Well, that was fast. Less than a month ago, Amazon.com, Inc. (NASDAQ:AMZN) officially launched Kindle Worlds, calling it “the first commercial publishing platform that will enable any writer to create fan fiction based on a range of original stories and characters and earn royalties for doing so.”

But while the service gave aspiring writers the rights to create fan fiction based on only three books from Warner Brothers Television Group’s Alloy Entertainment — namely Gossip Girl, Pretty Little Liars, and Vampire Diaries — I noted at the time that Amazon.com, Inc. (NASDAQ:AMZN) had also promised “plans to announce more licenses soon.”

A Valiant effort

Now, Amazon.com, Inc. (NASDAQ:AMZN) just announced it has secured the rights to a decidedly more action-oriented genre, with content from comic-book publisher Valiant Entertainment.

Of course, I did mention last month that the holy grail of licensing deals would ideally involve signatures from DC Entertainment or The Walt Disney Company (NYSE:DIS)‘s Marvel. After all, Disney was willing to fork out more than $4 billion for Marvel in 2009, thanks largely to the more than 9,000 distinct characters in its universe, including the likes of Spider-Man, Captain America, Iron Man, The Fantastic Four, the X-Men, and the Hulk.

And DC, for its part, has more than 10,000 characters in its universe, most notably including Superman, Batman, Wonder Woman, the Green Lantern, Aquaman, and Catwoman.

Then again, while Disney and DC are doing just fine capitalizing on their content by themselves, I still maintain that they could both benefit by signing a fan-fiction deal with Amazon.com, Inc. (NASDAQ:AMZN). As Valiant CFO and head of strategic development Gavin Cuneo stated in Friday’s release:

Comics are well known for their passionate and interactive fan communities, and, through the Kindle Worlds platform, we’re excited to give aspiring authors and fans the opportunity to work within the Valiant Universe, make their stories accessible to a large audience, and earn revenue for their work.

Besides, as I also mentioned a few weeks ago, thanks to its recent Star Wars video-game deal with Electronic Arts Inc. (NASDAQ:EA), we already know Disney isn’t new to the licensing game.

Back to Valiant, though. Even in the massive shadows of its rivals, it’s worth noting that the small company did win the Diamond Gem Award for Best Comic Book Publisher of the Year in 2012 for companies with less than 4% total market share. In addition, Valiant boasts a library of more than 1,500 characters and has sold more than 80 million comic books since its founding in 1989.

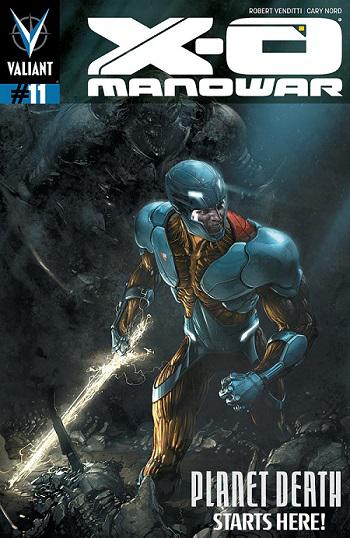

For now, though, Valiant’s agreement with Amazon.com, Inc. (NASDAQ:AMZN) gives fan-fiction writers the rights to create and sell their own works based only on the comic book series Bloodshot, X-O Manowar, Archer & Armstrong, Harbinger, and Shadowman, “with more to be added at a later date.” In addition, it includes Howey’s Silo Saga, Eisler’s John Rain novels, Crouch’s Wayward Pines Series, and the Foreworld Saga.

Source: ValiantUniverse.com.

In the end, however, this should give Kindle Worlds writers plenty to chew on while Amazon works on securing even more content for our literary pleasure.

But speaking of aspiring writers’ work, Amazon also stated that, later this month, the Kindle Worlds Store is expected to finally launch starting with at least 50 commissioned works.