Energy, Inc. (NYSE:NBL). Perhaps one reason for the muted enthusiasm is Anadarko’s liability connected to the Macondo oil rig explosion and oil spill. As a partner in the disastrous drilling platform, a judge has ruled Anadarko Petroleum Corporation (NYSE:APC) must face an investor lawsuit claiming the company’s CEO misled investors regarding Anadarko’s stake in the rig. Settlement costs also adversely impacted last quarter’s earnings despite improved cash flow and earnings from operations.

Classic midstream MLP for income and growth

The growing production from Colorado’s Niobrara piqued the interest of Enterprise Products Partners L.P. (NYSE:EPD). Enterprise Products Partners L.P. (NYSE:EPD) already owns pipelines serving the western part of Colorado and plans to have another pipeline to the eastern part completed by the end of 2013. As described in its latest presentation the Front Range pipeline expansion is a joint venture with Anadarko. The initial planned capacity is for 150,000 barrels per day with possible expansion to 230,000 barrels per day.

This pipeline expansion is a part of Enterprise Products Partners L.P. (NYSE:EPD)’s $7.5 billion 2013 capital expansion budget. Most of this budget focuses on expansion of onshore oil and natural gas liquids pipelines. The company also operates pipelines to offshore rigs in the Gulf of Mexico. A more recent development is expansion of its export facilities in Texas that will allow Enterprise to ship more propane, butane and isobutene overseas.

As an investment, Enterprise Products Partners L.P. (NYSE:EPD) looks tough to beat. The company has increased its distributions every quarter for the past 36 quarters, and the stock has grown from $22 a share to $66 a share since 2009. The current distribution yields 4.2% with a rock-solid cash distribution coverage of 1.86 for 2012. Not surprisingly, the stock sells at a premium of over 22 times earnings. Corporate management forecasts continued growth in earnings and distributions as its operations grow.

Final Foolish Thoughts

The Niobrara Shale could be yet another huge source of oil and natural gas for the US. While not amenable to traditional vertical drilling, horizontal drilling and hydraulic fracturing opened the play to exploration and development. As a result, there’s money to be made there. For overall safety, income and growth, I like Enterprise best. Its track record, financials and business make it a great choice for those looking to minimize risk but still enjoy some returns. Of the two exploration companies, I like Noble best. It has none of the Macondo related liabilities and has outperformed Anadarko for the past two years. Though it pays next to nothing in dividends, Noble offers investors a diversified oil and natural gas portfolio with a great track record of earnings growth and potential for more to come.

The article Three Ways to Profit From Colorado Oil originally appeared on Fool.com and is written by Robert Zimmerman.

Robert Zimmerman has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Robert is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.