A screen for high-yield stocks will send you to two very different levered business models: business development companies and mortgage REITs, both of which are known for double-digit annual distribution yields. But the threat of a less active Federal Reserve has recently left the latter class of stocks under attack.

Why mREITs are diving

Mortgage REITs use inexpensive short-term financing to purchase (with leverage) long-term mortgage-backed securities. The name of the game is simple: borrow for the short term at low rates and buy mortgage-backed securities that offer higher rates. With leverage, mREITs can return 15% or more in annual dividends to investors thanks to the spread between short and long term interest rates.

The Fed currently spends some $85 billion each month in an effort to suppress long-term interest rates. But this quantitative easing may soon come to an end, driving up long-term interest rates. When interest rates rise, the value of a mortgage-backed security declines substantially.

In recent weeks, mortgage-backed securities have been the subject of heavy selling. Investors, fearing an end to Fed purchases of MBS products, dumped the asset class and long-term rates have risen ever since. Meanwhile, MBS values have fallen substantially.

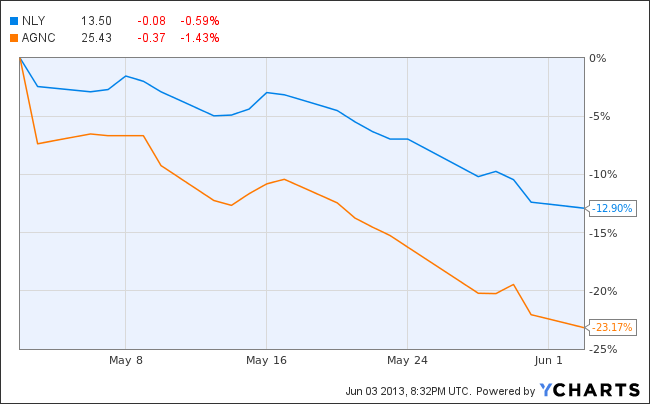

Falling MBS values are bad news for the likes of American Capital Agency Corp. (NASDAQ:AGNC) and Annaly Capital Management, Inc. (NYSE:NLY), the two largest mortgage REITs on the market. Because these two firms employ leverage nearing eight times equity value, a modest change in long-term rates can put a hefty dent in their book value. Recent earnings reports for both firms reflected the impact of higher rates, as earnings came in weaker than anticipated on falling book values. Investors sold the sector off, fearing the worst was yet to come.

What investors fear most

Investors are not afraid of rising interest rates. American Capital Agency Corp. (NASDAQ:AGNC) and Annaly Capital Management, Inc. (NYSE:NLY) can generate a profit in a rising rate environment. Mortgage REITs need only a spread between short and long-term rates to make a profit. If an mREIT can borrow at 2% and lend at 4%, it can generate spectacular returns for investors.

Instead, investors fear that rising rates will arrive too quickly. If rates on 30-year mortgage-backed securities rise to, say, 1% over the course of three months, American Capital Agency Corp. (NASDAQ:AGNC) and Annaly Capital Management, Inc. (NYSE:NLY) will find it difficult to raise new capital to invest in more lucrative mortgages.

These companies would far prefer very slow and modest increases in MBS rates, even as short-term borrowing costs remain suppressed.

In the long term, the end of quantitative easing on the long-end of the yield curve should benefit American Capital Agency Corp. (NASDAQ:AGNC) and Annaly Capital Management, Inc. (NYSE:NLY). Short-term rates would stay mostly flat, while long-term rates would rise precipitously. The result is a larger spread, which enables mREITs to reinvest in new investments that are much more profitable and less sensitive to further interest-rate flux.

Why risks (probably) won’t play out

The exodus from mortgage-backed securities is led by their biggest owners: mREITs, banks, and pension funds, which hold long-term securities for safe yields. Because the Fed will taper its quantitative easing before it increases short-term interest rates, capital raises by the mREIT sector would allow REITs to add proportionally more higher-yielding securities to their portfolios, while borrowing at existing low rates.

Besides outside capital raises, mortgage REITs also have the capacity to temporarily cut dividends and reinvest in new securities at a higher spread, slashing interest rate risk and boosting bottomline income.

While the best days are over for mortgage REITs (the sector performs best when interest rates are headed downward, and book values increase in line with declining rates), mortgage REITs continue to offer compelling yields in a yield-starved market. Investors should stay the course.

When the MBS market levels out, mREITs can capitalize on higher long-term rates while borrowing at currently low short-term rates. The biggest fear is that the Fed raises short-term rates faster than expected, but with unemployment well above Bernanke’s 6.5% threshold for potential increases in the overnight lending rate, short-term interest rates should stay low for quite some time.

Jordan Wathen has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

The article Fed’s Taper vs. mREITs: Who Wins and Why originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.